ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

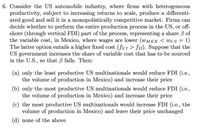

Transcribed Image Text:6. Consider the US automobile industry, where firms with heterogeneous

productivity, subject to increasing returns to scale, produce a differenti-

ated good and sell it in a monopolistically competitive market. Firms can

decide whether to perform the entire production process in the US, or off-

shore (through vertical FDI) part of the process, representing a share B of

the variable cost, in Mexico, where wages are lower (WMEX < WUS = 1)

The latter option entails a higher fixed cost (fvI > fD). Suppose that the

US government increases the share of variable cost that has to be sourced

in the U.S., so that B falls. Then:

(a) only the least productive US multinationals would reduce FDI (i.e.,

the volume of production in Mexico) and increase their price

(b) only the most productive US multinationals would reduce FDI (i.e.,

the volume of production in Mexico) and increase their price

(c) the most productive US multinationals would increase FDI (i.e., the

volume of production in Mexico) and leave their price unchanged

(d) none of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Zar Island Gas Company is the sole producer of natural gas in the remote island country of Zar. The company's operations are regulated by the State Energy Commission. The demand function for gas in Zar has been estimated as: P = 1,000 − .2Qwhere Q is output (measured in units) and P is price (measured in dollars per unit). Zar Island's cost function is: TC = 300,000 + 10QThe firm's asset base is $4 million.In the absence of any government price regulation, determine Zar Island's optimal (i) output level, (ii) selling price, (iii) total profits, and (iv) rate of return on its asset base.arrow_forward10.13arrow_forwardTim's Tires sells tires under the firm's own brand name and private label tires to discount stores. The tires sold in both sub-markets are identical, and the marginal cost is constant at $15 per tire for both types. The firm has estimated the following demand curves for each of the markets: PB = 70 - 0.0005QB (brand name) PP = 20 - 0.0002QP (private label). Quantities are measured in thousands per month and price refers to the wholesale price. a) By selling the brand name and private label tires at different prices, is the firm is using first, second, or third degree price discrimination? b) With price discrimination, the firm's TOTAL profit is _______________ (assume fixed costs are zero). c) If the firm cannot price discriminate and must charge a single price in the market, the optimal price is and the optimal quantity is ________________. The firm's total profit in this case is approximately ________________(again, assume fixed costs are zero). d) When price discriminating, the…arrow_forward

- Based on the best available econometric estimates, the market elasticity of demand for your firm’s product is −3. The marginal cost of producing the product is constant at $100, while average total cost at current production levels is $175.Determine your optimal per unit price if:Instructions: Enter your responses rounded to two decimal places.a. you are a monopolist. b. you compete against one other firm in a Cournot oligopoly. c. you compete against 19 other firms in a Cournot oligopoly.arrow_forwardhelparrow_forwardLI Auto can produce any quantity of cars at a constant marginal cost equal to $100 and a total foxed cost of $10000 globally You are asked to advise the CEO as to what prices and quantties LI Auto should set for car sales in Europe and in the US to maximize its profits The demand for LI Auto in each market is given by Og= 6000-8 P and Q, = 4000-2 P,where the subscript E denotes Europe, the subscript U denotes the US. Assume that LI Auto can restrict Europe or US car sales to authorized LI Auto dealers only. If, by an international agreement between Europe and US, LI Auto was forced to charge the same price in each market, calculate the following (round of to nearest number): Question: 1. Equilibrium Price 2. Quantity of cars sold in Europe and In the US 3. Total Profitarrow_forward

- Glyde Air Fresheners is the dominant firm in the solid room aromatizer industry, which has a total market demand given by Q = 80 - 2P. Glyde has competition from a fringe of four small firms that produce where their individual marginal cost equals the market price. The fringe firms each have a total cost given by: TCi = 10Qi + 2Qi2. If Glyde’s total costs are given by TCG = 100 + 6QG a) what price should Glyde establish for air fresheners? b) what is Glyde’s maximum profit?arrow_forwardA firm supplies its product to a number of UK cities. Its overall cost function can be expressed as TC = 40q² + 900q – 250. The Demand function in Lancaster is given by p = 3600 - 10q and that in Norwich by p = 5040-6q. i) What prices should the firm charge for its product in Lancaster and Norwich? ii) If the firm only supplies its output to Lancaster and Norwich, is it profitable? Interpret your answer; why might the firm be unable to pursue this strategy? 5.arrow_forwardadvanced microeconomics, imperfect competitionarrow_forward

- Assume that annual inverse demand for a particular product is P=150-Q. The product is offered by a pair of Bertrand competitors, each with marginal costs of $75. The discount factor is 0.9. What is the current equilibrium price and total surplus? Now, assume though that if R&D is conducted at rate x, it incurs one-off costs of r(x)=10x^2 and reduces the marginal costs to (75-x). Suppose that one firm decides to conduct R&D at rate x=10. This research will be protected by a patent of T years. a) What profit(ignoring the one-off costs of R&D) does the innovating firm make each year during the period of patent protection? b) What is the new equilibrium price and total surplus once patent protection expires? c) Use your answer above to write the total surplus from the innovationarrow_forwardAssume Ghacem Limited (Ghacem) continues to enjoy monopoly power over the production and sale of cement products in Ghana and operates with marginal costs of Ghs10 and sells to two sets ofconsumers. It is estimated that each set ofconsumers is made up of20 buyers. The individual demand function for the first set of consumers (A) is given by: QA(P) = 20 - P; and for the second set of consumers (B) it's given as: QB(P) = 16 - P; Using the above information estimate market output(s), price(s) and profits for both set of consumers under the following condition(s): 1. If Ghacem cannot prevent arbitrage ii. If Ghacem is able to prevent arbitrage but has no knowledge about the type of consumers it is dealing with. iii. If Ghacem is capable of preventing arbitrage between the different set ofconsumers but not within consumers in the same group. iv. If Ghacem can now identify all its consumers and can prevent arbitrage both between and within groups of consumers.arrow_forward[Suppose] A Cmpany is the sole provider of electricity in the various districts of Dubai. To meet the monthly demand for electricity in these districts, which is given by the inverse demand function: P = 1,200 − 4Q, the company has set up two electric generating facilities: Q1 kilowatts are produced at facility 1 and Q2 kilowatts are produced at facility 2; where Q = Q1 + Q2. The costs of producing electricity at each facility are given by C1(Q1) = 8,000 + 6Q1 C2(Q2) = 6,000 + 3Q2 + 5Q22 Calculate the profit maximizing output levels of each factory? What is the profit maximizing level of price? What is the maximum profit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education