ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

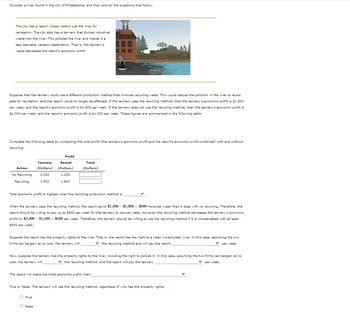

Transcribed Image Text:Consider a river found in the city of Philadelphia, and then answer the questions that follow.

The city has a resort whose visitors use the river for

recreation. The city also has a tannery that dumps industrial

waste into the river. This pollutes the river and makes it a

less desirable vacation destination. That is, the tannery's

waste decreases the resort's economic profit.

Suppose that the tannery could use a different production method that involves recycling water. This would reduce the pollution in the river to levels

safe for recreation, and the resort would no longer be affected. If the tannery uses the recycling method, then the tannery's economic profit is $1,500

per week, and the resort's economic profit is $1,800 per week. If the tannery does not use the recycling method, then the tannery's economic profit is

$2,000 per week, and the resort's economic profit is $1,000 per week. These figures are summarized in the following table.

Complete the following table by computing the total profit (the tannery's economic profit and the resort's economic profit combined) with and without

recycling.

Profit

Tannery Resort

Action (Dollars) (Dollars)

No Recycling 2,000

Recycling

1,500

Total

(Dollars)

1,000

1,800

Total economic profit is highest when the recycling production method is

When the tannery uses the recycling method, the resort earns $1,800-$1,000 = $800 more per week than it does with no recycling. Therefore, the

resort should be willing to pay up to $800 per week for the tannery to recycle water. However, the recycling method decreases the tannery's economic

profit by $2,000-$1,500 - $500 per week. Therefore, the tannery should be willing to use the recycling method if it is compensated with at least

$500 per week.

Suppose the resort has the property rights to the river. That is, the resort has the right to a clean (unpolluted) river. In this case, assuming the two

firms can bargain at no cost, the tannery will

the recycling method and will pay the resort

per week.

Now, suppose the tannery has the property rights to the river, including the right to pollute it. In this case, assuming the two firms can bargain at no

cost, the tannery will

the recycling method, and the resort will pay the tannery

The resort will make the most economic profit when

per week.

True or False: The tannery will use the recycling method, regardless of who has the property rights.

True

False

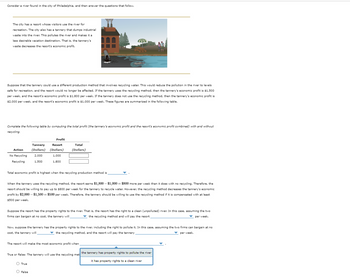

Transcribed Image Text:Consider a river found in the city of Philadelphia, and then answer the questions that follow.

The city has a resort whose visitors use the river for

recreation. The city also has a tannery that dumps industrial

waste into the river. This pollutes the river and makes it a

less desirable vacation destination. That is, the tannery's

waste decreases the resort's economic profit.

Suppose that the tannery could use a different production method that involves recycling water. This would reduce the pollution in the river to levels

safe for recreation, and the resort would no longer be affected. If the tannery uses the recycling method, then the tannery's economic profit is $1,500

per week, and the resort's economic profit is $1,800 per week. If the tannery does not use the recycling method, then the tannery's economic profit is

$2,000 per week, and the resort's economic profit is $1,000 per week. These figures are summarized in the following table.

Complete the following table by computing the total profit (the tannery's economic profit and the resort's economic profit combined) with and without

recycling.

Profit

Tannery

Resort

Action

No Recycling

Recycling

(Dollars) (Dollars)

2,000

1,000

Total

(Dollars)

1,500

1,800

Total economic profit is highest when the recycling production method is

When the tannery uses the recycling method, the resort earns $1,800-$1,000 = $800 more per week than it does with no recycling. Therefore, the

resort should be willing to pay up to $800 per week for the tannery to recycle water. However, the recycling method decreases the tannery's economic

profit by $2,000-$1,500 - $500 per week. Therefore, the tannery should be willing to use the recycling method if it is compensated with at least

$500 per week.

Suppose the resort has the property rights to the river. That is, the resort has the right to a clean (unpolluted) river. In this case, assuming the two

firms can bargain at no cost, the tannery will

the recycling method and will pay the resort

per week.

Now, suppose the tannery has the property rights to the river, including the right to pollute it. In this case, assuming the two firms can bargain at no

cost, the tannery will

the recycling method, and the resort will pay the tannery

The resort will make the most economic profit when

per week.

the tannery has property rights to pollute the river

True or False: The tannery will use the recycling met

it has property rights to a clean river

True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Table 3 given in the following page describes the long run cost schedules for a typical firm in a given industry operating under perfect competition and without positive or negative external economies. Table 4 gives the demand schedule for the product of this industry. a) Fill out the missing entries in the table b) Plot the long run average total cost and marginal cost curves for the typical firm. Plot the supply curve for the typical firm on a second diagram. Plot the demand schedule for the whole industry on a third diagram. c) Currently the number of firms in the industry is 16. They all enjoy the same cost schedules given in Table 3. What is the equilibrium price? (Hint construct the market supply curve and plot it on the same diagram as the demand curve) d) What will happen to the number of firms in the long run? What are the basic economic forces and the characteristics of competitive markets that justify your answer? e) What is the long run equilibrium price and long run…arrow_forwardA university spent $1.3 million to install solar panels atop a parking garage. These panels will have a capacity of 70 kilowatts (kW) and have a life expectancy of 20 years. Suppose that the discount rate is 30%, that electricity can be purchased at $0.20 per kilowatt-hour (kWh), and that the marginal cost of electricity production using the solar panels is zero. Hint : It may be easier to think of the present valuearrow_forwardSuppose the inverse demand curve on ore is given by P = X - 0.47 Q. Ore can be either mined or obtained through a recycling program. The marginal cost of mining is MC1 = 8 q1. The marginal cost of obtaining ore through recycling is MC2 = 91 + 2 q2. What should be a maximum value of X so that recycling is NOT cost-effective?arrow_forward

