Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

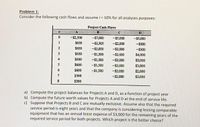

Transcribed Image Text:Problem 1:

Consider the following cash flows and assume i = 10% for all analyses purposes:

Project Cash Flows

A

D

-$2,500

-$7,000

-$5,000

-$5,000

1

$650

-$2,500

-$2,000

-$500

2

$650

-$2,000

-$2,000

-$500

$650

-$1,500

-$2,000

$4,000

4

$600

-$1,500

-$2,000

$3,000

5

$600

-$1,500

-$2,000

$3,000

$600

-$1,500

-$2,000

$2,000

7

$300

-$2,000

$3,000

8

$300

a) Compute the project balances for Projects A and D, as a function of project year

b) Compute the future worth values for Projects A and D at the end of service life.

c) Suppose that Projects B and C are mutually exclusive. Assume also that the required

service period is eight years and that the company is considering leasing comparable

equipment that has an annual lease expense of $3,000 for the remaining years of the

required service period for both projects. Which project is the better choice?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Compute the NPV for Project X and accept or reject the project with the cash flows shown below if the appropriate cost of capital is 10 percent. Time: 1 2 4 Cash flow: -150 -150 250 225 200arrow_forwardThere is a project with the following cash flows : Year 0 1 2 1345 Cash Flow -$ 23,350 6,300 7,400 8,450 7,350 5,900 What is the payback period?arrow_forwardWhat is the NPV of the estimated cash flows for the following project using a Weighted Average Cost of Capital of 7.0%? Year 0 1 2 3 Cash Flow -140 50 70 90 Group of answer choices 47.54 38.63 59.94 70.00 41.34arrow_forward

- Consider the following information: Cash Flows ($) Project C0 C1 C2 C3 C4 A –5,300 1,300 1,300 2,700 0 B –700 0 600 2,300 3,300 C –5,200 3,400 1,700 800 300 a. What is the payback period on each of the above projects? (Round your answers to 2 decimal places.)arrow_forwardCarland, Incorporated, has a project available with the following cash flows. If the required return for the project is 7.9 percent, what is the project's NPV? Year Cash Flow 0 -$ 258,000 1 66, 300 2 90, 400 3 117,800 4 70,900 5-12,000 $35, 378.61 $18, 968.78 $27, 173.69 $15, 173.69 $13,276.98arrow_forwardA project has the cash flows shown in the following table. If the cost of capital is 9%, what is the NPV of the project? Year 0 1 2 3 4 5 6 Incremental Free Cash Flow -913 281 281 281 281 281 191 Question 5Answer a. $294 b. $272 c. $312 d. $325arrow_forward

- Compute the IRR statistic for Project E. The appropriate cost of capital is 8 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project E Time: 0 1 2 3 4 5 Cash flow −$1,300 $470 $570 $580 $360 $160 IRR?arrow_forwardCompute the Internal Rate of Return for a project with the following cash flows: Year Cash Flow 0 ($2,000) 1 $500 2 $400 3 $400 4 $1,500 Question 7 options: 7% 40% 12% 8%arrow_forward1) What is the IRR of the following cashflows? 2) What is the NPV at a 15% target yield? 3) How Much can I pay for the property with a 15% target yield? n 0 ($275,000.00) 1 $21,000.00 2 $12,000.00 3 $32,000.00 4 $41,230.00 5 $48,750.00 $51,230.00 6 $291,000.00arrow_forward

- Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $222,000 and would yield the following annual net cash flows. (PV of $1. EV of $1. PVA of $1, and EVA of $1) Note: Use appropriate factor(s) from the tables provided. Net cash flows Year 1 Year 2 Year 3 Totals Project C1 $ 10,000 106,000 166,000 $ 282,000 Project C2 $ 94,000 94,000 94,000 $ 282,000 a. The company requires a 12% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. b. Using the answer from part a, is the internal rate of return higher or lower than 12% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question. Complete this question by entering your answers in the tabs below. Required A Required B The company requires a 12% return from its investments. Compute net present values using factors from Table B.1 in Appendix B…arrow_forwardPlease aware the questions aarrow_forwardConsider the following information relating to the expected cash flows from two independent projects. The cash flows are expressed in real terms, the nominal discount rate is 10% p.a. and the expected inflation rate is 4% p.a. Time 0 1 2 3 4 5 6 Project 1 -$200,000 $50,000 $50,000 $50,000 $50,000 $50,000 Project 2 -$250,000 $65,000 $65,000 $65,000 $65,000 $65,000 $65,000 a) Calculate the NPV of each of the projects b) In no more than 6 lines, explain which of the above projects you should select and why?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education