Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Question 3

From the information generated in the previous two questions;

a) Identify two investment alternatives that can be combined in a portfolio. Assume a 50-

50 investment allocation in each investment alternative

b) Compute the expected return of the portfolio thus formed

c) Compute the portfolio’s beta. Is the portfolio aggressive or defensive?

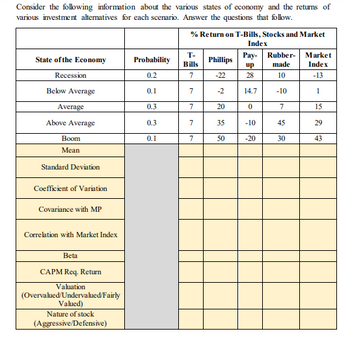

Transcribed Image Text:Consider the following information about the various states of economy and the returns of

various investment alternatives for each scenario. Answer the questions that follow.

State of the Economy

Recession

Below Average

Average

Above Average

Boom

Standard Deviation

Coefficient of Variation

Covariance with MP

Correlation with Market Index

Beta

CAPM Req. Return

Valuation

(Overvalued/Undervalued/Fairly

Valued)

Nature of stock

(Aggressive/Defensive)

Probability

0.2

0.1

0.3

0.3

0.1

% Return on T-Bills, Stocks and Market

Index

T-

Bills

7

7

7

7

7

Phillips

-22

-2

20

35

50

Pay- Rubber-

made

10

-10

7

45

30

up

28

14.7

0

-10

-20

Market

Index

-13

1

15

29

43

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- b. As an equity portfolio manager, you may use certain risk-adjusted performance measures. Describe and discuss the following measures of performance evaluation! Treynor Index, William Sharpe, Michael Jensen Using the following table evaluate which is better than other using three different measure of performance evaluation. Asset X E(R)% 12 beta Stdv 1.25 16 Y 11 1.0 12 Risk-free 3 0 0 Market index 12 1 12arrow_forwardSuppose you are considering investing your entire portfolio in three assets A, B and C. You expect that after you invest, four possible mutually exclusive scenarios will occur, with associated returns (in %) for each of the three assets as listed below. The probability of each scenario is given below (Attached image). Find the expected returns and standard deviations of Asset A, B & C. (HINT: the expected return is given by the probability-weighted sum of returns in each scenario. The expected standard deviation is given by the square root of the probability-weighted sum of squared deviations from the expected return.) Is there any reason to invest in Asset A given its low expected return and high standard deviation?arrow_forwardThe market portfolio has a beta of _________ Group of answer choices a. 0 b. 1 c. -1 d. 0.5arrow_forward

- Explain well all question with proper answer. And type the answer step by step.arrow_forwardConsider the following graph. According to Markowitz’ portfolio theory, which point on the graph represents optimal portfolio? C A B Darrow_forwarda. What are the expected return and standard deviation of your client's portfolio?arrow_forward

- The Capital Market Line (CML) expresses the risk-return trade-off for a portfolio as follows: E(Rport )=RFR+Oport [(E(Rm)-RFR)/om ] Required: Extend this expression to allow for the evaluation of any individual risky Asset i. Explain the steps in details.arrow_forwardIn order to create an efficient set of portfolios thru optimization using concepts from Markowitz portfolio theory, you would need to forecast only 2 variables including expected return and standard deviation or variance for the asset classes or securities in focus. True or falsearrow_forwardQuestion 5 Choose the correct answer for the following: (1) Which is the best measure of risk for choosing an asset which is to be held in isolation? (2) Which is the best measure for choosing an asset to be held as part of a diversified portfolio? O Variance; correlation coefficient. O Standard deviation; correlation coefficient. O Beta; variance. O Coefficient of variation; beta. O Beta; beta.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education