ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Please Help Me ASAP. Thanks

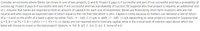

Transcribed Image Text:Consider an economy where Banks can invest in one of two projects, G and B. Project G pays G if successful and zero if not successful and has a probability of

success ag. Project B pays B if successful and zero if not successful and has a probability of success TB. Suppose also that project G requires an additional cost

of c. Assume that banks are required to hold an amount of capital k for each unit of investment. Banks are financed by short term investors who are risk

neutral and who require an expected rate of return equal to the risk free rate which is zero. Capital is costly because its holders can demand a rate of return

of p>0 and so the profit of a bank is given by either TG(G - (1 - k)R) -C-(1+p)k or ab(B - (1 - k)R) - (1+p)k depending on what project is invested in Suppose that

G = 8, B = 14, TG = 5, B = { and c = = 1. If k = 0, i.e. banks are not required and to hold any capital, what is the critical level of interest rates above which the

bank will choose to invest in the bad project? Options: A. 3/4 B. 4/5 C. 5/4 D. 4/2 E. None of A-D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- How can we determine the number of payment periods?arrow_forwardWhen does the money have time value?arrow_forwardOnly typed answer and please don't use chatgpt You are looking for a new apartment in Manhattan. Your income is $4,000 per month, and you know that you should not spend more than 25 percent of your income on rent. You have come across the following listing for one-bedroom apartments on craigslist. You are indifferent about location, and transportation costs are the same to each neighborhood. Chelsea $1,200 Battery Park $2,200 Delancey $950 Midtown $1,500 Instructions: You may select more than one answer. Click the box with a check mark for correct answers and click to empty the box for the wrong answers. a. Which apartments fall within your budget? Chelsea Battery Park Delancey Midtown b. Suppose you adhere to the 25 percent guideline but also receive a $1,000 monthly cost-of-living supplement since you are living and working in Manhattan. Which apartments fall within your budget now? Chelsea Battery Park Delancey Midtownarrow_forward

- Looking for sample grant proposals for nonprofit organizationarrow_forwardWhen seeking employment, your photo on your social media sites should bearrow_forwardSelect 6 online companies you are familiar with and visit their Web sites. How many of them have privacy policies posted on their sites? What are these policies?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education