Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Provide answer

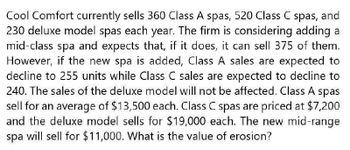

Transcribed Image Text:Cool Comfort currently sells 360 Class A spas, 520 Class C spas, and

230 deluxe model spas each year. The firm is considering adding a

mid-class spa and expects that, if it does, it can sell 375 of them.

However, if the new spa is added, Class A sales are expected to

decline to 255 units while Class C sales are expected to decline to

240. The sales of the deluxe model will not be affected. Class A spas

sell for an average of $13,500 each. Class C spas are priced at $7,200

and the deluxe model sells for $19,000 each. The new mid-range

spa will sell for $11,000. What is the value of erosion?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bubbly Waters currently sells 320 Class A spas, 470 Class C spas, and 220 deluxe model spas each year. The firm is considering adding a mid-class spa and expects that if it does, it can sell 395 units per year. However, if the new spa is added, Class A sales are expected to decline to 235 units while the Class C sales are expected to increase to 495. The sales of the deluxe model will not be affected. Class A spas sell for an average of $12,300 each. Class C spas are priced at $6,200 and the deluxe models sell for $17,200 each. The new mid-range spa will sell for $8,200. What annual sales figure should you use in your analysis?arrow_forwardWhat is the value of erosion?arrow_forwardHyperion Inc., currently sells its latest high-speed color printer, the Hyper 500, for $350. Its cost of goods sold for the Hyper 500 is $200 per unit, and this year's sales (at the current price of $350) are expected to be 20,000 units. Hyperion plans to lower the price of the Hyper 500 to $300 one year from now. a. Suppose Hyperion considers dropping the price to $300 immediately, (rather than waiting one year). By doing so, it expects to increase this year's sales by 25% to 25,000 units. What would be the incremental impact on this year's EBIT of such a price drop? b. Suppose that for each printer sold, Hyperion expects additional sales of $75 per year on ink cartridges for the three-year life of the printer, and Hyperion has a gross profit margin of 70% on ink cartridges. What is the incremental impact on EBIT for the next three years of dropping the price immediately (rather than waiting one year)?arrow_forward

- Hyperion, Inc. currently sells its latest high-speed color printer, the Hyper 500, for $350. It plans to lower the price to $300 next year. Its cost of goods sold for the Hyper 500 is $200 per unit, and thi year's sales are expected to be 20,000 units.a) Suppose that if Hyperion drops the price to $300 immediatley, it can increase this year's sales by 25% to 25,000 units. What would be the incremental impact on this eyar's EBIT of such a price drop?b) Suppose that for each printer sold, Hyperion expects additional sales of $75 per year on ink cartridges for the next years, and Hyperion has a gross profit margin of 70% on ink cartridges. What is the incremntal impact on EBIT for the next three years of a priced drop this year?arrow_forwardHyperion Inc., currently sells its latest high-speed colour printer, the Hyper 500, for $354. Its cost of goods sold for the Hyper 500 is $202 per unit, and this year's sales (at the current price of $354) are expected to be 24,000 units. Hyperion plans to lower the price of the Hyper 500 to $303 one year from now. a. Suppose Hyperion considers dropping the price to $303 immediately, (rather than waiting one year). By doing so it expects to increase this year's sales by 30% to 31,200 units. What would be the incremental impact on this year's EBIT of such a price drop? b. Suppose that for each printer sold, Hyperion expects additional sales of $82 per year on ink cartridges for the three-year life of the printer, and Hyperion has a gross profit margin of 61% on ink cartridges. What is the incremental impact on EBIT for the next three years of dropping the price immediately (rather than waiting one year)? a. Suppose Hyperion considers dropping the price to $303 immediately, (rather than…arrow_forwardUnder pressure from its board of directors, management at Roadside is planning to enter the conventional battery-powered flashlight market. Roadside expects to sell this boring product to wholesalers for $18.12 per unit. Relevant fixed costs will total $334,573, and variable costs to make this product will be $14.57 per unit. Background research estimates the size of the market for conventional flashlights at 1.8 million units per year. If sales of this unit reach breakeven, what market share will Roadside have? Report your answer as a percent. Report 27.5%, for example, as "27.5". Rounding: tenth of a percent.arrow_forward

