Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

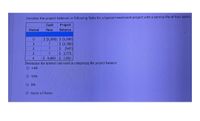

Transcribed Image Text:Consider the project balances in following Table for a typical investment project with a service life of four years.

Project

Balance

Cash

Period

Flow

$ (5,200) $ (5,200)

$ (3,780)

$ (547)

$ 3,771

$ 3,600 $ 7,937

1

3.

Determine the interest rate used in computing the project balance.

O 1496

O 10%6

896

O None of these

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- nformation on four investment proposals is given below: Investment Proposal A B C D Investment required $ (900,000) $ (170,000) $ (90,000) $ (1,430,000) Present value of cash inflows 1,263,600 233,400 136,500 1,908,300 Net present value $ 363,600 $ 63,400 $ 46,500 $ 478,300 Life of the project 5 years 7 years 6 years 6 years Required: 1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference.arrow_forwardPlease answer entire question! (mc options 19%, 20%, 21%, 22%, 23%)arrow_forwardYear 0 ($100,000)-Project Outlay (The bracket indicates a negative figure) Year 1 Year 2 Year 3 Year 4 Year 5 $ 18,000 $ 18,000 $18,000 $18,000 $ 18,000 Assume that cash flows are reinvested at the rate of 10%, compounded annually. Calculate the Modified Internal Rate of Return (MIRR) on this project. (Note that n=5) a 18.96% b 18% c 15.98% d 19.2%arrow_forward

- Cash Payback Period A project has estimated annual net cash flows of $49,500. It is estimated to cost $198,000. Determine the cash payback period. If required, round your answer to one decimal place. ? Yearsarrow_forwardIvanhoe Corporation has $310 million of debt outstanding at an interest rate of 9 percent. What is the dollar value of the tax shield on that debt, just for this year, if Ivanhoe is subject to a 35 percent marginal tax rate?arrow_forwardA firm evaluates all of its projects by applying the IRR rule. Year 0 1 2 3 Cash Flow -$ 149,000 67,000 72,000 56,000 What is the project's IRR? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- 19 es TB MC Qu. 14-36 (Algo) Moates Corporation has... Moates Corporation has provided the following data concerning an investment project that it is considering: $ 190,000 $ 120,000 per year 4 years 9% Initial investment Annual cash flow Expected life of the project Discount rate Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. The net present value of the project is closest to: Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Multiple Choice $190,000 $198,680 $(70,000)arrow_forward24arrow_forwardCompute the discounted payback statistic for Project C if the appropriate cost of capital is 8 percent and the maximum allowable discounted payback period is three years. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project C Time: 1 3 4 Cash flow: -$1,900 $840 $750 $790 $480 $280 Discounted payback period years Should the project be accepted or rejected?arrow_forward

- Part Five APPLY THE CONCEPTS: Net present value and Present value index This project requires an initial investment of $175,000. The project will have a life of 8 years. Annual revenues associated with the project will be $130,000 and expenses associated with the project will be $35,000. Calculate the net present value and the present value index for each project using the present value tables provided below. Present Value of $1 (a single sum) at Compound Interest. Present Value of an Annuity of $1 at Compound Interest. Note: • Use a minus sign to indicate a negative NPV. • If an amount is zero, enter "0". • Enter the present value index to 2 decimals. Total present value of net cash flow Amount to be invested Net present value Present value index: Project A Project B Sutherland Corp. is looking to invest in Project A or Project B. The data surrounding each project is provided below. Sutherland's cost of capital is 8%. Project A Project A Project B Project B This project requires an…arrow_forwardCompute the payback statistic for Project A if the appropriate cost of capital is 9 percent and the maximum allowable payback period is four years. (Round your answer to 2 decimal places.) Project A Time: 0 1 2 3 4 5 Cash flow: −$2,100 $790 $810 $740 $520 $320 Payback: ? Yearsarrow_forwardTB 13-47 (Appendix 13A) The following data pertain to an investment (Appendix 13A) The following data pertain to an investment proposal: Present Investment Required $27,130 Annual Cost Savings $5,000 Projected life the investment 10 years Projected Salvage Value $-0- What would be the internal rate of return? (Ignore income taxes in this problem.) Multiple Choice 5.426%. 13.0%. 54.26%. О 542.6%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education