Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

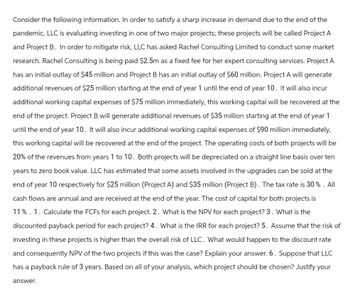

Transcribed Image Text:Consider the following information. In order to satisfy a sharp increase in demand due to the end of the

pandemic, LLC is evaluating investing in one of two major projects; these projects will be called Project A

and Project B. In order to mitigate risk, LLC has asked Rachel Consulting Limited to conduct some market

research. Rachel Consulting is being paid $2.5m a fixed fee for her expert consulting services. Project A

has an initial outlay of $45 million and Project B has an initial outlay of $60 million. Project A will generate

additional revenues of $25 million starting at the end of year 1 until the end of year 10. It will also incur

additional working capital expenses of $75 million immediately, this working capital will be recovered at the

end of the project. Project B will generate additional revenues of $35 million starting at the end of year 1

until the end of year 10. It will also incur additional working capital expenses of $90 million immediately,

this working capital will be recovered at the end of the project. The operating costs of both projects will be

20% of the revenues from years 1 to 10. Both projects will be depreciated on a straight line basis over ten

years to zero book value. LLC has estimated that some assets involved in the upgrades can be sold at the

end of year 10 respectively for $25 million (Project A) and $35 million (Project B). The tax rate is 30%. All

cash flows are annual and are received at the end of the year. The cost of capital for both projects is

11%. 1. Calculate the FCFs for each project. 2. What is the NPV for each project? 3. What is the

discounted payback period for each project? 4. What is the IRR for each project? 5. Assume that the risk of

investing in these projects is higher than the overall risk of LLC. What would happen to the discount rate

and consequently NPV of the two projects if this was the case? Explain your answer. 6. Suppose that LLC

has a payback rule of 3 years. Based on all of your analysis, which project should be chosen? Justify your

answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please provide full and authentic solution. Please ensure the working out eases the eyes. Please dont make mistakes. Please double check when done. Greatly Appreciated!!. Please know that it is not 1000 on Project Beta it was 10,000. I was told that Project Alpha had higher IRR and higher net present value. Please confirm if it is true.arrow_forwardPortland Gaming, Inc. uses payback to evaluate potential projects and has a required payback period of four years for all projects. Currently, Portland is evaluating two independent projects. Project A has an expected payback period of 3.6 years and a net present value of $8,400. Project B has an expected payback period of 4.2 years with a net present value of $26,800. Which projects should be accepted based on the payback decision rule? Group of answer choices Project A only Project B only Both A and B Neither A nor B Answer cannot be determined based on the information given.arrow_forwardWavy Inc is examining a project that requires an initial investment of -10 million today. This will be followed by several years of positive incremental after-tax cash flows. However, during the last year of the project's life Wavy expects that the incremental cash flow will again be negative. By which method should Wavy determine whether or not to invest? A) Both NPV or IRR are fine, as they must arrive at same investment decision B) IRR, because there will be no NPV solution in this case C) Neither NPV or IRR are useful in this situation D) NPV, since this project will have two IRRsarrow_forward

- 1. Calvulate the internal rate of return(IRR) of each project and based on this criterion. Indicate which project you would recommend or acceptance.arrow_forwardWhat would the effect of the failure in the ratio measurement?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- The proposed capital project calls for the Manufacturing Department to fully automate a production facility using one of two different advanced robotics systems. System A will incur development costs of $175,500. System B will cost $650,000 to develop. Both systems will be capitalized and amortized using a CCA rate of 10%. In addition, the firm believes that Net Working Capital will rise by $95,000 at time zero and then by an additional $9,000 at the end of each year for each year that the new system is operating (except at the end of the final year of the project). This applies to both alternatives. However, all of the increase in Net Working Capital will be recovered at the end of the project.If the new automated robotics system is put into use, the pre-tax cost savings each year are estimated as follows:Table 1Year System A System B1 $60,000 $350,0002 $50,000 $220,0003 $50,000 $240,0004 $50,000 $260,0005 $25,000 $280,000 As the financial analyst, you are required to draft a…arrow_forwardBillabong Tech uses the internal rate of return (IRR) to select projects. Calculate the IRR for each of the following projects and recommend the best project based on this measure. Project T-Shirt requires an initial investment of $ 15,333 and generates cash inflows of $ 7,000 per year for 4 years. Project Board Shorts requires an initial investment of $ 28,500 and produces cash inflows of $ 13,500 per year for 5 years.arrow_forwardCIP Co, a telecommunications company, is considering an investment of $150 million into a wind farm. The wind farm is expected to generate after-tax cash flows of $75 million in Year 1, $120 million in Year 2, and $175 million in Year 3. CIP Co’s WACC is 12% but some members of management believe the project should be assessed using a discount rate of 15% (which is what Major Bank Ltd advises is a typical discount rate for a wind farm project). The company has spent $15 million up to today researching this opportunity. What is NPV?arrow_forward

- Blossom, Inc., is considering investing in a new production line for eye drops. Other than investing in the equipment, the company needs to increase its cash and cash equivalents by $11,000, increase the level of inventory by $31,000, increase accounts receivable by $26,000, and increase accounts payable by $6,000 at the beginning of the project. Blossom will recover these changes in working capital at the end of the project 6 years later. Assume the appropriate discount rate is 8 percent. What are the present values of the relevant investment cash flows? (Do not round intermediate calculations. Round answer to 2 decimal places, e.g. 5,275.25.) Present value $arrow_forwardUse the following information for the next four questions: The Anti-Zombie Corporation is considering expanding one of its production facilities to research a new type of virus, which will hopefully not cause a future zombie outbreak. The project would require a $24,000,000 capital investment and will be depreciated (straight-line to zero) over its 3 year life. They know that they will be able to salvage $6,000,000 for the equipment at that time. Incremental sales are expected to be $16,000,000 annually for the 3 year period with costs (excluding depreciation) of 40% of sales. The company would also have to commit initial working capital to the project of $2,000,000. The company has a 30% tax rate, and requires a 15% rate of return for projects of this risk level.arrow_forwardSeveral companies, including Barnyard and Energy Solutions Corporation, are considering project A, which is believed by all to have a level of risk that is equal to that of the average-risk project at Barnyard. Project A is a project that would require an initial investment of $78,000 and then produce an expected cash flow of $101,300 in 4 years. Project A has an internal rate of return of 7.65 percent. The weighted-average cost of capital for Barnyard is 10.92 percent and the weighted-average cost of capital for Energy Solutions Corporation is 5.21 percent. What is the NPV that Energy Solutions Corporation would compute for project A? $-2568.40 (plus or minus $10) $144922.17 (plus or minus $10) $-11077.83 (plus or minus $10) $4676.36 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education