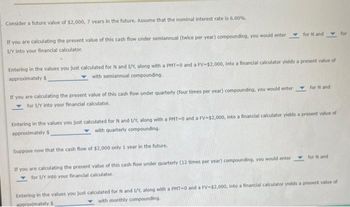

Consider a future value of $2,000, 7 years in the future. Assume that the nominal interest rate is 6.00%. If you are calculating the present value of this cash flow under semiannual (twice per year) compounding, you would enter 1/Y into your financial calculator. Entering in the values you just calculated for N and I/Y, along with a PMT-0 and a FV-$2,000, into a financial calculator yields a present value of with semiannual compounding. approximately $ If you are calculating the present value of this cash flow under quarterly (four times per year) compounding, you would enter for 1/Y into your financial calculator. for N and Suppose now that the cash flow of $2,000 only 1 year in the future. Entering in the values you just calculated for N and I/Y, along with a PMT-0 and a FV-$2,000, into a financial calculator yields a present value of with quarterly compounding. approximately $ If you are calculating the present value of this cash flow under quarterly (12 times per year) compounding, you would enter for 1/Y into your financial calculator. for N and for N and Entering in the values you just calculated for N and I/Y, along with a PMT-0 and a FV-$2,000, into a financial calculator yields a present value of with monthly compounding. approximately $ for

Consider a future value of $2,000, 7 years in the future. Assume that the nominal interest rate is 6.00%. If you are calculating the present value of this cash flow under semiannual (twice per year) compounding, you would enter 1/Y into your financial calculator. Entering in the values you just calculated for N and I/Y, along with a PMT-0 and a FV-$2,000, into a financial calculator yields a present value of with semiannual compounding. approximately $ If you are calculating the present value of this cash flow under quarterly (four times per year) compounding, you would enter for 1/Y into your financial calculator. for N and Suppose now that the cash flow of $2,000 only 1 year in the future. Entering in the values you just calculated for N and I/Y, along with a PMT-0 and a FV-$2,000, into a financial calculator yields a present value of with quarterly compounding. approximately $ If you are calculating the present value of this cash flow under quarterly (12 times per year) compounding, you would enter for 1/Y into your financial calculator. for N and for N and Entering in the values you just calculated for N and I/Y, along with a PMT-0 and a FV-$2,000, into a financial calculator yields a present value of with monthly compounding. approximately $ for

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. provide the drop down list for the respective blanks. Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:Consider a future value of $2,000, 7 years in the future. Assume that the nominal interest rate is 6.00%.

If you are calculating the present value of this cash flow under semiannual (twice per year) compounding, you would enter

1/Y into your financial calculator.

Entering in the values you just calculated for N and I/Y, along with a PMT-0 and a FV-$2,000, into a financial calculator yields a present value of

with semiannual compounding.

approximately $

If you are calculating the present value of this cash flow under quarterly (four times per year) compounding, you would enter

for 1/Y into your financial calculator.

for N and

Suppose now that the cash flow of $2,000 only 1 year in the future.

Entering in the values you just calculated for N and I/Y, along with a PMT-0 and a FV-$2,000, into a financial calculator yields a present value of

with quarterly compounding.

approximately $

If you are calculating the present value of this cash flow under quarterly (12 times per year) compounding, you would enter

for 1/Y into your financial calculator.

for N and

for N and

Entering in the values you just calculated for N and I/Y, along with a PMT-0 and a FV-$2,000, into a financial calculator yields a present value of

with monthly compounding.

approximately $

for

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education