- 8. a) Suppose a firm A produces a product q, but also pollution x that affects a second firm B. Firm A is a competitive firm and faces an equilibrium price of £12 for its product. The cost function of firm A is C (q,x) = q² + (x-4)2. Firm B is a competitive firm and faces an equilibrium price of £10. Firm B's cost function is C₂(r,x) = r² + xr. Compute the equilibrium prices and quantities and the profits of the two separate, competitive firms. Interpret the first order conditions. Explain. b) Compute the social optimum, that is, the equilibrium prices, quantities, and profit when firm A and B are merged. Interpret the conditions and compare it to the solution in (a). Explain. c) Devise a quantity tax on product q for firm A in (a) such that the government can restore the social optimum in (b).arrow_forwardMetropolitan Utilities District currently charges residents in Omaha $1.23 per cubic feet of water use for each home's first 900 cubic feet of water used, $1.73 per cubic feet of water use for each home's usage rate between 900 and 3,000 cubic feet, and $2.22 per cubic feet of water use for anything over 3,000 cubic feet of use. The pricing structure is an example of: over-use and inefficient pricing. too few water permits being traded on the local water market. block pricing. conservation pricing.arrow_forwardQuestion 4 Calculate the equilibrium price for an illegal good that can be harvested for zero cost when competitive sellers face confiscation and a fine of 600 dollars and the probability of arrest is equal to n = 1/6.arrow_forward

- The information in the table below shows the demand schedule for water in a certain small town. Assume the marginal cost of supplying water is constant at $4 per bottle. Price Quantity (bottles) $9 200 $8 400 $7 600 $6 800 $5 1000 $4 1200 $3 1400 $2 1600 (Note: You may want to extend this table to generate additional data. If you do, you need not submit the extended table.) 1. Suppose there is only one supplier of water in this market, what will be its price and quantity for water? (MAKE THE SOLUTIONS READABLE!!!) 2. If there are two suppliers of water in the market (Victor and Sam) and they are able to collude and successfully form a cartel and agree to divide the market evenly, what would be the price of water and what quantity of water will each firm sell? How much profit will each seller earn (show solution)? 3. Suppose the town enacts new antitrust laws that prohibit Victor and Sam from operating as a monopolist.…arrow_forwardA university spent $1.5 million to install solar panels atop a parking garage. These panels will have a capacity of 200 kilowatts (kW) and have a life expectancy of 20 years. Suppose that the discount rate is 10%, that electricity can be purchased at $0.30 per kilowatt-hour (kWh), and that the marginal cost of electricity production using the solar panels is zero. Hint: It may be easier to think of the present value of operating the solar panels for 1 hour per year first. Approximately how many hours per year will the solar panels need to operate to enable this project to break even? 1,468.26 2,936.51 3,230.16 4,111.11 If the solar panels can operate only for 2,643 hours a year at maximum, the project Continue to assume that the solar panels can operate only for 2,643 hours a year at maximum. break even. In order for the project to be worthwhile (1.e., at least break even), the university would need a grant of at least,arrow_forward9arrow_forward

- A university spent $1.6 million to install solar panels atop a parking garage. These panels will have a capacity of 700 kilowatts (kW) and have a life expectancy of 20 years. Suppose that the discount rate is 20%, that electricity can be purchased at $0.30 per kilowatt-hour (kWh), and that the marginal cost of electricity production using the solar panels is zero. Hint: It may be easier to think of the present value of operating the solar panels for 1 hour per year first. Approximately how many hours per year will the solar panels need to operate to enable this project to break even? 1,564.62 2,503.39 625.85 If the solar panels can operate only for 1,408 hours a year at maximum, the projectwould break even. Continue to assume that the solar panels can operate only for 1,408 hours a year at maximum. In order for the project to be worthwhile (i.e., at least break even), the university would need a grant of at leastarrow_forwardthe answers shown for the part c are incorrectarrow_forward******ONLY ANSWER PART 3 IN PICTURE PLEASE**** Demand for Thunder games in Oklahoma City is given by: P(0)=430-20 Seattle does not currently have an NBA team, but they would like to attract the the Thunder. ok ok ok Demand for Thunder games in Seattle is given by: P (Q) = 490 -20 The marginal cost of production in both cities is constant at MC = 70. Suppose that the Thunder faces an extra fixed cost of 10000 in Seattle because they need to build a new stadium if they move. If the Thunder decides to stay in Oklahoma City, they don't need to pay the fixed cost. Cities can still offer bids to attract the team. a) Will the Thunder move to Seattle? b) How much is the winning bid? c) What is the profit plus bid for the Thunder? d) What is the value minus bid for the winning city?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education