FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

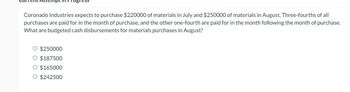

Transcribed Image Text:Coronado Industries expects to purchase $220000 of materials in July and $250000 of materials in August. Three-fourths of all

purchases are paid for in the month of purchase, and the other one-fourth are paid for in the month following the month of purchase.

What are budgeted cash disbursements for materials purchases in August?

$250000

$187500

O $165000

O $242500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The controller of Sonoma Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budgetinformation: May June July Sales $141,000 $169,000 $233,000 Manufacturing costs 59,000 73,000 84,000 Selling and administrative expenses 41,000 46,000 51,000 Capital expenditures _ _ 56,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 60% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $7,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in September, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of…arrow_forwardWaterway Company prepares monthly cash budgets. Relevant data from operating budgets for 2027 are as follows. January February Sales $460,800 $512,000 Direct materials purchases 153,600 160,000 Direct labor 115,200 128,000 Manufacturing overhead 89,600 96,000 Selling and administrative expenses 101,120 108,800 All sales are on account. Collections are expected to be 50% in the month of sale, 30% in the first month following the sale, and 20% in the second month following the sale. Sixty percent (60%) of direct materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items above are paid in the month incurred except for selling and administrative expenses, which include $1,280 of depreciation per month. Other data: 1. Credit sales: November 2026, $320,000; December 2026, $409,600. 2. Purchases of direct materials: December 2026, $128,000. 3. Other receipts: January-Collection of December 31, 2026, notes…arrow_forwardThe total budgeted sales of Nana Kay Ltd for October, the first month of the last quarter in 2019 were GHS1,900,000. Sales are expected to increase by GHS100,000 in each month. Cash sales for each month are GHS200,000 and the remaining are credit sales. All the products are sold at a mark up of the cost plus 25 per cent. On average, Nana Kay Ltd collects 60 per cent of the credit sales in the month of sale and 35 per cent in the month following sales. The remainder is uncollectible. Determine the budgeted total cash receipt for each month of the last quarter of 2019 and the expected account receivables at the end of the quarter. (Show all workings clearly)arrow_forward

- Rishi Sunak Manufacturing Pte. Ltd. is preparing its budget for next year. The company estimates that it will be making the following raw materials purchases in the last five months of 2021: $200,000 in August, $220,000 in September, $250,000 in October, $280,000 in November and $240,000 in December. The company anticipates that it will pay 55% of what is owed one month after the month of purchase, 30% of what is owed two months after the month of purchase and the remaining 15% three months after the month of purchase. What figure will be presented in the company’s cash budget for payments for raw materials purchases in December 2021? $233,500 $253,500 $262,000 $403,500arrow_forwardFolgerty Enterprises prepared the following sales budget: Month Budgeted Sales March $6,000 April $13,000 May $12,000 June $14,000 The expected gross profit rate is 30% and the inventory at the end of February was $10,000. Desired finished goods inventory levels at the end of the month are 20% of the next month's cost of goods sold. What is the desired beginning finished goods inventory on June 1 (in dollars)? Select one: a. $1,960 b. $840 c. $1,680 d. $9,800 e. $1,860arrow_forwardPlease help me with show all calculation thankuarrow_forward

- Frolic Corporation has budgeted sales and production over the next quarter as follows: July August September Sales in units 70,000 83,000? question mark Production in units 73,250 84, 750 91,750 The company has 17,500 units of product on hand at July 1. 25% of the next month's sales in units should be on hand at the end of each month. October sales are expected to be 97,000 units. Budgeted sales for September would be (in units):arrow_forwardZisk Company purchases direct materials on credit. Budgeted purchases are April, $85,000; May, $115,000; and June, $125,000. Cash payments for purchases are: 75% in the month of purchase and 25% in the first month after purchase. Purchases for March are $75,000. Prepare a schedule of cash payments for direct materials for April, May, and June. Schedule of Cash Payments for Direct Materials April May Materials purchases Cash payments for: ZISK COMPANY Total cash payments Junearrow_forwardS ABC Company's raw materials purchases for June, July, and August are budgeted at $39,000, $29,000, and $54,000, respectively. Based on past experience, ABC expects that 70% of a month's raw material purchases will be paid in the month of purchase and 30% in the month following the purchase. Required: Prepare an analysis of cash disbursements from raw materials purchases for ABC Company for August. Budgeted raw material purchases August cash payments: Current month's purchases Prior month's purchases Total cash payments June July August $ 0arrow_forward

- Ivanhoe Design provided the following budgeted information for April through July: April May June July Projected sales $112320 $132840 $124200 $142560 Projected merchandise purchases $88560 $99360 $84240 $71280 The cash balance on June 1 is $12960. The company pays 40% of merchandise purchases in the month purchased and 60% in the following month. General operating expenses are budgeted to be $33480 per month of which depreciation is $3240 of this amount. Management pays operating expenses in the month incurred. The company makes loan payments of $4320 per month of which $648 is interest and the remainder is principal. How much are budgeted cash disbursements for June? $111024. $127872. $93312. $68256.arrow_forwardCoronado Company prepares monthly cash budgets. Relevant data from operating budgets for 2022 are as follows. January February Sales $331,200 $368,000 Direct materials purchases 110,400 115,000 Direct labor 82,800 92,000 Manufacturing overhead 64,400 69,000 Selling and administrative expenses 72,680 78,200 All sales are on account. Collections are expected to be 50% in the month of sale, 30% in the first month following the sale, and 20% in the second month following the sale. Sixty percent (60%) of direct materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items above are paid in the month incurred except for selling and administrative expenses that include $920 of depreciation per month.Other data: 1. Credit sales: November 2021, $230,000; December 2021, $294,400. 2. Purchases of direct materials: December 2021, $92,000. 3. Other…arrow_forwardD’s Company Ltd expects to have a cash balance of $45000 on March 1, 2024.Relevant monthly budget data for the months of March and April are as follows:• Collections from customers: March $85000; April $150000• Payments for direct materials: March $50000; April $75000• Direct labour: March $30000; April $45000. Wages are paid in the month they are incurred.• Manufacturing overhead: March $21000; April $25000. These costs include depreciation of$1500 per month. All other overhead costs are paid as incurred.• Selling and administrative expenses: March $15000; April $20000. These costs are exclusive ofdepreciation. They are paid as incurred.• Sales of marketable securities in March are expected to be realised $12000 in cash.D’s Company Ltd. has a line of credit at a local bank that enables it to borrow up to$25000. Thecompany wants to maintain a minimum monthly cash balance of $20000. prepare cash budgets for march n april 2024arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education