Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

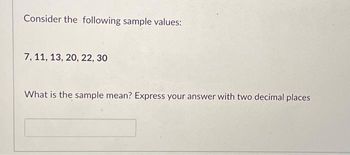

Transcribed Image Text:Consider the following sample values:

7, 11, 13, 20, 22, 30

What is the sample mean? Express your answer with two decimal places

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- A linear regression model is Units = 4,004 – 0.659×Week. For week 46, what is the forecast for the number of units? Round your answer to the nearest whole number. unitsarrow_forwardWhat is a one-sample t test? When would it be used?arrow_forwardHow does Probability Proportionate to Size (PPS) sampling compare to Classic Variables sampling?arrow_forward

- Using Appendix B of this book, select a simple random sample of 10 numbers in the range from 1 to 9,876. What is each step in the process?arrow_forwardWhat is the coefficient of variation over the same period?arrow_forwardIn a test of the hypothesis Ho: = 10 versus Ha: H10, a sample of n = 50 observations possessed mean x = 10.8 and standard deviation s = 3.3. Find and interpret the p-value for this test. The p-value for this test is ☐. (Round to four decimal places as needed.)arrow_forward

- Which of the following are measurements of risk? range coefficient of variation mean average standard deviation medianarrow_forward1. What percent of the area under the standard normal curve is within one standard deviation of (above or below) the mean? 2. What does this tell you about scores that are more than one standard deviation away from the mean?arrow_forwardConsider the following POPULATION of returns: 5%, -4%, -3%, and 12%. What is the standard deviation of this population of returns? O A. 0.42% O B. 0.56% OC. 6.50% O D. 7.51%arrow_forward

- Dividing the analysis amount by the base amount and multiplying the result by 100.arrow_forwardUsing the following returns, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y. Year X Y 1 15% 21% 2 26 36 3 7 13 4 -13 -26 5 11 15arrow_forwardWhat is the symbol for the number of groups when calculating an Analysis of Variance? k-1 df All of the above.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education