ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

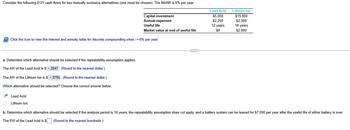

Transcribed Image Text:Consider the following EOY cash flows for two mutually exclusive alternatives (one must be chosen). The MARR is 6% per year.

Capital investment

Annual expenses

Lead Acid

$5,000

$2,250

Lithium lon

$15,000

$2,500

12 years

Market value at end of useful life

$0

18 years

$2,800

Useful life

Click the icon to view the interest and annuity table for discrete compounding when i = 6% per year.

a. Determine which alternative should be selected if the repeatability assumption applies.

The AW of the Lead Acid is $ -2847. (Round to the nearest dollar.)

The AW of the Lithium Ion is $ - 3795. (Round to the nearest dollar.)

Which alternative should be selected? Choose the correct answer below.

Lead Acid

Lithium Ion

b. Determine which alternative should be selected if the analysis period is 18 years, the repeatability assumption does not apply, and a battery system can be leased for $7,000 per year after the useful life of either battery is over.

The PW of the Lead Acid is $ (Round to the nearest hundreds.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- What is the monthly payment for a $5000.04 year loan with an APR of 2%?arrow_forwardA sum of $10,000 now (lime 0) in equivalent to the tolowing cash Row diagram. What in he of $8 rthe annual interest rate is 4? $3,200 S8 $2,200 $2,200 End of Year $10.000 Click the icon to view the interest and annulty table for discrete compounding when i4 per year The value of $8 is , Round to the nearest dolar.)arrow_forwardA professional footy player and his agent are evaluating three contract options to play in the Australian Football League (AFL). Each option offers a signing bonus and a series of payments over the life of the contract. The player uses 7.25% rate of return (compounded annually) to evaluate the options. Year Cash flow Richmond Football Club Hawthorn Football Club Collingwood Football Club 0 signing bonus $3,500,000 $3,500,000 $3,500,000 1 Annual Salary $700,000 $850,000 $775,000 2 Annual Salary $750,000 $800,000 $775,000 3 Annual Salary $800,000 $750,000 $775,000 4 Annual Salary $850,000 $700,000 $775,000 Using the information provided above, which contract should be chosen? (Show your calculations).arrow_forward

- An individual deposits an annual bonus into asavings account that pays 5% interest compoundedannually. The size of the bonus increases by $6,000each year, and the initial bonus amount was $30,000.Determine how much will be in the account immediately after the fifth depositarrow_forwardBruce deposited $100 into the bank account. The account is credited with interest at a nominal annual interest rate of 4% which can be converted every half year. At the same time, Peter deposited $100 into a separate account. Peter's account is credited with annual interest of δ. After 7.25 years, their value for money is the same. calculate value δ!arrow_forwardENGINEERING ECONOMICS Mrs. Sayon receives a loan of 200,000 from Mrs. Monte today and will receive 300,000 more at the end of 2 years. Mrs. Sayon will pay 100,000 at the end of 3 years, 150,000 at the end of 5 years, and a final payment (Q) at the end of 6 years. If money is worth 9% compounded semiannually find the final payment Q using 5 years as the focal datearrow_forward

- A certain property is being sold and the new owner received two bids. The first bidder offered to pay P400,000 each year for 5 years, each payment is to be made at the beginning of each year. The second bidder offered to pay P240,000 first year, P360,000 the second and P540,000 each year the next 3 years, all payments will be made at the beginning of each year. If money is worth 20% compounded annually, which bid should the owner of the property accept?arrow_forwardCompute and show your compute solution.arrow_forwardplz solve it within 30-40 mins I'll give you multiple upvotearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education