Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

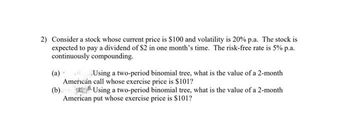

Transcribed Image Text:2) Consider a stock whose current price is $100 and volatility is 20% p.a. The stock is

expected to pay a dividend of $2 in one month's time. The risk-free rate is 5% p.a.

continuously compounding.

(a)

Using a two-period binomial tree, what is the value of a 2-month

American call whose exercise price is $101?

(b) Using a two-period binomial tree, what is the value of a 2-month

American put whose exercise price is $101?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- 2. Two-step Binomial Tree St=100 Step: n=0 Su=105 Sd=95.23 (Bonus question, maturity n=1 Suu=110.25 Sud=Sdu=100 Sdd=90.70 n=2 Consider the above two-step binomial tree, with each step being three months, At=0.25. The stock price is shown on the tree. The annual risk-free rate is 5%. u= Su/St=1.05, d=1/u. There is no dividend from the stock. 1) Consider an at-the-money European call option (S=K) with six-month maturity a) What is the payoff to this call option at the expiration date at each possible stock price? b) Calculate the call option fair value today. 2) Consider a European put option with six-month maturity and a strike price of $90. a) What is the payoff to this put option at the expiration date at each possible stock price? b) Calculate the put option fair value today. ) Calculate at-the-money American call option (S-K) with six-montharrow_forwardIf the interest rate on T Bills is 2% and the market risk premium is 6%, what is the CAPM-implied expected return on a stock with a beta of 1.25? Enter your answer as a percentage rounded to 2 decimal places.arrow_forwardThe level of the Syldavian market index is 21,600 at the start of the year and 26,100 at the end. The dividend yield on the index is 4.3%. a. What is the return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Retur b. If the interest rate is 5%, what is the risk premium over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Risk Premium % Real Return % c. If the inflation rate is 7%, what is the real return on the index over the year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) %arrow_forward

- The market price of a security is $50. Its expected rate of return is 10%. The risk-free rate is 5%, and the market risk premium is 8%. What will the market price of the security be if its beta doubles (and all other variables remain unchanged)? Assume the stock is expected to pay a constant dividend in perpetuity. (Round your answer to 2 decimal places.)arrow_forwardFor a two-period binomial model, you are given: Each period is one year. The current price for a non dividend-paying stock is 20. u = 1.2840, where u is one plus the rate of capital gain on the stock per period if the stock price goes up. d = 0.8607, where d is one plus the rate of capital loss on the stock per period if the stock price goes down. The continuously compounded risk-free interest rate is 5%. Calculate the price of an American call option on the stock with a strike price of 22.arrow_forwardThe risk-free rate of return is 5%, the required rate of return on the market is 10%, and High-Flyer stock has a beta coefficient of 1.8. If the dividend per share expected during the coming year, D1, is $3.60 and g = 5%, at what price should a share sell? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

- Currently, the risk-free return is 2 percent, and the expected market rate of return is 11 percent. What is the expected return of the following three-stock portfolio? Do not round intermediate calculations. Round your answer to two decimal places. Investment Beta $ 200,000 1.0 100,000 0.1 700,000 2.9 %arrow_forwardThe current price of a non-dividend-paying biotech stock is $140 with a volatility of 25%. The risk-free rate is 4%. For a 3-month time step: (a) What is the percentage up movement? (b) What is the percentage down movement? (c) What is the probability of an up movement in a risk-neutral world? (d) What is the probability of a down movement in a risk-neutral world? Use a two-step tree to value a 6-month European call option and a 6-month European put option. In both cases the strike price is $150. Answer: (For (a) to (d), answer XX.XX if the answer is XX.XX% or 0.XXXX; for the option prices: please round you answers to the second decimal places.) (a, (c) (d) Price of the Call: Price of the Put: % % % %arrow_forwardPerform all calculations with excel: ABC Corporation is currently trading at $40, with volatility\ sigma 30%, r = 5%, and no dividends. Assume that the ABC stock price can be modeled according to a three period binomial approach with T = 9 months and n = 3, so that the stock price moves every 3 months. 1. Build out the binomial tree for ABC. 2. What is the value of an American put option with strike price 40? 3. What is the value of a European call option with strike price 50?arrow_forward

- Suppose TRF = 4%, TM = 9%, and b = 1.1. a. What is n, the required rate of return on Stock i? Round your answer to one decimal place. % b. 1. Now suppose rar increases to 5%. The slope of the SML remains constant. How would this affect ry and n? I. ry will increase by 1 percentage point and n will remain the same. II. Both ry and r, will decrease by 1 percentage point. III. Both rm and r, will remain the same.. IV. Both r and r, will increase by 1 percentage point. V. r will remain the same and r, will increase by 1 percentage point. -Select- v 2. Now suppose rar decreases to 3%. The slope of the SML remains constant. How would this affect ry and n? I. TM will decrease by 1 percentage point and n will remain the same. II. rs will remain the same and n will decrease by 1 percentage point. III. Both ry and r, will increase by 1 percentage point. IV. Both ry and r, will remain the same. V. Both ry and r, will decrease by 1 percentage point. Selectarrow_forwardA stock has a current price of 50. The continuously compounded risk - free interest rate is 8%. The stock is going to pay a dividend of 0.5 one month from now and another dividend of 1 five months from now. Suppose that the market prepaid forward price of a prepaid forward contract that delivers one share after 6 months is 49. Construct an arbitrage portfolio and give the arbitrage profit.arrow_forwardA stock is currently trading at $54 and we assume a three-period binomial tree model where each period the stock can either increase by 20%, or fall by 18%. Each step in the tree is 3 months. The interest rate is 1.1% per year (continuous compounding). In this model, what is the risk-neutral probability that the stock price will go up twice and drop once over the three periods? [Provide your answer as a percentage rounded to two decimals, i.e. 40.25 for 0.4025=40.25%]arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education