- Hyperion, Inc. currently sells its latest high-speed colour printer, the Hyper 500, for $371. It plans to lower the price to $318 next year. Its cost of goods sold for the Hyper 500 is $212 per unit, and this year's sales are expected to be 21,000 units. a. Suppose that, if Hyperion drops the price to $318 immediately, it can increase this year's sales by 27% to 26,670 units. What would be the incremental impact on this year's EBIT of such a price drop? b. Suppose that, for each printer sold, Hyperion expects additional sales of $78 per year on ink cartridges for the three years, and Hyperion has a gross profit margin of 61% on ink cartridges. What is the incremental impact on EBIT for the next three years of a price drop this year?arrow_forwardUnder pressure from its board of directors, management at Roadside is planning to enter the conventional battery-powered flashlight market. Roadside expects to sell this boring product to wholesalers for $18.16 per unit. Relevant fixed costs will total $343,600, and variable costs to make this product will be $12.15 per unit. Background research estimates the size of the market for conventional flashlights at 1.8 million units per year. If sales of this unit reach breakeven, what market share will Roadside have? Report your answer as a percent. Report 27.5%, for example, as "27.5". Rounding: tenth of a percent. Your Answer: Answerarrow_forwardAPQ Company currently sells a piece of equipment for $150 per unit. It plans on lowering the price of the unit to $119 per unit. The cost of goods for each unit is consistent each year, at $52 per unit. The company expects to sell 100,000 units in the current year. Suppose that if APQ drops the price on the equipment immediately, it can increase sales over the next year by 30% to 130,000 units. Will this price decrease have a positive or negative impact on the company's EBIT? What will be the dollar value of the incremental impact of this price drop on the firm's EBIT? Will this have a positive or negative impact on the EBIT for the company? What will the dollar value of the incremental impact of the price drop be for the company? (Enter a negative for a loss, positive for a gain; round your answer to the nearest whole dollar.)arrow_forward

- John Deere Tractors is considering the introduction of a mid-priced version of the firm's DC6900 lawn and garden tractor product line the DC6900-X. The DC6900-X would sell for $3,900 with unit variable costs of $1,800. Projections made by an independent marketing research firm indicate that the DC6900-X would achieve a sales volume of 500,000 units next year, in its first year of commercialization. One-half of the first year's volume would come from competitors' products and market growth. However, a consumer research study indicates that 30 percent of the DC6900-X sales volume would come from the higher-priced DC600-Omega tractor, which sells for $5,900 (with unit variable costs of $2,200). Another 20 percent of the DC00-X sales volume would come from the economy-priced DC6900-Alpha tractor, priced at $2,500 (with unit variable costs of $1,200). The DC6900-Omega unit volume is expected to be 400,000 units next year, and the DC6900-Alpha is expected to achieve a 600,000-unit sales…arrow_forwardWinn Corp. currently sells 9,820 motor homes per year at $45,500 each, and 3,680 luxury motor coaches per year at $89,700 each. The company wants to introduce a new portable camper to fill out its product line. It hopes to sell 4,000 of these campers per year at $14,750 each. An independent consultant has determined that if the new campers are introduced, sales of its existing motor homes will most likely increase by 250 units per year while the sales of its motor coaches will probably decline by 368 units per year. What is the amount that should be used as the annual sales figure when evaluating the portable camper project?arrow_forwardPhlight Restaurant is considering a delivery service. The firm expects that sales from the new service will be $150,000 per year. Phlight currently offers a sit-down service with annual sales of $100,000. While many of the delivery sales will be to new customers, Phlight estimates that 60% of their current sit-down customers will switch and use the delivery service. The level of incremental sales associated with introducing the delivery service is closest to: Select one: a. $90,000 b. $150,000 c. $60,000 d. $120,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College