FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

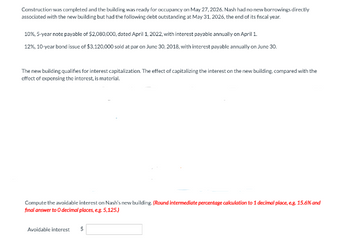

Transcribed Image Text:Construction was completed and the building was ready for occupancy on May 27, 2026. Nash had no new borrowings directly

associated with the new building but had the following debt outstanding at May 31, 2026, the end of its fiscal year.

10%, 5-year note payable of $2,080,000, dated April 1, 2022, with interest payable annually on April 1.

12%, 10-year bond issue of $3,120,000 sold at par on June 30, 2018, with interest payable annually on June 30.

The new building qualifies for interest capitalization. The effect of capitalizing the interest on the new building, compared with the

effect of expensing the interest, is material.

Compute the avoidable interest on Nash's new building. (Round intermediate percentage calculation to 1 decimal place, e.g. 15.6% and

final answer to O decimal places, e.g. 5,125.)

Avoidable interest $

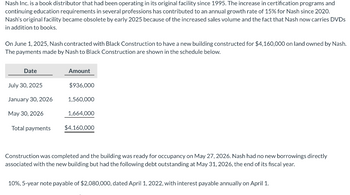

Transcribed Image Text:Nash Inc. is a book distributor that had been operating in its original facility since 1995. The increase in certification programs and

continuing education requirements in several professions has contributed to an annual growth rate of 15% for Nash since 2020.

Nash's original facility became obsolete by early 2025 because of the increased sales volume and the fact that Nash now carries DVDs

in addition to books.

On June 1, 2025, Nash contracted with Black Construction to have a new building constructed for $4,160,000 on land owned by Nash.

The payments made by Nash to Black Construction are shown in the schedule below.

Date

July 30, 2025

January 30, 2026

May 30, 2026

Total payments

Amount

$936,000

1,560,000

1,664,000

$4,160,000

Construction was completed and the building was ready for occupancy on May 27, 2026. Nash had no new borrowings directly

associated with the new building but had the following debt outstanding at May 31, 2026, the end of its fiscal year.

10%, 5-year note payable of $2,080,000, dated April 1, 2022, with interest payable annually on April 1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Blossom Company issued $260,000 of 10% bonds on January 1, 2020. The bonds are due January 1, 2025, with interest payable each July 1 and January 1. The bonds were issued at 98.Prepare the journal entries for (a) January 1, (b) July 1, and (c) December 31. Assume The Blossom Company records straight-line amortization semiannually. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit (a) choose a transaction date Jan. 1, 2020July 1, 2020Dec. 31, 2020 enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount enter a credit amount (b) choose a transaction date…arrow_forwardOn March 2, 2022, 20-year, 3 percent, general obligation serial bonds were issued at the face amount of $3,000,000. Interest of 3 percent per annum is due semiannually on March 1 and September 1. The first payment of $150,000 for redemption of principal is due on March 1, 2023. Fiscal year-end occurs on December 31. What is the interest expenditure in the governmental funds for the fiscal year ending December 31, 2022?arrow_forwardOn March 2, 2022, 20-year, 3 percent, general obligation serial bonds were issued at the face amount of $3,000,000. Interest of 3 percent per annum is due semiannually on March 1 and September 1. The first payment of $150,000 for redemption of principal is due on March 1, 2023. Fiscal year-end occurs on December 31. What is the interest expense in the governmental activities accounts for the fiscal year ending December 31, 2022?arrow_forward

