Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

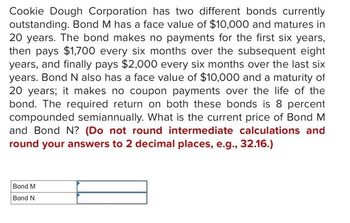

Transcribed Image Text:Cookie Dough Corporation has two different bonds currently

outstanding. Bond M has a face value of $10,000 and matures in

20 years. The bond makes no payments for the first six years,

then pays $1,700 every six months over the subsequent eight

years, and finally pays $2,000 every six months over the last six

years. Bond N also has a face value of $10,000 and a maturity of

20 years; it makes no coupon payments over the life of the

bond. The required return on both these bonds is 8 percent

compounded semiannually. What is the current price of Bond M

and Bond N? (Do not round intermediate calculations and

round your answers to 2 decimal places, e.g., 32.16.)

Bond M

Bond N

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- ABC Company issued a $250,000 bond at the coupon rate of 2 percent payable semi-annually. Now, the bond has a remaining life of 4 years. i. Two years from now, you bought the ABC bond when the market interest rate for a new ABC bond is 4 percent. How much did you pay for the bond? ii. You sold the bond purchased in part i. after holding it for a year, when interest rates (for bonds of similar risk as ABC's bonds) fell to 3 percent. What is the percentage gain / loss on the bond? Illustrate your answer using the bond valuation equation.arrow_forwardThe Exley Company bonds are currently selling for $1,041.30. This is a 50-year bond issued 17 years ago, which pays semi-annual interest. Other bonds in the market similar to Exley Company's bond pay a market interest rate of 7.75%. What is the coupon rate?arrow_forwardSimilar to the mortgage pass-through security (PT), a competing bond has a par value of $100,000, a 4% coupon paid monthly, and a maturity of 258 months. Like most bonds, the payments on this bond are interest only. The current market rate for similar bonds is 3.5%, and prepayments on the mortgage pass through currently equal $100 per month. Assume rates immediately drop to 3%, and prepayments increase to $150 on the mortgage pass through as a result. What is the price of the bond today? Multiple Choice $87,347 $119,766 $115,830 O $100.017arrow_forward

- Dufner Co. issued 13-year bonds one year ago at a coupon rate of 7 percent. The bonds make semiannual payments. If the YTM on these bonds is 5.3 percent, what is the current dollar price assuming a par value of $1,000? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardMcCurdy Co.'s Class Q bonds have a 12-year maturity, $1,000 par value, and a 10% coupon paid semiannually (5% each 6 months), and those bonds sell at their par value. McCurdy's Class P bonds have the same risk, maturity, and par value, but the p bonds pay a 10% annual coupon. Neither bond is callable. At what price should the annual payment bond sell? Select the correct answer. Oa. $992.23 b. $989.21 O c. $986.19 Od. $980.15 e. $983.17arrow_forwardART Vandelay Inc. has two different bonds currently outstanding. Bond A has a face value of $40,000 and matures in 20 years. The bond makes no payment for the first 6 years, pays $2000 semiannually for the subsequent eight years, and finally $2500 semiannually for the last 6 years. Bond B also has a value of $40,000 and matures in 20 years. However, it makes no coupon payments over the life of the bond. If the stated annual interest rate is 12%, compounded semiannually, a. What is the current price of Bond A? b. What is the current price of Bond B?arrow_forward

- One year ago Quantum of Solace Inc. issued 14-year bonds. Here's what's known about these bonds: • The coupon rate for these bonds is 7.4 %. • The coupon payments are semiannual. • The bonds' par value is $1,000. • The yield to maturity is 5.7%. How much should each of the bonds of Quantum of Solace Inc. cost if purchased today? (Do not round intermediate calculations. Round your final answer to 2 decimal places, e.g., 32.16.) Current bond pricearrow_forwardKebt Corporation's Class Semi bonds have a 15-year maturity and a 7.25% coupon paid semiannually (3.625% each 6 months), and those bonds sell at their $1,000 par value. The firm's Class Ann bonds have the same risk, maturity, nominal interest rate, and par value, but these bonds pay interest annually. Neither bond is callable. At what price should the annual payment bond sell? Do not round your intermediate calculations. a. $988.31 b. $1,000.00 c. $1,035.90 d. $678.87 e. $992.53arrow_forwardBright Sun, Inc. sold an issue of 30-year $1,000 par value bonds to the public. The bonds had a 7.61 percent coupon rate and paid interest annually. It is now 12 years later. The current market rate of interest on the Bright Sun bonds is 11.08 percent. What is the current market price (intrinsic value) of the bonds? Round the answer to two decimal places.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education