ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Consider that the macroeconomy is hit by aftershocks. Exports decrease by $40 billion and imports increase by $200 billion. Modify your macroeconomic model to reflect both these aftershocks

1. At GDP of 7400: 1. Inventories are in surplus by 80 2. Inventories are in shortage by 80 3. Equilibrium is achieved by the macroeconomy according to the Keynesians 4. Inventories are in surplus by 240

2. At GDP of 8200: Inventories are in surplus by 320, Inventories are in shortage by 320, Equilibrium is achieved by the macroeconomy according to the Keynesians, or Inventories are both in surplus and shortage by 240

3. At GDP of 5000: Inventories are in surplus by 80, Inventories are in shortage by 80, Equilibrium is achieved by the macroeconomy according to the Keynesians, or Inventories are in surplus by 240

4. At GDP of 5800, exports are:

5. At GDP of 9000, imports are:

6. At the new equilibrium GDP, the economy is in:

7. The marginal propensity to consume (MPC) for your macroeconomic model is: 0.1, 0.4, 0.9, or 0.8

8. The multiplier for your macroeconomic model is: 10 , 5, 0.9, or 0.8

9. The goal of fiscal policy would be to increase equilibrium GDP by: $4,000 billion $3,200 billion $10,000 billion $1,000 billion

10. To achieve the goal of fiscal policy in your model, Government purchases of goods and services (G) would have to be increased by: $4,000 billion $3,200 billion $10 billion $320 billion

11. A cost-benefit analysis of the use of fiscal policy in your macroeconomic model ceteris paribus would lead to the conclusion that the policy should be undertaken since the costs are $ ___ while the benefits are $ ___ Group of answer choices $4,000 billion; $300 billion, $3,200 billion; $0 billion, $10 billion; $5000 billion, $320 billion; $3,200 billion

Transcribed Image Text:Now suppose I decreases by $80 billion as a result of a macroeconomic shock. Modify

your macroeconomic model to reflect this change ceteris paribus and answer the

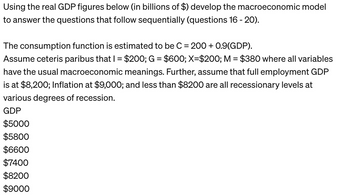

Transcribed Image Text:Using the real GDP figures below (in billions of $) develop the macroeconomic model

to answer the questions that follow sequentially (questions 16 - 20).

The consumption function is estimated to be C = 200+ 0.9(GDP).

Assume ceteris paribus that I = $200; G = $600; X=$200; M = $380 where all variables

have the usual macroeconomic meanings. Further, assume that full employment GDP

is at $8,200; Inflation at $9,000; and less than $8200 are all recessionary levels at

various degrees of recession.

GDP

$5000

$5800

$6600

$7400

$8200

$9000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The total expenditure in Macroland begins with these initial levels (in trillions of dollars): autonomous consumption=1, Investment = 2; Net Exports = 0, T=2, and MPC = 0.75. Assume that equilibrium has been achieved. Suddenly there is an external shock and as a result investment goes down to 1. What is the change in GDP? Use the base model to answer this question. Equilibrium GDP goes down by 1 Equilibrium GDP goes up by 1 Equilibrium GDP goes up by 4 Equilibrium GDP goes down by 4arrow_forwardRight click on image and click on open image in new tab to see the full and clear image. Consider two closed economies that are identical except for their marginal propensity to consume (MPC). Each economy is currently in equilibrium with real GDP and total expenditure equal to $100 billion, as shown by the black points on the following two graphs. Neither economy has taxes that change with income. The grey lines show the 45-degree line on each graph. The first economy's MPC is 0.5. Therefore, its initial total expenditure line has a slope of 0.5 and passes through the point (100, 100). The second economy's MPC is 0.75. Therefore, its initial total expenditure line has a slope of 0.75 and passes through the point (100, 100). Now, suppose there is a decrease of $20 billion in investment in each economy. Place a green line (triangle symbol) on each of the previous graphs to indicate the new total expenditure line for each economy. Then place a black point (plus symbol) on each graph…arrow_forwardWhich of the following states is equivalent to saying that we are in a short-run equilibrium? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a There is no unplanned changes in inventories. b Investment (I) is equal to Planned Investment Spending (Ip). Income is equal to aggregate expenditures. d All of the above.arrow_forward

- Consider the following income/expenditure diagram in the simple Keynesian model. If taxes, T, were increased, then Group of answer choices A) The Y = C+S+T line would shift to the right, and equilibrium Y would increase. B) the C+I+G line would shift downward, and equilibrium Y would decrease. C) The Y = C+S+T line would shift to the left, and equilibrium Y would decrease. D) neither of the lines would shift, and equilibrium Y would stay the same. E) the C+I+G line would shift upward, and equilibrium Y would increase.arrow_forwardAccording to Keynes’ Law... A) The total demand for products determine the level of gross domestic product and may not equal the supply capacity of the economy in the short run. B) The total demand always equals the total supply capacity in the short run. C) The total demand tends to rise above the total supply capacity in the short run which leads to recessions D) The total supply of products determines the level of gross domestic product and the level of demand in the economy in the long run.arrow_forwardThe accompanying graph represents the Keynesian cross for a country, where the planned aggregate spending line (Planned AE) is graphed against a 45° line. Suppose that there is an autonomous decrease in aggregate spending of $40 billion in this country. a. Show this change on the graph (you can drag and shift the whole line or either of the endpoints) and answer the following two questions. b. What is the initial unplanned inventory investment? If the number is negative, be sure to include a negative sign. billion dollars c. After firms adjust their production, what is the total change in real GDP? If the number is negative, be sure to include a negative sign. following two questions. vay and answer the b. What is the initial unplanned inventory investment? If the number is negative, be sure to include a negative sign. billion dollars c. After firms adjust their production, what is the total change in real GDP? If the number is negative, be sure to include a negative sign. billion…arrow_forward

- Price Level AD1 AD₂ AD2 Real Domestic Output, GDP Refer to the accompanying graph. What combination would most likely cause a shift from AD1 to AD2? Multiple Choice О an increase in taxes and no change in government spending О a decrease in taxes and a decrease in government spending О a decrease in taxes and an increase in government spendingarrow_forwardJustify for the correct optionarrow_forwardIf Saving+Tax+Import > Investment+Government spending+Export, then _____ must fall to establish macroeconomic equilibrium. Group of answer choices net exports gross exports taxes real GDP government spendingarrow_forward

- The chart below gives the data necessary to make a Keynesian cross diagram. Assume that the tax rate is 0.4 of national income, the MPC out of after-tax income is 0.9, investment is 58, government spending is 60, exports are 40, and imports are 0.1 of after-tax income. Alt Text: This chart contains the following columns: National Income, After-tax income, Consumption, I+G+X, Minus Imports, and Aggregate Expenditures. The National Income Column contains the following values for each of the following rows: 100, 200, 300, 400, 500, and 600. The only other value provided is the consumption, 104, for national income, 100. What does consumption equal when income equals 600? Group of answer choices a. 324 b. 374 c. 540 d. 104arrow_forwardtrue or false and why The economy is at the Keynesian equilibrium. Assuming that taxes are zero, a decrease in the marginal propensity to consume decreases unplanned inventories in the short run.arrow_forwardAn increase in consumer spending causes the ["", ""] curve to shift to the ["", ""] .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education