Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Sub : Economics

Pls answer with in 15 mins.Please type the answer.I ll upvote. Thank You

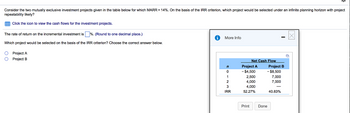

Transcribed Image Text:Consider the two mutually exclusive investment projects given in the table below for which MARR = 14%. On the basis of the IRR criterion, which project would be selected under an infinite planning horizon with project

repeatability likely?

Click the icon to view the cash flows for the investment projects.

The rate of return on the incremental investment is %. (Round to one decimal place.)

Which project would be selected on the basis of the IRR criterion? Choose the correct answer below.

O Project A

O Project B

More Info

n

0

1

2

3

IRR

Net Cash Flow

Project A

-$4,500

2,500

4,000

4,000

52.27%

Print

Project B

- $8,500

7,000

7,000

Done

40.83%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Prepare the following journal entriesarrow_forwardPlease do the required and bonus either way and please all the tables to be copy and pasted to a word document so I can editarrow_forwardmy.sharepoint.com/w:/t/personal/hayess_students_an_edu/_layouts/15/Docaspx?sourcedoc=(c6 anvas erences Review View Help Editing i Share A^ A U Ov Av Ao E E E E E ACC200 PRINCIPLES OF ACCOUNTING III ASSIGNMENT 4 EA1. LO 6.1Steeler Towel Company estimates its overhead to be $250,000. It expects to have 100,000 direct labor hours costing $2,500,000 in labor and utilizing 12,500 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hours FA2arrow_forward

- Chrome File Edit View History Bookmarks Tab Profiles Window Help Inbox (240) - abigailoforiwaa X M Gmail × | QuickLaunchSSO:: Single Sig x M Question 13 - Mid-Term Exam x On December 1, Jasmin Erns Ne ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Mid-Term Exam Saved 13 Refer to Apple's financial statements in Appendix A to answer the following. Skipped Help Save & Exit 1. For the fiscal year ended September 28, 2019, what amount is credited to Income Summary to summarize its revenues earned? 2. For the fiscal year ended September 28, 2019, what amount is debited to Income Summary to summarize its expenses incurred? 3. For the fiscal year ended September 28, 2019, what is the balance of its Income Summary account before it is closed? 1. Amount credited to income summary 2. Amount debited to income summary Ask 3. Balance in income summary account Mc с $ tv MacBook Pro G Search or type URL & ☆ Aa Carrow_forwardHistory Bookmarks Profiles Tab Window Help M Question 2 - Ch 21: Homewor × D2L Classlist - Spring 2024 Intro × New Tab .edu/webwork2/MATH_107_online_Spring_2024/HW_20_Simple_and_Compound_Interest/14 MAA MATHEMATICAL ASSOCIATION OF AMERICA / HW 20 Simple and Compound Interest / 14 Previous Problem Problem List Next Problem HW 20 Simple and Compound Interest: Problem 14 (6 points) What are the effective annual rates for an account paying an annual interest rate of 6% which is compounded: (a) annually? (b) quarterly? % % (c) daily (assuming there are 365 days in the year)? % (d) continuously? % Note: You can earn partial credit on this problem. Preview My Answers Submit Answers You have attempted this problem 0 times. You have unlimited attempts remaining. Page generated at 05/04/2024 at 02:41pm EDT WeBWorK 1996-2022 | theme: math4-green | ww_version: 2.17 | pg_version 2.17 | The WeBWarrow_forwardI have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forward

- Class Collaborate-AC-163-44 P x CengageNOWv2| Online teachin X + 2.cengagenow.com/ilmn/takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignments... A Determine the following measures for 2018. Round ratio values to one decimal place and dollar amounts to the nearest cent. For number of days' sales in receivables and number of days' sales in inventory, round intermediate calculations to the nearest whole dollar and final amounts to one decimal place. Assume there are 365 days in the year. 1. Working capital Г 2,790,000 2. Current ratio 4.1 3. Quick ratio 2.5 4. Accounts receivable turnover 16 5. Days' sales in receivables 22.8 days 6. Inventory turnover 7. Days sales in inventory 8. Debt ratio days % 9. Ratio of liabilities to stockholders' equity 10. Ratio of fixed assets to long-term liabilities 11. Times interest earned times times 12. Times preferred dividends earned Check My Work 8 144 0 P Previous Email Instructor Save and Exr Submit Assignment for Grading pri se…arrow_forward1537_1&content_id= _43546 1 Guest On January 8, ABC Company purchases Raw material of $42,000 on account On January 30, ABC Company incurs $32,000 of factory labor costs. Of that amount, $27,000 relates to wages payable and $5,000 relates to payroll taxes payable in February 30/1/2020 ABC company incurred the following manufacturing overhead for the month of January: $1500 Depreciation of factory machines $3000 Depreciation of factory building $500 Factory water and electricity bill on account $250 Factory building property taxes will be paid at the end of the year 2020 $200 Factory machines repair on account On January, ABC Company uses $24,000 of direct materials and $6,000 of indirect materials in January On January, the $32,000 total factory labor cost consists of $28,000 of direct labor and $4,000 of indirect labor 7:36 PM 20°C Clear A S O la 11/6/2021arrow_forwardQuestion #2 in this image.arrow_forward

- e File Edit View History Bookmarks Profiles Tab Window Help Week 4 Home X Short Exercis X G Dalton Hair St X C For each acco X plus.pearson.com/products/658729f2-cb81-45ee-babb-bf032e847a35/pages/urn:pearso... ☆ 5 6 32 Total 33 Net (b) 34 Total 35 A partial worksheet for Ramey Law Firm is presented below. Solve for the missing information. A 6 32 Total 33 Net (c) 34 Total 35 End of Chapter: Completing the Accounting Cycle A J Income Statement Debit (a) 8,375 (d) Credit $ 24,850 (e) $ 24,850 JA 23 Income Statement Debit $ 22,400 K Credit (a) F4-34 S-F:4-8. Determining net loss using a worksheet (Learning Objective 2) A partial worksheet for Aaron Adjusters is presented below. Solve for the missing information. 5,300 (f) L ▶ M Balance Sheet Debit $ 211,325 C For each acce X (e) L Debit (b) (d) (g) Credit $ 202,950 tv (c) (f) Balance Sheet M Credit $61,400 + $ 61,400 AA ⠀arrow_forwardBookmarks Window Help docs.google.com nkuspace.h. Tn https://soul2.hkuspace.h... h https://soul2.hkuspace.h. G Google Docs: Free Onlin.. E Untitled ls Add-ons Help Last edit was seconds ago 3回回,三 州咖山 1三 Arial 11 BIUA + ニ三▼三▼三 4 5 1 6 The company sells T-shirts with identical unit costs and selling prices. Shown below are the revenue and cost information: Unit Variable Data (per unit) Selling price Variable Cost Monthly Fixed Costs $140,000 $200,000 $40,000 Other fixed costs $20,000 $ 80.00 $30.00 Rent Salaries Advertising The com has no beginning or ending inventories. The company produced and sold 10,000 units last month. Required: a) Prepare the contribution format income statement for last month. b) Compute the breakeven sales in dollars. Compute the margin of safety percentage last month. c) Compute the degree of operating leverage. d) How many units should the company sell to achieve a target net operating income of $49.500? e) If the company plans to offer sales commission to…arrow_forwardplease help with parts a,b, and carrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education