ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

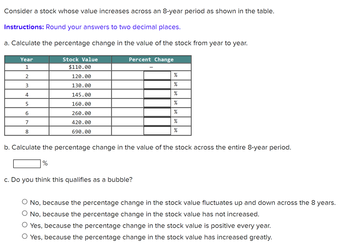

Transcribed Image Text:Consider a stock whose value increases across an 8-year period as shown in the table.

Instructions: Round your answers to two decimal places.

a. Calculate the percentage change in the value of the stock from year to year.

Year

Stock Value

1

$110.00

2

120.00

3

130.00

4

145.00

5

160.00

6

260.00

7

420.00

8

690.00

Percent Change

%

%

%

%

%

b. Calculate the percentage change in the value of the stock across the entire 8-year period.

%

c. Do you think this qualifies as a bubble?

O No, because the percentage change in the stock value fluctuates up and down across the 8 years.

O No, because the percentage change in the stock value has not increased.

Yes, because the percentage change in the stock value is positive every year.

○ Yes, because the percentage change in the stock value has increased greatly.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The present value of JECK Co.'s expected free cash flow is $90 million. If JECK has $25 million in debt, $4 million in cash, and 3.8 million shares outstanding, what is its share price?arrow_forward3. You bought a fully-restored vintage Mustang convertible five years ago for $82,000. Today you have been offered $98,000 for the car. What is the Rate of Return (ROR) on your investment in the car if you sell today?arrow_forward15. The daily newspaper lists this information on a stock:'Last $36.19, Net Chg -1.63 and Yld 1.3%. What is the amount of the current dividend? A. $0.44 B. $0.45 C S0.47 D. $0.49 E. $0.52arrow_forward

- What is an economically meaningful corporate event from a shareholders’ ownership perspective? a. stock buyback b. stock split c. stock dividendarrow_forward1.Which of these is an example of an index (and would have a corresponding Index Fund)? Question options: Apple stock US Treasury bonds A target retirement fund The S&P 500 2. Suppose you put $1,000 in an account that earns 5% interest per year, every year. You never invest additional money and you never withdraw money or interest payments. So in the first you, you earn $50 in interest. In Year 4, how much will this account earn? Question options: Less than $50 More than $50 $50 This is too hard.arrow_forwardSam, Inc. has current assets of $5,300, net fixed assets of $24,900, current liabilities of $4,600, and long-term debt of $10,300. What is the value of shareholder’s equity? Group of answer choices a. Cannot be determined without knowing the value of Common Stock b. $17,680 c. $60,030 d. $15,300 e. Cannot be determined without knowing the value of Retained Earningsarrow_forward

- .An investor invests $2,600 in a company at a steady annual interest yield of 4.99 percent. She earns $390 profit in year 1, earns $467 profit in year 2, and earns $285 profit in year 3. Find the Present Value of this investment asset flow.arrow_forwardWhy are they the answers can you explain all steps and formulas involved please ?arrow_forward49) If stock prices follow a random walk, it means that stock prices are just as likely to rise as to fall at any given time. True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education