FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

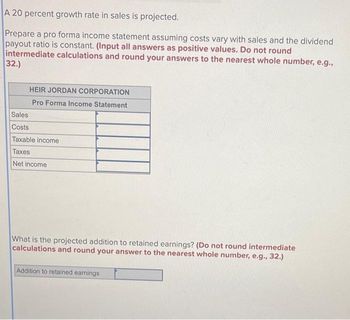

Transcribed Image Text:A 20 percent growth rate in sales is projected.

Prepare a pro forma income statement assuming costs vary with sales and the dividend

payout ratio is constant. (Input all answers as positive values. Do not round

intermediate calculations and round your answers to the nearest whole number, e.g.,

32.)

HEIR JORDAN CORPORATION

Pro Forma Income Statement

Sales

Costs

Taxable income

Taxes

Net income

What is the projected addition to retained earnings? (Do not round intermediate

calculations and round your answer to the nearest whole number, e.g., 32.)

Addition to retained earnings

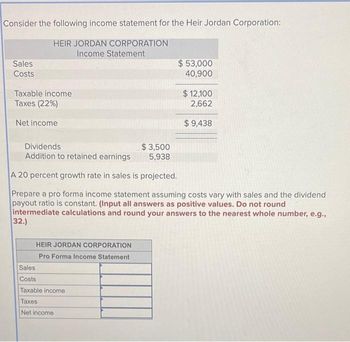

Transcribed Image Text:Consider the following income statement for the Heir Jordan Corporation:

HEIR JORDAN CORPORATION

Income Statement

Sales

Costs

Taxable income

Taxes (22%)

Net income

Dividends

Addition to retained earnings

HEIR JORDAN CORPORATION

Pro Forma Income Statement

$3,500

5,938

Sales

Costs

Taxable income

Taxes

Net income

$ 53,000

40,900

A 20 percent growth rate in sales is projected.

Prepare a pro forma income statement assuming costs vary with sales and the dividend

payout ratio is constant. (Input all answers as positive values. Do not round

intermediate calculations and round your answers to the nearest whole number, e.g.,

32.)

$ 12,100

2,662

$ 9,438

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Jorge Ricard, a fi nancial analyst, is estimating the costs of capital for the Zeale Corporation. In the process of this estimation, Ricard has estimated the before-tax costs of capital for Zeale’s debt and equity as 4 percent and 6 percent, respectively. What are the after-tax costs of debt and equity if Zeale’s marginal tax rate is 1. 20 percent? 2. 45 percent? 2. ABC, Inc. has one class of preferred stock outstanding, a $3.75 cumulative preferred stock, for which there are 546,024 shares outstanding.15 If the price of this stock is $72, what is the estimate of ABC’s cost of preferred equity? 3. Valence Industries wants to know its cost of equity. Its chief financial officer (CFO)believes the risk-free rate is 5 percent, equity risk premium is 7 percent, and Valence’s equity beta is 1.5. What is Valence’s cost of equity using the CAPM approach? 4. Suppose a company has a current dividend of $ 2 per share, a current price of $ 40 per share, and an expected growth rate of 5…arrow_forwardAnswer the question attached in the image belowarrow_forwardThe most recent financial statements for Crosby, Incorporated, appear below. Sales for 2022 are projected to grow by 25 percent. Interest expense will remain constant; the tax rate and the dividend payout rate also will remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. Sales Costs Other expenses CROSBY, INCORPORATED 2021 Income Statement Earnings before interest and taxes Interest expense Taxable income Taxes (24%) Net income Dividends Addition to retained earnings $ 19,940 50,664 $772,000 628,000 33,500 $ 110,500 17,600 $ 92,900 22,296 $ 70,604arrow_forward

- 1.A Assume that a Peruvian company, DMB LLC, just reported its earnings this year. The reported revenue was $10 million and the reported cost was $9 million. The discount rate is 8%. Mark ALL the CORRECT statements. For this question, profit = revenue - cost. Hint: Apply the Gordon Formula to the profits of the firm. a) If the profit is expected to be constant, the present value of all the company's future profits is $125 million. b) If the profit is expected to grow 3% annually, the present value of all the company's future profits is $20 million. c) If the profit is expected to grow 4% annually, the present value of all the company's future profits is $25.75 million. d) If the profit is expected to grow 6% annually, the present value of all the company's future profits is $50 million. e) If the profit is expected to grow 10% annually, the present value of all the company's future profits is negative.arrow_forwardgo.3arrow_forwardhello, I need help pleasearrow_forward

- The most recent financial statements for Crosby, Incorporated, follow. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. Assume the firm is operating at full capacity and the debt- equity ratio is held constant. CROSBY, INCORPORATED 2020 Income Statement Sales Costs Other expenses Earnings before interest and taxes Interest paid Taxable income Taxes (23%) Net Income Dividends $ 38,340 Addition to retained earnings 40,816 Current assets Cash Accounts receivable Inventory Total Total assets $ 25,040 34,440 71,240 $ 130,720 Fixed assets Net plant and equipment $ 218,000 $ 761,000 617,000 28,000 CROSBY, INCORPORATED Balance Sheet as of December 31, 2020 Assets $ 116,000 13,200 $ 102,800 23,644 $ 79,156 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common…arrow_forwardson.2arrow_forwardConsider the following income statement for Larry & Harry drug stores: Revenue - 90mm Variable costs- 48mm Interest on debt- 6mm Depreciation- 0 mm It’s tax rate is 25% and the book value of its equity is 150mm. What is L&H’s coverage ratio? A) 0.18 B) 5.25 C) 6 D) 7 E) 8 F)15arrow_forward

- Use the information below to calculate WACC given the Market Capitalization of the company: Market Cap = 193.2 Million EBIT = 17.2 Million Depreciation = 4.2 Million Capital Expenditures = - 3.8 Million Change in W/C = 2.1 Million growth = 7% FCF = ? WACC = ?arrow_forwardThe financial statements of Eagle Sport Supply are shown in the table below. For simplicity, "Costs" include interest. Assume that Eagle's assets are proportional to its sales. Assume a growth rate of 30% in revenue, expenses, and assets in 2023. The tax rate will remain constant. Income Statement Sales Costs $ 4,550 2,050 Pretax income Taxes (at 30.0%) $ 2,500 750 Net income $ 1,750 Balance Sheet, Year-End 2022 Net assets $ 6,600 2021 $ 6,300 Total $ 6,600 $ 6,300 Debt Equity Total 2022 $ 2,800 3,800 2021 $ 2,700 3,600 $ 6,600 $ 6,300 a. Assume that the dividend payout ratio is fixed at 60% and the equity-to-asset ratio is fixed at two-thirds. What is the internal growth rate for 2023? b. What is the sustainable growth rate for 2023? Note: For all requirements, do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. a. Internal growth rate b. Sustainable growth rate % %arrow_forwardIn the table below x denotes the X-Tract Company’s projected annual profit (in $1,000). The table also shows the probability of earning that profit. The negative value indicates a loss. x f(x) x = profit -100 0.01 f(x) = probability -200 0.04 0 100 0.26 200 0.54 300 0.05 400 0.02 10 On average, profit (loss) amounts deviate from the expected profit by ______ thousand. a $114.77 thousand b $112.52 thousand c $110.31 thousand d $108.15 thousandarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education