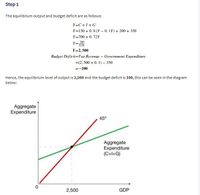

Consider a closed economy with fixed prices and wages. Suppose consumption function takes the form C = 150+0,8Yd, Investments are I = 200, government purchases are G = 350, tax rate t= 0,1. There are no lump-sum taxes. (some calculations are added in the images)

1)Compute the government spending multiplier before and after changes in tax rate. Explain why multiplier is changed?

2) If the potential output is 3000 and economy is in initial equilibrium (a) what changes in government purchases the Government need to implement in order to achieve potential output? Show how changes in government purchases affect the planned aggregate spending line and new equilibrium output.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

- This is a question that has four parts, here are parts two and three. 1.2. Use the information in Table 1 to analyze aggregate expenditures (AE) model (Figure 1. Equilibrium in a Private Closed Economy). (table 1 and figure one are in the attachments; table 1 is the table and figure 1 is the graph). 1.3. Identify the mistake and explain why the graph of the aggregate expenditures line does not correctly illustrate the economy's equilibrium.arrow_forwardIn the economy of Akron, the tax and savings functions are as follows: T=220+0.2Y S = -140 +0.3Y a) What is the equation for the consumption function? Remember to enter a minus (-) sign to indicate negative values. C=(Clickselect) Y b) If Y=1100, complete the following table: Y 1100 YDarrow_forwardTyped and correct answer please. Very important for me. Iarrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardQuestions A, B, and C are associated with each other. Please answer all three. Thank you!arrow_forwarda) Calculate the national income equilibrium. b) Based on your answer in (a), show the aggregate expenditure graph. c) Explain what would happen to the national income equilibrium if the investment changes by RM100 million.arrow_forward

- The simple economy of Altria shown in the table below has no government or taxes and no international trade. Its investment is autonomous and its MPC is constant. a. Complete the table below. Remember to use a minus (-) sign to indicate negative values. Y S I AE 500 0 750 1,500 2,250 3,000 3,750 с 500 1,000 0 750 b. The value of expenditures equilibrium is $ c. The value of the multiplier isarrow_forwardno handwritten notes!arrow_forward1. If an economy has an MPC of 0.9 what is the multiplier? 2. If an economy has an MPS of 0.2 what is the multiplier? 3. If an economy has an MPC of .08 and the government needs to close a recessionary gap of 20 Billion dollars how much government spending should occur? 4. If an economy has an MPS of .05 and the government needs to close an inflationary gap of 10 Billion dollars how much should government spending decrease?arrow_forward

- How would I do g?arrow_forwardSuppose the government raised taxes by $100,000 and simultaneously raised spending by $100,000. If the marginal propensity to consume is 0.65, what is the net effect on Gross Domestic Product? (use a negative number if GDP would go down, and a positive number if GDP would go up) Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardFor questions #9, 10, 11, and 12 use the following equation. C = 20 + 0.2(Y – T) 9) What is the marginal propensity to save for this economy? a) 2% b) 20% c) 60% d) 80% ( plz show the equation and how you use the numbers from the equation to solve it)10) What is the tax multiplier for this economy? a) -0.25 b) 0.25 c) -1.25 d) 1.25 11) If the government increases taxes by 20, then how much will consumption change by? a) -5 b) 5 c) -25 d) 25 12) To increase real GDP by 40 the government needs to change government spending by a) 48 b) 40 c) 32 d) 20arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education