ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

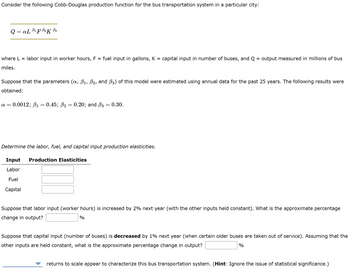

Transcribed Image Text:Consider the following Cobb-Douglas production function for the bus transportation system in a particular city:

Q=aL B₁F B₂K B3

where L = labor input in worker hours, F = fuel input in gallons, K = capital input in number of buses, and Q = output measured in millions of bus

miles.

Suppose that the parameters (α, B₁, B₂, and ß3) of this model were estimated using annual data for the past 25 years. The following results were

obtained:

a = 0.0012; B₁ = 0.45; ß₂ = 0.20; and B3 = 0.30.

Determine the labor, fuel, and capital input production elasticities.

Input Production Elasticities

Labor

Fuel

Capital

Suppose that labor input (worker hours) is increased by 2% next year (with the other inputs held constant). What is the approximate percentage

change in output?

%

Suppose that capital input (number of buses) is decreased by 1% next year (when certain older buses are taken out of service). Assuming that the

other inputs are held constant, what is the approximate percentage change in output?

%

returns to scale appear to characterize this bus transportation system. (Hint: Ignore the issue of statistical significance.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In 1997, researchers at Texas A&M University estimated the operating costs of cotton gin plans of various sizes. A quadratic model of cost (in thousands of dollars) for the largest plants was found to be very similar to: C(q)=0.023q^2+21.8q+326 where q is the annual quanity of bales (in thousands) produced by the plant. Revenue was estimated at $70 per bale of cotton. find the MC(q)/MR(q)/MP(q)/arrow_forwardEvery year in September, the NFL (National Football League) announces official prices of their next Super bowl tickets. The official ticket prices for 2022 Super bowl ticket in the NFL official websites started from $6,800 per person and it was up to over $81,800 per person depending on the location of the seats from the field. However, about three fourth of all tickets were already distributed to the NFL teams. The other one fourth are distributed to the media, NFL partners and sponsors. As a result, a small fraction of a total of about 70,000 tickets were sold in the secondary market. Those tickets were available to buy and sell in the official NFL online sites and other ticket brokers. Given the limited supply of tickets available to the NFL fans to purchase, the actual prices are dominated by the wide fluctuation of demand caused by many factors such as the venue of the game, the winning teams for the championship match, the packages of tickets offered by the brokers, and the…arrow_forwardDo the following production functions exhibit increasing, constant, or decreasing returns to scale in K and L (assuming A is fixed)? (a) Y=AK^⅓ L^⅓ (b) Y=AK^⅔ L^arrow_forward

- 1) Production function for agricultural sector of a country is specified as the following, log Y=B1 + B2 log K+ ß3 log L+u. where Y represents wheat output, K capital stock and L employment (labor). The model is estimated using annual data over 1980-2020 (n=41) periods. The results are reported below. p-values are given in squared parentheses. loĝ Y = 4.17 +0.67 log K+ 0.35 log L p-value [0.015] [0.18] R² = 0.81 1.a) Test if each slope coefficient is significant individually (one by one) using the p-values in parentheses and interpret the results. (arrow_forwardI am wanting to verify my own answer for average variable cost (AVC) of the following equation: C = 10 + 10q – 4q2 + q3 Thanks in advance!arrow_forwardLuke used regression analysis to fit quadratic relations to monthly revenue, TR, and total cost, TC, data with the following results, where Q is quantity. TR = -0.008Q² + 32Q TC = 0.005Q² +2.2Q + 10 Given the computed amount Q in problem #2, its corresponding maximum profit is Blank 1 (round off to whole number).arrow_forward

- Country X has Per Capita GDP of $5,500 in 2021. Suppose this country grew at a constant 3% per year indefinitely into the future. In 2,069 (i.e., 48 years in the future) the value of Per Capita GDP in Country X would be approximately. a) $20,000 b) $22,000 c) $50,000 d) $5,500arrow_forwardConsider the following Cobb-Douglas production function for the bus transportation system in a city: Q = Lβ1Fβ2Bβ3 Where L = labour input in worker hours F = fuel input in gallons B = capital input in number of buses Q = output measured in millions of bus miles Suppose that the parameters (α, β1, β2 and β3) of this model were estimated using annual data for the past 25 years. The following results were obtained: β1 = 0.45, β2 = 0.20 and β3 = 0.30 a. Determine the (i) labour, (ii) fuel, and (iii) capital-input production elasticitiesarrow_forwardWhat conditions must non-linear time series models, such as vector autoregressive models, satisfy in order to use impulse response functionsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education