- Prepare all journal entries and adjusting journal entries necessary to record the information below for 2022: Red Robin holds corporate bonds with a face value of $218,500. It purchased these bonds on January 1 of the prior year (2021). The stated rate of the bonds is 4.85 %, but they were purchased at an effective rate of 7%. The bonds are 5-year bonds and pay interest on December 31 every year. Red Robin correctly classifies this investment as available for sale. This is the only AFS debt investment that Red Robin has ever had. The fair value of the bond on December 31 of the current year is $224,900.arrow_forwardThe Company issued a short-term debt of $65,000 on July 1, 2021 for a period of 5 months with a note payable of 14% interest. The company uses the accounting period on a quarterly basis. Required: Prepare the journal entries needed to record the issuance of the debt, recognize interest expense, and pay off the debt as it matures. Note: Include the current method of processing and the excel formulaarrow_forwardOn December 31, 2024, L Incorporated had a $3,000,000 note payable outstanding, due July 31, 2025. L borrowed the money to finance construction of a new plant. L planned to refinance the note by issuing long-term bonds. Because L temporarily had excess cash, it prepaid $650,000 of the note on January 23, 2025. In February 2025, L completed a $4,500,000 bond offering. L will use the bond offering proceeds to repay the note payable at its maturity and to pay construction costs during 2025. On March 13, 2025, L issued its 2024 financial statements. What amount of the note payable should L include in the current liabilities section of its December 31, 2024, balance sheet? Multiple Choice A. $0 B. $650,000 C. $2,350,000 D. $3,000,000 Please don't provide answer in image format thank youarrow_forward

- Blossom Company issued $510,000 of 5-year, 9% bonds at 96 on January 1, 2022. The bonds pay interest annually. (a1) Your answer is correct. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Cash Discount on Bonds Payable Bonds Payable Your answer is incorrect. Compute the total cost of borrowing for these bonds. Total cost of borrowing eTextbook and Media List of Accounts - Your answer is partially correct. Account Titles and Explanation Interest Expense (DZ). Premium on Bonds Payable $ Interest Payable Prepare the journal entry to record the issuance of the bonds, assuming the bonds were issued at 104. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Total cost of borrowing Debit eTextbook and Media $ 489600 Debit 20400 Compute the total cost of borrowing for these bonds, assuming the bonds were…arrow_forwardThe Company issued a short-term debt of $65,000 on July 1, 2021 for a period of 5 months with a note payable of 14% interest. The company uses the accounting period on a quarterly basis. Required: Prepare the journal entries needed to record the issuance of the debt, recognize interest expense, and pay off the debt as it matures. Note: Include the current method of processing and the excel formulaarrow_forwardNeed complete and correct answer for all parts with all workings and steps in text form please show calculation narrations and explanation clearly for all steps answer in text formarrow_forward

- At December 31 2025, Crane co has outstanding 3 long term debt issues. The first is a 6,150,000 note payable which matures June 30, 2028. Second is a 20, 250,000 bond issue which matures september 30, 2029. Third is a 57,410,000 sinking fund debenture with annual sinking fund payments of 11,482,000 in each of the years 2027 through 2031. Prepare the note disclosure for the long term debt at December 31, 2025, 2026, 2027, 2028, 2029, and 2030. Also prepare the journal entry for the purchase on 12/31/25.arrow_forwardOn January 1, 2025, Concord Corporation issued $500,000 of 7% bonds, due in 10 years. The bonds were issued for $537.196, and pay interest each July 1 and January 1. The effective-interest rate is 6%. Prepare the company's journal entries for (a) the January 1 issuance. (b) the July 1 interest payment, and (c) the December 31 adjusting entry. Concord uses the effective interest method. (Round answers to 0 decimal places, eg, 38,548. If no entry is required, select "No Entry for the account titles and enter O for the amounts Credit account titles are automatically indented when the amount is entered. Do not indent manually List all debit entries before credit entries) No. (4) Date Account Titles and Explanation Debit Credarrow_forwardYour answer is partially correct. On January 1, 2020, Oriole Enterprises issued 8%, 20-year bonds with a face amount of $5,350,000 at 102. Interest is payable annually on January 1. Prepare the entries to record the issuance of the bonds and the first annual interest accrual and amortization assuming that the company uses straight-line amortization. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Jan. 1 Dec. 31 Account Titles and Explanation Cash Bonds Payable Premium on Bonds Payable Interest Expense Premium on Bonds Payable Interest Payable Debit 5457000 385200 42800 Credit 5350000 107000 428000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education