Microeconomic Theory

12th Edition

ISBN: 9781337517942

Author: NICHOLSON

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Solve all this question......you will not solve all questions then I will give you down?? upvote...

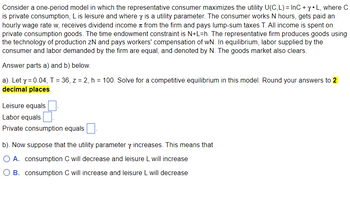

Transcribed Image Text:Consider a one-period model in which the representative consumer maximizes the utility U(C,L) = InC + y •L, where C

is private consumption, L is leisure and where y is a utility parameter. The consumer works N hours, gets paid an

hourly wage rate w, receives dividend income from the firm and pays lump-sum taxes T. All income is spent on

private consumption goods. The time endowment constraint is N+L=h. The representative firm produces goods using

the technology of production ZN and pays workers' compensation of wN. In equilibrium, labor supplied by the

consumer and labor demanded by the firm are equal, and denoted by N. The goods market also clears.

Answer parts a) and b) below.

a). Let y = 0.04, T = 36, z = 2, h = 100. Solve for a competitive equilibrium in this model. Round your answers to 2

decimal places.

Leisure equals

Labor equals

Private consumption equals

b). Now suppose that the utility parameter y increases. This means that

A. consumption C will decrease and leisure L will increase

B. consumption C will increase and leisure L will decrease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Principles and Policy (MindTap Co...EconomicsISBN:9781305280601Author:William J. Baumol, Alan S. BlinderPublisher:Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co...EconomicsISBN:9781305280601Author:William J. Baumol, Alan S. BlinderPublisher:Cengage Learning Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co...

Economics

ISBN:9781305280601

Author:William J. Baumol, Alan S. Blinder

Publisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning