FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

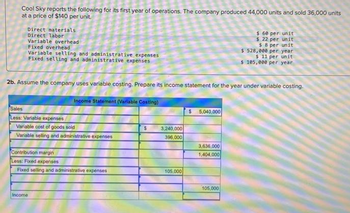

Transcribed Image Text:Cool Sky reports the following for its first year of operations. The company produced 44,000 units and sold 36,000 units

at a price of $140 per unit.

Direct materials

Direct labor

Variable overhead

Fixed overhead

Variable selling and administrative expenses

Fixed selling and administrative expenses

2b. Assume the company uses variable costing. Prepare its income statement for the year under variable costing.

Income Statement (Variable Costing)

Sales

Less: Variable expenses

Variable cost of goods sold

Variable selling and administrative expenses

Contribution margin

Less: Fixed expenses

Fixed selling and administrative expenses

Income

$

3,240,000

396,000

105,000

5,040,000

3,636,000

1,404,000

$ 60 per unit

$ 22 per unit

$ 8 per unit

$ 528,000 per year

$ 11 per unit

$ 105,000 per year

105,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need helparrow_forwardAnswer the following question(s) using the information below. Jeppson Company manufactures computer hard drives. The following data is related to sales and production of the computer hard drives for last year. Selling price per unit Variable manufacturing costs per unit Variable selling and administrative expenses per unit Fixed manufacturing overhead (in total) Fixed selling and administrative expenses (in total) Units produced during year Units sold during year Units in beginning inventory Using variable costing, what is the variable cost of goods available for sale at Jeppson Company for last month? A) $54,000 B) $150,000 C) $9,000 $100.00 $45.00 $6.00 $30,000 $8,000 1,500 1,200 0 D) $67,500arrow_forwardPrapare an Income Statement Using absorption costing. Prapare an Income Statement Using variable costing.arrow_forward

- Prepare Income statement for the month of December 2020 assuming absorption Costing and Variable Costing and state the reason for difference in income computed between absorption costing and variable costing.arrow_forwardCost of Goods Manufactured, using Variable Costing and Absorption Costing On March 31, the end of the first year of operations, Barnard Inc., manufactured 3,300 units and sold 2,800 units. The following income statement was prepared, based on the variable costing concept: Sales Variable cost of goods sold: Variable cost of goods manufactured Inventory, March 31 Total variable cost of goods sold Manufacturing margin Total variable selling and administrative expenses Contribution margin Fixed costs: Barnard Inc. Variable Costing Income Statement For the Year Ended March 31, 20Y1 Fixed manufacturing costs Fixed selling and administrative expenses Total fixed costs Operating income Variable costing Absorption costing $508,200 (77,000) $231,000 72,800 $896,000 (431,200) $464,800 (106,400) $358,400 (303,800) $54,600 Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.arrow_forwardFarris Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced $ 172 0 9,700 9,300 400 Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense What is the net operating income (loss) for the month under variable costing? $6,000 $11,600 $17,600 ($40,000) $ 33 $75 $21 $ 25 $ 145,500 $ 10,300arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Cool Sky reports the following for its first year of operations. The company produced 44,000 units and sold 36,000 units at a price of $140 per unit. Direct materials Direct labor Variable overhead Fixed overhead Variable selling and administrative expenses Fixed selling and administrative expenses Income Statement (Absorption Costing) 1b. Assume the company uses absorption costing. Prepare its income statement for the year under absorption costing. Sales Cost of goods sold Gross profit Income Income $ $ $ $ 5,040,000 3,240,000 1,800,000 1,404,000 396,000 $ 60 per unit $ 22 per unit $ 8 per unit 528,000 per year $ 11 per unit 105,000 per yeararrow_forwardOn November 30, the end of the first month of operations, Weatherford Company prepared the following income statement, based on the absorption costing concept: Weatherford Company Absorption Costing Income Statement For the Month Ended November 30 Sales (6,100 units) Cost of goods sold: Cost of goods manufactured (7,000 units) Inventory, November 30 (1,000 units) Total cost of goods sold Gross profit $161,000 Sales Variable cost of goods sold: Variable cost of goods manufactured Inventory, November 30 (23,000) $201,300 138,000 $63,300 Selling and administrative expenses 35,910 Income from operations $27,390 Assume the fixed manufacturing costs were $38,640 and the fixed selling and administrative expenses were $17,590 Prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Weatherford Company Variable Costing Income Statement For the Month Ended November 30 201,300arrow_forwardDomesticarrow_forward

- 1. Prepare the current-year income statement for the company using variable costing. 2. Prepare the current-year income statement for the company using absorption costing.arrow_forwardAaron Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead. Variable selling and administrative expense Multiple Choice Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense What is the unit product cost for the month under variable costing? $110 per unit $137 per unit $143 0 $120 per unit 6,850 6,550 300 $93 per unit $23 $53 $17 $17 $184,950 $ 27,300arrow_forwardA company reports the following contribution margin income statement. Contribution Margin Income Statement For Year Ended December 31 Sales (19,200 units at $22.50 each) Variable costs (19,200 units at $18.00 each) Contribution margin. Fixed costs Income The manager believes the company can increase sales volume to 22,000 total units by increasing advertising costs by $16,200. Required A Required B Complete this question by entering your answers in the tabs below. Contribution Margin Income Statement For Year Ended December 31 $ 432,000 345,600 Prepare a contribution margin income statement assuming the company incurs the additional advertising costs and sales volume increases to 22,000 units. Sales Variable costs Contribution margin 86,400 64,800 $ 21,600 Fixed costs Incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education