Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

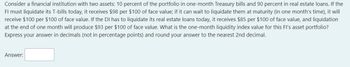

Transcribed Image Text:Consider a financial institution with two assets: 10 percent of the portfolio in one-month Treasury bills and 90 percent in real estate loans. If the

FI must liquidate its T-bills today, it receives $98 per $100 of face value; if it can wait to liquidate them at maturity (in one month's time), it will

receive $100 per $100 of face value. If the DI has to liquidate its real estate loans today, it receives $85 per $100 of face value, and liquidation

at the end of one month will produce $93 per $100 of face value. What is the one-month liquidity index value for this FI's asset portfolio?

Express your answer in decimals (not in percentage points) and round your answer to the nearest 2nd decimal.

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ace Development Company is trying to structure a loan with the First National Bank. Ace would like to purchase a property for $3.25 million. The property is projected to produce a first year NOI of $125,000. The lender will allow only up to an 80 percent loan on the property and requires a DCR in the first year of at least 1.25. All loan payments are to be made monthly but will increase by 3.5 percent at the beginning of each year for five years. The contract rate of interest on the loan is 5.5 percent. The lender is willing to allow the loan to negatively amortize; however, the loan will mature at the end of the five-year period. Excel calculation would be appreciated! a. What will the balloon payment be at the end of the fifth year? b. If the property value does not change, what will the loan-to-value ratio be at the end of the five-year period?arrow_forwardTitusville Petroleum Company is considering pledging its receivables to finance an increase in working capital. Citizens National Bank will lend the company 85 percent of the pledged receivables at 3 percentage points above the prime rate (currently 6%). The bank charges a service fee equal to 1.4 percent of the pledged receivables. The interest costs and the service fee are payable at the end of the borrowing period. Titusville has $2 million in receivables that can be pledged as collateral. The average collection period is 40 days. Assume that there are 365 days per year. Determine the annual financing cost to Titusville of this receivables-backed loan. Round your answer to two decimal places. %arrow_forwardTeal and Associates needs to borrow $35,000. The best loan they can find is one at 12% that must be repaid in monthly installments over the next years. How much are the monthly payments? (a) State the type. O present value future value O sinking fund O ordinary annuity O amortization (b) Answer the question. (Round your answer to the nearest cent.) $arrow_forward

- A property worth $16 million can be refinanced with an 85% loan at 9.5% over 20 years. The balance on the current loan is $12,148,566. Loan payments are $113,302 per month. The loan balance in 10 years will be $8,396,769. If the property is expected to be sold in 10 years, what is the incremental cost of refinancing? a)11.18% b)12.42% c) 10.45% d) 10.94%arrow_forwardD3) Finance Calculate the loan risk associated with a $4 million, five-year loan to a BBB-rated corporation in the computer parts industry that has a duration of 5.8 years. The cost of funds for the bank is 8 per cent. Based on four years of historical data, the bank has estimated the maximum change in the risk premium on the computer parts industry to be approximately 4.0 per cent. The current market rate for loans in this industry is 11 per cent.arrow_forward.You are negotiating to make a 7-year loan of $25,000 to Breck Inc. To repay you, Breck will pay $2,500 at the end of Year 1, $5,000 at the end of Year 2, and $7,500 at the end of Year 3, plus a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Breck is essentially riskless, so you are confident the payments will be made. You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X?arrow_forward

- Ivanhoe needs to borrow $7 million for an upgrade to its headquarters and manufacturing facility. Management has decided to borrow using a five-year term loan from its existing commercial bank. The prime rate is 4 percent, and Ivanhoe's current rating is prime + 2.45 percent. The yield on a five-year U.S. Treasury note is 1.98 percent, and the three-month U.S. Treasury bill rate is .10 percent. What is the estimated loan rate for the five-year bank loan? Estimated loan rate is %.arrow_forwardHow do i calculate this corporate finance problem without using excel? You will be paying off a mortgage of $100,000 over the next 25 years. You have signeda loan agreement with the Toronto Dominion Bank to secure a rate of 15.4%, however youare planning to re-negotiate the loan at the end of 10 years, how much will your payments be over the first 10 years? What is the amount of principal that you paid off with the first payment?arrow_forwardRanger Enterprises is considering pledging its receivables to finance a needed increase in working capital. Its commercial bank will lend 70 percent of the pledged receivables at 2.5 percentage points above the prime rate, which is currently 10 percent. In addition, the bank charges a service fee equal to 2 percent of the pledged receivables. Both interest and the service fee are payable at the end of the borrowing period. Ranger’s average collection period is 55 days, and it has receivables totaling $7 million that the bank has indicated are acceptable as collateral. Calculate the annual financing cost for the pledged receivables. Assume that there are 365 days per year. Round your answer to two decimal places. %arrow_forward

- Ace Development Company is trying to structure a loan with the First National Bank. Ace would like to purchase a property for $3.50 million. The property is projected to produce a first year NOI of $140,000. The lender will allow only up to an 80 percent loan on the property and requires a DCR in the first year of at least 1.25. All loan payments are to be made monthly but will increase by 3.5 percent at the beginning of each year for five years. The contract rate of interest on the loan is 5.5 percent. The lender is willing to allow the loan to negatively amortize; however, the loan will mature at the end of the five-year period. Required: a. What will the balloon payment be at the end of the fifth year? b. If the property value does not change, what will the loan-to-value ratio be at the end of the five-year period? Complete this question by entering your answers in the tabs below. Required A Required B What will the balloon payment be at the end of the fifth year? (Do not round…arrow_forwardSuppose a property you are seeking to purchase is valued at $200,000. You can take out a loan of 80 percent from the bank, which amortizes in 30 years. The current market interest rate is 7.35 percent. Suppose you can only afford a monthly payment of USD 900, but the seller is desperate to sell this property. The seller has already lowered the selling price to USD 180,000. What is the minimum amount of rebate that the seller should provide to you in order to make you purchase the property?arrow_forwardSuppose your firm is seeking a four year, amortizing $260,000 loan with annual payments and your bank is offering you the choice between a $268,000 loan with a $8,000 compensating balance and a $260,000 loan without a compensating balance. The interest rate on the $260,000 loan is 9.8 percent. How low would the interest rate on the loan with the compensating balance have to be for you to choose it? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Interest rate %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education