ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

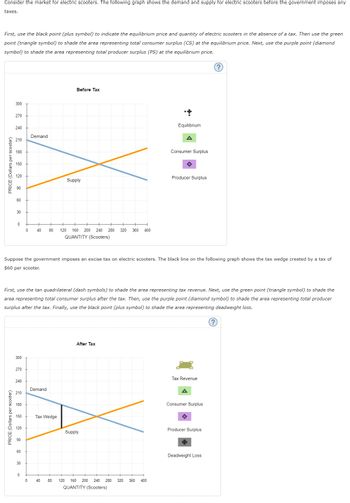

Transcribed Image Text:Consider the market for electric scooters. The following graph shows the demand and supply for electric scooters before the government imposes any

taxes.

First, use the black point (plus symbol) to indicate the equilibrium price and quantity of electric scooters in the absence of a tax. Then use the green

point (triangle symbol) to shade the area representing total consumer surplus (CS) at the equilibrium price. Next, use the purple point (diamond

symbol) to shade the area representing total producer surplus (PS) at the equilibrium price.

PRICE (Dollars per scooter)

300

270

PRICE (Dollars per scooter)

240

210

180

150

60

30

0

300

270

240

210

180

150

120

60

0

30

Suppose the government imposes an excise tax on electric scooters. The black line on the following graph shows the tax wedge created by a tax of

$60 per scooter.

0

Demand

First, use the tan quadrilateral (dash symbols) to shade the area representing tax revenue. Next, use the green point (triangle symbol) to shade the

area representing total consumer surplus after the tax. Then, use the purple point (diamond symbol) to shade the area representing total producer

surplus after the tax. Finally, use the black point (plus symbol) to shade the area representing deadweight loss.

40

0

80

Demand

Before Tax

Supply

Tax Wedge

120 160 200 240 280 320 360 400

QUANTITY (Scooters)

After Tax

+

Supply

Equilibrium

40 80 120 160 200 240 280 320 360 400

QUANTITY (Scooters)

Consumer Surplus

Producer Surplus

Tax Revenue

A

Consumer Surplus

?

Producer Surplus

Deadweight Loss

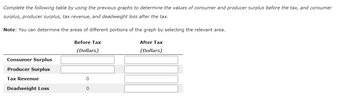

Transcribed Image Text:Complete the following table by using the previous graphs to determine the values of consumer and producer surplus before the tax, and consumer

surplus, producer surplus, tax revenue, and deadweight loss after the tax.

Note: You can determine the areas of different portions of the graph by selecting the relevant area.

Consumer Surplus

Producer Surplus

Tax Revenue

Deadweight Loss

Before Tax

(Dollars)

0

0

After Tax

(Dollars)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The linear demand curve is: Q = 100 - 4P The linear supply curve is: QS = -20 + 2P For each of the following questions, you need to show the basic calculation steps. 1) Given the above market demand and supply curves for the bottled wine in a hypothetical economy, please calculate the market equilibrium price and market equilibrium quantity for a bottle of wine. 2) If the government decides to charge an excise tax at the rate of 3 for each bottle of wine, what is the tax burden on consumers? And what is the tax burden on the firms? Show your calculation steps. B) Who shares more of the tax burden, the consumer or the firms? Please explain the reasons behind it.arrow_forwardThe demand for tomatoes is Q = 40-4P and the supply of tomatoes is Q = P +10. Answer the following questions. (a) Suppose that $1 per unit tax is levied on the consumers. Who bears the economic incidence of this tax? (b) Calculate the deadweight loss (c) Suppose that stores will pay $1 per unit tax directly. What will happen to the "sticker price" on tomatoes? How will the size of the consumer tax burden change? (d) Suppose that tax is increased to $2 per unit on the consumers. Calculate the deadweight loss. Compare the size of the deadweight loss with (b).arrow_forwardConsumer surplus is a measure of the difference between: a) The price which a consumer has to pay and the cost of producing the good (in a diagram, the area between the market price, and the supply curve). b) The consumer’s willingness to pay, and the cost of production (the area between the demand curve and the supply curve). c) The value which a consumer places on a unit of the good, and the market price (the area between the demand curve and the market price line). d) The marginal revenue from sales and the marginal cost of sales (the area between the marginal revenue and the marginal cost curves).arrow_forward

- Each rectangle on the graph corresponds to a particular seller in this market: blue (circe symbols) for Andrew, green (triangle symbols) for Beth, purple (diamond symbols) for Darnell, tan (dash symbols) for Eleanor, and orange (square symbols) for Jacques. (Note: The name labels are to the right of the corresponding segment on the supply curve.) Use the rectangles to shade the areas representing producer surplus for each person who is willing to sell a motor scooter at a market price of $70. (Note: If a person will not sell a motor scooter at the market price, indicate this by leaving their rectangle in its original position on the palette.) ? PRICE (Dollars per motor scooter) 160 140 120 100 180 60 40 20 0 0 Andrew 2 K Bet Darnell Jacques Eleanor 5 3 QUANTITY (Motor scooters) Market Price 6 7 8 ITI Andrew Beth Damell Eleanor 8 8 Jacquesarrow_forward14. Over the past few year’s consumer tastes and the number of buyers in the market for a game called ‘pickle ball’ have increased dramatically. Thus, the demand for tickets to pickle ball events has increased. Before this all started the equilibrium price of a ticket to a pickle ball event was negative. This means that: A few years ago, there would have been a surplus of tickets even at a price of zero, now the invisible hand has pushed prices to greater than zero. A few years ago, the quantity of tickets demanded was less than quantity supplied. Pickle ball event tickets resembled the market for recyclable cardboard a few years ago Greater demand for pickle ball tournament tickets will lead to a greater demand – and higher pay – for professional pickle ball players. All of the above. B and D onlyarrow_forwardYou’d be willing to pay $200 for a daylong admission ticket to a theme park. The cost of the ticket is $120. Your consumer surplus is:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education