ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

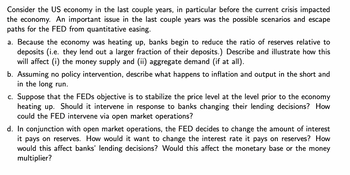

Transcribed Image Text:Consider the US economy in the last couple years, in particular before the current crisis impacted

the economy. An important issue in the last couple years was the possible scenarios and escape

paths for the FED from quantitative easing.

a. Because the economy was heating up, banks begin to reduce the ratio of reserves relative to

deposits (i.e. they lend out a larger fraction of their deposits.) Describe and illustrate how this

will affect (i) the money supply and (ii) aggregate demand (if at all).

b. Assuming no policy intervention, describe what happens to inflation and output in the short and

in the long run.

c. Suppose that the FEDs objective is to stabilize the price level at the level prior to the economy

heating up. Should it intervene in response to banks changing their lending decisions? How

could the FED intervene via open market operations?

d. In conjunction with open market operations, the FED decides to change the amount of interest

it pays on reserves. How would it want to change the interest rate it pays on reserves? How

would this affect banks' lending decisions? Would this affect the monetary base or the money

multiplier?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- a. List the three main tools of monetary policy used by the Fed and briefly describe how each of the tools impacts the money supply and interest rates. b. Give examples of both restrictive and easy monetary policy.arrow_forwardHi, can someone help me with this question? Thank you in advance. 1. Suppose the Central Bank has just announced a higher overnight interest rate, thereby decreasing the desire for new loans. A commercial bank is holding excess reserves and wants to buy $46,000 of government bonds from the CB (which they are willing to sell). a. What is the immediate change in the Central Bank’s assets and liabilities? b. What is the immediate change in the commercial bank’s assets?arrow_forward1. For the each of the following, use the supply and demand of reserves diagram to make the necessary changes, describe the type of policy that the Fed would need to conduct (if any) and indicate what happens to the market (effective) federal funds rate. (In all scenarios, you can assume that the "normal" starting equilibrium, that is, where vertical portion of supply curve intersects demand at its downward sloping portion.) a. Holiday shopping season causes banks to increases holdings of excess reserves. The Fed decides not to react. As an example, answer is already given below. FER In this case demand for reserves would increase pushing federal funds rate up. b. Holiday shopping season causes banks to increases holdings of excess reserves. The Fed decides to react to keep the federal funds rate at the target. c. FOMC raises the target federal funds rate and NY Fed conducts necessary operations to achieve it. d. Fed decides to raise interest rate on reserve balances above the current…arrow_forward

- Hi, can I get help with this question I'm not sure what to choose? I'm confused base on the graph and I'm not quite sure what statement is accurate. The graph is in the attachments with download data. Here's the question: Why is it important for the central bank to be independent from the part of the government responsible for spending? A. The Federal Reserve is, historically, driven by political ideologies. Allowing it to influence the rest of government could harm its ability to enact effective monetary policy. B. If not independent, the government might be tempted to have the central bank print more money (creating inflation) whenever the government runs a budget deficit. C. If not independent, the government might be tempted to have the central bank print more money (creating deflation) whenever the government runs a budget surplus.arrow_forwardExplanation it correctlyarrow_forward2.2arrow_forward

- The Fed’s bond holdings increased from $900 billion in 2009 to $4.5 Trillion in 2016. The purpose of the Fed’s decision to increase its bond holdings from 2009 to 2016 was to A. to decrease the reserves in the banking system thus engaging in so called “contractionary monetary policy” needed to contract the level of inflation B. contract the money supply to counteract the high rates of unemployment then existing in the United States C. increase the reserves in the banking system to increase bank lending and aggregate demand. D. engage in expansionary fiscal policyarrow_forwardFigure 31-3 On the following graph, MS represents the money supply and MD represents money demand. VALUE OF MONEY 0.6 0.45 5000 MS, MS 9000 QUANTITY OF MONEY MD Refer to Figure 31-3. Which of the following events could explain a shift of the money-supply curve from MS₁ to MS2? An increase in the value of money A decrease in the price level An open-market purchase of bonds by the Federal Reserve The Federal Reserve sells bondsarrow_forwardAll other things being equal, by how much will nominal GDP expand if the central bank increases the money supply by $100 billion, and the velocity of money is 3? (Use this information as necessary to answer the following 4 questions.) Suppose now that economists expect the velocity of money to increase by 50% as a result of the monetary stimulus. What will be the total increase in nominal GDP? If GDP is 1,500 and the money supply is 400, what is velocity? If GDP now rises to 1,600, but the money supply does not change, how has velocity changed?arrow_forward

- What is the main tool used by central banks to influence short-term interest rates and the money supply? A. Fiscal policy B. Open market operations C. Exchange rate policy D. Price controlsarrow_forwardM7arrow_forwardFrom 2020 to 2021, the Bank of Canada started the Corporate Bond PurchaseProgram, an attempt to inject liquidity into the economy. This involved the Bank ofCanada purchasing up to $10 billion of corporate bonds. What expected effect would this have on interest rates and the money supply? Explainarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education