Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN: 9780079039897

Author: Carter

Publisher: McGraw Hill

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Sure! Here's the transcription of the text from the image:

---

1. ☐ Yes, because it is expected that as the *safety rating* increases then the *cost* should decrease.

2. ☐ No, because it is expected that as the *safety rating* increases then the *cost* should also increase.

3. ☐ Yes, because it is expected that as the *safety rating* increases then the *cost* should also increase.

4. ☐ No, because it is expected that as the *safety rating* increases then the *cost* should decrease.

---

There are no graphs or diagrams present in the image.

Transcribed Image Text:**Transcription: Educational Context**

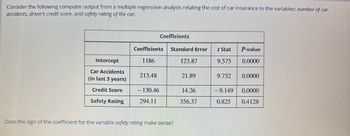

Consider the following computer output from a multiple regression analysis relating the cost of car insurance to the variables: number of car accidents, driver's credit score, and safety rating of the car.

| Coefficients | Coefficients | Standard Error | t Stat | P-value |

|------------------|--------------|----------------|--------|---------|

| Intercept | 1186 | 123.87 | 9.575 | 0.0000 |

| Car Accidents (In last 3 years) | 213.48 | 21.89 | 9.752 | 0.0000 |

| Credit Score | -130.46 | 14.26 | -9.149 | 0.0000 |

| Safety Rating | 294.11 | 356.37 | 0.825 | 0.4128 |

**Explanation of Coefficients Table:**

- **Intercept**: The baseline cost of insurance is represented by the intercept, which is 1186. This is the estimated cost when all other variables are zero.

- **Car Accidents**: For each additional car accident in the last three years, the cost of insurance increases by 213.48. The small P-value (0.0000) indicates this is a statistically significant predictor.

- **Credit Score**: A higher credit score is associated with a decrease in insurance costs, as shown by the coefficient of -130.46. This predictor is statistically significant with a P-value of 0.0000.

- **Safety Rating**: While a higher safety rating shows an increase in cost by 294.11, this factor is not statistically significant given the P-value of 0.4128.

**Question for Learners:**

Does the sign of the coefficient for the variable safety rating make sense? Reflect on why a higher safety rating might not be expected to increase costs and whether this result could be due to statistical variance or model specification issues.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- The ability of regression analysis to measure the impact of one variable on the dependent variable? How.arrow_forwardBriefly discuss the effect on a regression analysis of dependencies among the observations of the response variablearrow_forwardInterpret the slope of the least square regression line in contentarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Algebra and Trigonometry (MindTap Course List)AlgebraISBN:9781305071742Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning

Algebra and Trigonometry (MindTap Course List)AlgebraISBN:9781305071742Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning College AlgebraAlgebraISBN:9781305115545Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning

College AlgebraAlgebraISBN:9781305115545Author:James Stewart, Lothar Redlin, Saleem WatsonPublisher:Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897...

Algebra

ISBN:9780079039897

Author:Carter

Publisher:McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu...

Algebra

ISBN:9781680331141

Author:HOUGHTON MIFFLIN HARCOURT

Publisher:Houghton Mifflin Harcourt

Holt Mcdougal Larson Pre-algebra: Student Edition...

Algebra

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:9781305071742

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:Cengage Learning

College Algebra

Algebra

ISBN:9781305115545

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:Cengage Learning