Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

| What is the dividend yield for each of these four stocks? |

| What is the expected |

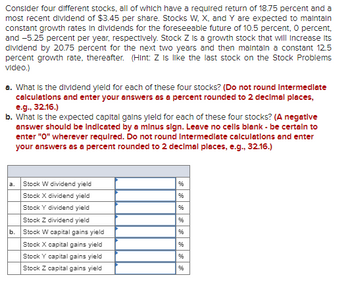

Transcribed Image Text:Consider four different stocks, all of which have a required return of 18.75 percent and a

most recent dividend of $3.45 per share. Stocks W, X, and Y are expected to maintain

constant growth rates in dividends for the foreseeable future of 10.5 percent, O percent,

and -5.25 percent per year, respectively. Stock Z is a growth stock that will increase its

dividend by 20.75 percent for the next two years and then maintain a constant 12.5

percent growth rate, thereafter. (Hint: Z is like the last stock on the Stock Problems

video.)

a. What is the dividend yield for each of these four stocks? (Do not round Intermedlate

calculations and enter your answers as a percent rounded to 2 decimal places,

e.g., 32.16.)

b. What is the expected capital gains yield for each of these four stocks? (A negative

answer should be indicated by a minus sign. Leave no cells blank - be certain to

enter "O" wherever required. Do not round Intermediate calculations and enter

your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

a.

Stock W dividend yield

Stock X dividend yield

Stock Y dividend yield

Stock Z dividend yield

b.

96

96

96

Stock W capital gains yield

Stock X capital gains yield

Stock Y capital gains yield

Stock Z capital gains yield

%

96

96

96

96

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Define actual rate of return on stockarrow_forwardExplain how to find the value of a stock given itslast dividend, its expected growth rate, and itsrequired rate of return.arrow_forwardHow do I calculate the net abount of stock issued when the firm pays X amount of dollars in dividends?arrow_forward

- Based on the dividend growth model. If you exepect the market rate of return to inclease across the board on all equity securities, the you should also expect, what?arrow_forwardToday's dividend yield for standard supply is computed by utilizing the formula C = A/S where A is the most recent annual dividend (in dollars) and S is the current share expense (in dollars). Encounter the function C's domain.arrow_forwardWhen calculating book value per share of common stock, do you also subtract additional paid in capital of preferred stock?arrow_forward

- What are three ways to estimate the expected dividend growthrate?arrow_forwardStock A has a capital gains yield of 6.5% and a dividend yield of 1.5%. Stock B has a capital gains yield of 8.5% and a dividend yield of 3.5%. Which stock has the higher required return? S en O A O They have the same required return.arrow_forwardThe beta risk of a share reflects the sensitivity of cash flow, earnings, and the share price to what sort of movements? Select one: a. Industry-wide market movements. b. Capital market movements. c. Economy-wide market movements. d. All of these.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education