ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

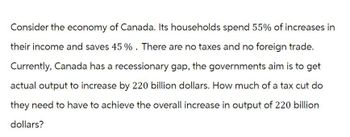

Transcribed Image Text:Consider the economy of Canada. Its households spend 55% of increases in

their income and saves 45 %. There are no taxes and no foreign trade.

Currently, Canada has a recessionary gap, the governments aim is to get

actual output to increase by 220 billion dollars. How much of a tax cut do

they need to have to achieve the overall increase in output of 220 billion

dollars?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Y = C + S even when the economy is not in equilibrium. True Or Falsearrow_forwardDescribe how a country of your choice’s economy is measured. Explain why it is desirable for a country to have a large GDP. Evaluate the impacts of stimulus checks on each of the components of the U.S. GDP. Identify something that would raise GDP and yet be undesirable?arrow_forwardKeynes once said, “Look after the unemployment, and the deficit will look after itself”. Explain what he meant and evaluate whether he was right.arrow_forward

- This is from a practice worksheet. Please help mearrow_forwardAn inflationary gap is how much GDP needs to decrease from the current GDP to maintain employment while avoiding inflation. Let us say that we are experiencing an inflationary gap of $200 million. The government decides to increase taxes. Assume that the MPC equals .80. What will be the tax increase?arrow_forwardThe government decides that it will cut taxes in an attempt to move the economy out of a severe recessionarrow_forward

- How much more output does the $20 trillion U.S economy produce when GDP increases by 1.0 percent?arrow_forwardThe following table shows the approximate value of exports and imports for the United States from 1983 through 1987. Complete the table by calculating the surplus or deficit both in absolute (dollar) terms and as a percentage of GDP. If necessary, round your answers to the nearest hundredth. Year GDP Exports Imports Exports – Imports (Billions of dollars) (Billions of dollars) (Billions of dollars) (Billions of dollars) (Percentage of GDP) 1983 3,535.0 277.0 328.6 1984 3,931.0 302.4 405.1 1985 4,218.0 302.0 417.2 1986 4,460.0 320.3 452.9 1987 4,736.0 363.8 508.7 Source: “Income, Expenditures, Poverty, & Wealth: Gross Domestic Product (GDP),” United States Census Bureau, United States Department of Commerce, last modified September 2011, accessed June 10, 2013, https://www.census.gov/library/publications/2011/compendia/statab/131ed/income-expenditures-poverty-wealth.html. Between 1983 and…arrow_forwardThe following table contains data for a hypothetical closed economy that uses the dollar as its currency. Suppose GDP in this country is $1,540 million. Enter the amount for government purchases. National Income Account Value (Millions of dollars) Government Purchases (GG) Taxes minus Transfer Payments (TT) 455 Consumption (CC) 700 Investment (II) 490 Complete the following table by using national income accounting identities to calculate national saving. In your calculations, use data from the preceding table. National Saving (S)National Saving (S) = = (y-t-g, g-t, y-c, y-c-g) = = (C,G,Y,I) $ ______millionarrow_forward

- In a recession spending is Krugman (who is a Keynesian) the government should taxes and spending. less than, cut, increase more than, cut, cut more than, cut, increase 58 less than, increase, cut than the productive capacity of the economy. According to Paul governmentarrow_forwardThere is $10 trillion in the loanable funds market. $6 trillion in private borrowing and $4 trillion in government borrowing. The federal government increases its borrowing to $5 trillion, crowding out $1 trillion in private borrowing. Interest rates remain the same. Make an argument that the GDP remains the same and that we don’t care about the crowding out.arrow_forwardAnswer the following questions: As you know, the US government has been running budget deficits for several years now. In your opinion, and based on economic reasoning, what will happen to the US economy if the US Federal Government continues to run annual budget deficits for the next decade. Will the economy survive that? Will the economy grow? Will it grow as fast as it could? Will the deficits cause the economy to grow faster? Will it grow at all? These are some of the questions you might address in your primary post.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education