ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

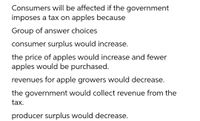

Transcribed Image Text:Consumers will be affected if the government

imposes a tax on apples because

Group of answer choices

consumer surplus would increase.

the price of apples would increase and fewer

apples would be purchased.

revenues for apple growers would decrease.

the government would collect revenue from the

tax.

producer surplus would decrease.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A market is most efficient when Social or economic surplus is maximized Producer surplus is greater than social surplus Consumer surplus is equal to producer surplus Consumer surplus is greater than producer surplusarrow_forwardThe vertical distance between points A and B represents a tax in the market. Price 24 22 20 18+ 16 14 + 12 10 8 6 4 2 A Supply Demand 5 10 15 20 25 30 35 40 45 50 55 60 Quantity As a result of the tax, consumer surplus decreases by $65, producer surplus decreases by $85, tax revenue is $120, and deadweight loss is $30. $75, producer surplus decreases by $75, tax revenue is $120, and deadweight loss is $30. $80, producer surplus decreases by $80, tax revenue is $120, and deadweight loss is $40. $120, producer surplus decreases by $120, tax revenue is $200, and deadweight loss is $40.arrow_forwardA market with a price ceiling creates Group of answer choices excess demand for goods and services in the market. a price floor. a greater quantity supplied than quantity demanded. a surplus of goods and services in the market.arrow_forward

- If the government imposes a price ceiling of $55 in this market, then total surplus will be what?arrow_forwardWhy does producer surplus arise? Consumers buy less of some commodities than they need. Sellers' costs of production for some goods are less than the market price. Producers make more off some commodities than the consumers desire. Sellers manufacture more units of a good than consumers are willing to purchase.arrow_forwardHelp me out please?arrow_forward

- The price of apples that shane buys monthly drops from $8 to $4, the equilibrium quantity is 4. What would be the increase amount of consumer surplus?arrow_forwardWhat is Consumer Surplus at a price of $5? Price Quantity Demanded Quantity Supplied 12 1 6 10 2 5 8 3 4 6 4 3 4 5 2 2 6 1 Multiple Choice $4 $20 $16arrow_forwardPrice $150 200 250 300 350 400 450 500 550 600 650 1. Equilibrium price $350 2. Quantity 50 3. Consumer Surplus? 6250 4. Producer Surplus? 6250 500 7. Remove the tax. Imposes a price floor $100 below the equilibrium price a Fiquilibrium price $350 and quantity? 50 Quantity Demanded 100 90 5. What is the total surplus? 12500 6. Suppose a $200 unit tax is placed on the good being sold. How much tax revenue is to be made? 4000 b. Resulting amount of surplus/shortage if any (0 if none) 0 8. Remove the price floor Impose a price ceiling $50 below the equilibrium price a Equilibrium price $350 and quantity? 50 b. Resulting amount of surplus/shortage (0 if none) o 80 70 60 50 40 30 20 10 0 Quantity Supplied 10 20 30 40 50 60 70 80 90 100 . How much deadweight loss is created (0 if none)?arrow_forward

- The area under the demand curve up to unit Q 1 represents the total ____ of Q 1 to society. A. surplus B. gain C. cost D. benefitarrow_forwardPrice (dollars) 8 6 4 2 0 X 100 200 S 300 400 surplus is $ 500 600 Quantity Assume the demand curve intersects the x-axis at $12 and the supply curve intersects the x-axis at $0 At a price floor of $10 in the above figure consumer surplus is $ units and search activity is $ Just enter a value. Do not enter the "$" sign. producerarrow_forwardQuestion 4 Suppose Home is a small exporter of wheat. At the world price of 100 US dollars per tonne, Home growers export 20 tons of wheat. Now suppose the Home government decides to support its domestic producers with an specific export subsidy of 40 US dollars per tonne. Use Figure 1 to answer the following questions: Figure 1: Supply and Demand for Wheat at Home Home price X 40 140 100 10 20 50 Supply Demand Quantity (a) Explain why consumer and producer surplus can be used to gauge the change in welfare caused by the export subsidy on individuals and firms. (b) What is the quantity exported by Home under free trade and with the export subsidy? (c) Calculate the effect of the export subsidy on consumer surplus, producer surplus and government revenue; depict each of these in a graph. What is the overall net effect of the export subsidy on Home welfare?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education