ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

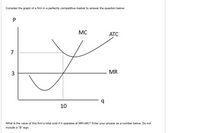

Transcribed Image Text:Consider the graph of a firm in a perfectly competitive market to answer the question below:

MC

АТС

7

MR

10

What is the value of this firm's total cost if it operates at MR=MC? Enter your answer as a number below. Do not

include a "$" sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- See attached imagearrow_forwardIn competitive markets, there are many small firms with each firm unable to influence the market price. Suppose company ABX operates in the wheat market. The company produces and markets wheats at a Price = $20 per container. The firm’s total costs are given as: TC = 50 +2Q + 3Q2 What is the firm Fixed Cost? Why? Also, use a graph to support your answerarrow_forwardSuppose that a firm's long-run average total costs of producing smart phones increases as it produces between 50,000 and 60,000 smart phones. For this range of output, the firm is experiencingarrow_forward

- Explain the profit and loss possibilities of a price taker firm and graphically draw the supply curve of the firm in the short run only.arrow_forwardQuestion 2 The market for hand-made bar soaps in Vancouver is perfectly competitive. The marginal cost function for each (identical) firm is given by MC = 2QS + 4. Also suppose the short run cost functions are the same as the long run cost functions. If the market price P is $10. What is the individual firm's MC? a) 8 b)14 c)10 d)12 Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forward$ 0 Based on the graph above, the firm is earning: ο ο ο Zero economic profits Zero accounting profits MC Zero normal profits ATC AVC D = MR We can say nothing about this firm's profit or loss situationarrow_forward

- An investment of P200,000 can be made in a project that will produce a uniform annual revenue of P145,000 for 5 years and then have a salvage value of 10% of the investment. Out-of-pocket costs for operation and maintenance will be P60,000 per year. Taxes and insurance will be 4% of the first cost per year. The company expects capital to earn not less than 22% before income taxes. Is this a desirable investment? What is the payback period of the investment? Compute the rate of return. What is the net annual profit using annual worth method? What is the net present worth of net cash flow? The rate of return is [ Select ] [ Select ] 26.87% 25.65% 26.65% 24.87% The net annual profit is [ Select ] [ Select ] P9,742.93 P10,742.93 P11,742.93 P12,742.93 The net present worth of net cash flow is [ Select ] [ Select ] P27,900.25 P28,900.25 P26,900.25 P30,900.25 Is this a desirable investment? [ Select ] [ Select ] Yes No The payback period is [ Select ] Select ] 1.33 2.01 3.20 1.87arrow_forwardSuppose you own an acre of land. You could grow crops on that land. The cost of seeds is $100. The crops you grow from those seeds will sell for $350. You could also rent the land to another farmer. The rent you could eam is $300. Calculate your economic profit. (Do not include a $ sign in your answer.) Answer: Suppose the total cost function for a firm is given by: TC= 100 + 2q +0.5q2. Find the marginal cost function and then use that to determine the marginal cost of the 10th unit. (Do not include a $ sign in your response.) # Answer:arrow_forwardFarmer Lee grows strawberries. The average total cost and marginal cost of growing strawberries in the long run for an individual farmer are illustrated in the graph to the right. Suppose the market price is $7.05 per box. If so, then farmers will strawberries until the market price is $ number rounded to two decimal places.) per box. (Enter a numeric the market for a real enter exit Price and cost (dollars per box) 10- 9- 8- 5- 3- 2- 1. 0 MC ATC 10 20 30 40 50 60 70 80 90 100 Quantity of strawberries (boxes per week) oarrow_forward

- Dear expert hand written not allowed.arrow_forwardhand written asap..i'll give you multiple upvotearrow_forward“That segment of a competitive firm’s marginal-cost curve that lies above its average-variable-cost curve constitutes the shortrun supply curve for the firm.” Explain using a graph and words.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education