ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

can you please solve this question for me

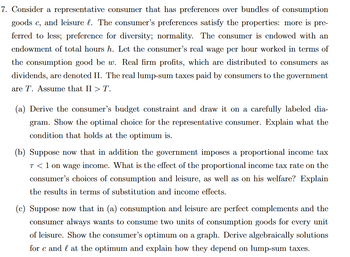

Transcribed Image Text:7. Consider a representative consumer that has preferences over bundles of consumption

goods c, and leisure l. The consumer's preferences satisfy the properties: more is pre-

ferred to less; preference for diversity; normality. The consumer is endowed with an

endowment of total hours h. Let the consumer's real wage per hour worked in terms of

the consumption good be w. Real firm profits, which are distributed to consumers as

dividends, are denoted II. The real lump-sum taxes paid by consumers to the government

are T. Assume that II > T.

(a) Derive the consumer's budget constraint and draw it on a carefully labeled dia-

gram. Show the optimal choice for the representative consumer. Explain what the

condition that holds at the optimum is.

(b) Suppose now that in addition the government imposes a proportional income tax

T < 1 on wage income. What is the effect of the proportional income tax rate on the

consumer's choices of consumption and leisure, as well as on his welfare? Explain

the results in terms of substitution and income effects.

(c) Suppose now that in (a) consumption and leisure are perfect complements and the

consumer always wants to consume two units of consumption goods for every unit

of leisure. Show the consumer's optimum on a graph. Derive algebraically solutions

for c and at the optimum and explain how they depend on lump-sum taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Something that is perceived as a luxury rather than a need is something that brings pleasure. Worldwide, the majority of people view food, shelter, and water as requirements. Undoubtedly, indoor plumbing and electricity would be included on the list by many Americans. As opposed to being a luxury, internet connection is increasingly considered as a need. But is it actually essential for surviving? What then happens to those who don't utilize or have access to the internet? Could the expansion of e-commerce be impacted by how people view Internet connection as a need or a luxury?arrow_forwardWhat is your opportunity cost for taking the time to study for a test?arrow_forwardTrying to figure out?arrow_forward

- Suppose you go to a restaurant and buy an expensive meal. Halfway through, despite feeling quite full, you decide to clean your plate. After all, you think, you paid for the meal, so you are going to eat all of it. What’s wrong with this thinking?arrow_forwardHow is the Rational decision making a complex process?arrow_forwardWhat is an Economistarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education