Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

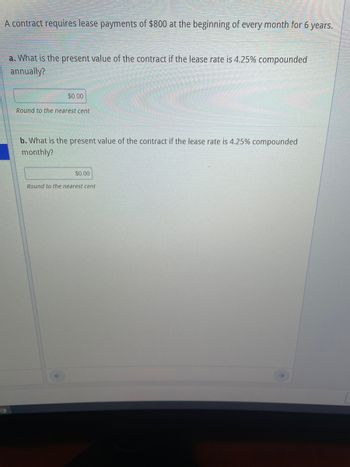

Transcribed Image Text:A contract requires lease payments of $800 at the beginning of every month for 6 years.

a. What is the present value of the contract if the lease rate is 4.25% compounded

annually?

$0.00

Round to the nearest cent

b. What is the present value of the contract if the lease rate is 4.25% compounded

monthly?

$0.00

Round to the nearest cent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 6arrow_forwardA lease agreement that qualifies as a finance lease calls for annual lease payments of $26,269 over a six-year lease term (also the asset's useful life with the first payment at January 1, the beginning of the lease. The interest rate is 5% FV of $1 PV of $1 FVA of PVA of $1, FVAD of $1 and PVAD of $t) (Use appropriate factor(s) from the tables provided.) 1 Required: a. Complete the amortization schedule for the first two payments b. If the lessee's fiscal year is the calendar year, what would be the amount of the lease liability that the lessee would report in its balance sheet at the end of the first year? What would be the interest payable? Complete this question by entering your answers in the tabs below. Required A Required B Complete the amortization schedule for the first two payments. (Enter all amounts as positive values.) Lease Payment Effective Interest Decrease in Outstanding Date 01/01/2016 01/01/2016 01/01/2017 Balance Balance Required B >arrow_forwardHonda is selling a 2014 Accord Coupe Ex M tor $30056.90 including freight, PDI and all applicatble fees. The lease payment of S382 is due at the beginning of each month. If the interest rate compounded annually is 3.99% and the residual value is S13 200, determine the size of the final lease paymentarrow_forward

- 2.arrow_forwardsharadarrow_forwardBlossom Leasing Company agrees to lease equipment to Blue Corporation on January 1, 2020. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $520,000, and the fair value of the asset on January 1, 2020, is $737,000. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $60,000. Blue estimates that the expected residual value at the end of the lease term will be 60,000. Blue amortizes all of its leased equipment on a 3. straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility of the lease payments is probable. 6. Blossom desires a 10% rate of return on its investments. Blue's incremental borrowing rate is 11%, and the lessor's implicit rate is unknown. (Assume the accounting period ends on December 31.)arrow_forward

- How is this wrongarrow_forwardLessee enters into a 10-year lease of property with annual lease payments of P50,000, payable at the beginning of each year. The contract specifies that lease payments will increase every two years on the basis of the increase in the Consumer Price Index for the preceding 24 months. The Consumer Price Index at the commencement date is 125. The rate implicit in the lease is not readily determinable. Lessee’s incremental borrowing rate is 5 per cent per annum, which reflects the fixed rate at which Lessee could borrow an amount similar to the value of the right-of-use asset, in the same currency, for a 10-year term, and with similar collateral. Discount factor for 5% for 9 periods is 7.10782.Lessee expects to consume the right-of-use asset’s future economic benefits evenly over the lease term and, thus, depreciates the right-of-use asset on a straight-line basis.At the beginning of the third year of the lease the Consumer Price Index is 135.Determine the amount of lease liability…arrow_forwardSolve this problems early all subpartsarrow_forward

- A lease valued at $40,000 requires payments of $5000 every three months. If the first payment is due three years after the lease was signed and interest is 10% compounded quarterly, what is the term of the lease? The term of the lease is quarters. (Round up to the nearest quarter.)arrow_forwardRefer to the following lease amortization schedule. The five payments are made annually starting with the beginning of the lease. A $1,500 purchase option is reasonably certain to be exercised at the end of the five-year lease. The asset has an expected economic life of eight years. Lease Cash Effective Decrease in Outstanding Payment Payment Interest Balance Balance 40,860 31,960 24,978 17,577 9,731 ?? 0 1 2 3 4 5 6 8,900 8,900 8,900 8,900 8,900 1,500 Multiple Choice $46,000 ?? 1,918 1,499 1,055 What is the total interest paid over the term of the lease? $2.760 ?? 85 ?? 6,982 7,401 7,845 ?? 1,415arrow_forwardA property is currently leased for $100,000 p.a. with fully recoverable outgoings. The lease has 3 years to run on the current (fixed) rent. The market rent for the property is $120,000. What is the current value of the property subject to the lease at a yield of 8% ? Assume rents are paid annually in arrears.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education