Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

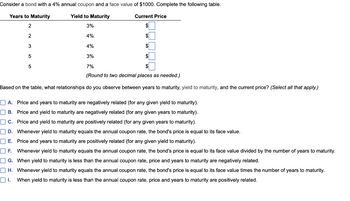

Transcribed Image Text:Consider a bond with a 4% annual coupon and a face value of $1000. Complete the following table.

Years to Maturity

Yield to Maturity

Current Price

2

3%

$

2

4%

$

3

4%

$

5

3%

$

5

7%

(Round to two decimal places as needed.)

Based on the table, what relationships do you observe between years to maturity, yield to maturity, and the current price? (Select all that apply.)

A. Price and years to maturity are negatively related (for any given yield to maturity).

B. Price and yield to maturity are negatively related (for any given years to maturity).

C. Price and yield to maturity are positively related (for any given years to maturity).

D. Whenever yield to maturity equals the annual coupon rate, the bond's price is equal to its face value.

E.

Price and years to maturity are positively related (for any given yield to maturity).

F. Whenever yield to maturity equals the annual coupon rate, the bond's price is equal to its face value divided by the number of years to maturity.

G. When yield to maturity is less than the annual coupon rate, price and years to maturity are negatively related.

H. Whenever yield to maturity equals the annual coupon rate, the bond's price is equal to its face value times the number of years to maturity.

01. When yield to maturity is less than the annual coupon rate, price and years to maturity are positively related.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please answer questions only no need to show workarrow_forwardThe following table summarizes the yields to maturity on several one-year, zero-coupon securities: a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate b AAA rating? b. What is the credit spread on AAA-rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate t AAA rating? The price of this bond will be ☐ %. (Round to three decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Important: The yields displayed are annually compounded yields. Security Treasury Yield (%) 3.14 AAA corporate 3.28 BBB corporate 4.27 B corporate 4.95 Print Donearrow_forwardA bond is currently selling for $880. This indicates that this bond is _____, and you would expect that the coupon rate would be _____ than the current market rate. Attractive; greater than Attractive; less than Unattractive; greater than Unattractive; less thanarrow_forward

- Coupon payments are fixed, but the percentage return that investors receive varies based on market conditions. This percentage return is referred to as the bond’s yield. Q1. Yield to maturity (YTM) is the rate of return expected from a bond held until its maturity date. However, the YTM equals the expected rate of return under certain assumptions. Which of the following is one of those assumptions? a. The bond is callable. b. The probability of default is zero. Consider the case of RTE Inc: Q2. RTE Inc. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $1,130.35. However, RTE Inc. may call the bonds in eight years at a call price of $1,060. What are the YTM and the yield to call (YTC) on RTE Inc.’s bonds? Value YTM ? YTC ? Q3. If interest rates are expected to remain constant, what is the best estimate of the remaining life left for RTE Inc.’s bonds? a. 8 years b. 10…arrow_forwardplease don't solve excel version. Please make a classic transactional solution with formulas.arrow_forwardDo solve all parts A. What risk premium do you use? Why? B. Why is the geometric mean lower than the arithmetic mean for both bonds and bills? C. If you had to use a risk premium with the longer periods, what biases will the investor have?arrow_forward

- Am. 101.arrow_forwardsolve this practice problemarrow_forwardConsider the following pure discount bonds with face value $1,000: Maturity Price 1 952.38 2 898.47 3 847.62 4 799.64 5 754.38 a). Find the spot rates and draw a yield curve.b). Assume that there is a constant liquidty premium that is equal to 1% across all maturities. Find the forward rates and the expected one period future interest rates.arrow_forward

- Which of the following statements is correct assuming same market rates for all maturities (flat yield curve)? e a Extendible bonds allow bond issuer to extend the maturity date. O b. Callable bonds give the bond issuer an option to call the bond back before the maturity date at a predetermined price. Oc. When the market yield is equal to a bond's stated coupon rate, the bond's current yield is greater than its coupon yield. Od. The cash price plus the accrued interest on the bond is the quoted price of the bond. Current yield is the ratio of annual coupon payment divided by the par value. o e.arrow_forwardcan you may this calculations for each of my bonds?. For each of your bonds, calculate expected defavvult percent loss as = default probability* (1 - recovery rate ). You will need to use the default rates and recovery rates that match each bond's rating. 4. Calculate the overall expected loss to your portfolio as the weighted average of the expected default percent lossarrow_forwardConsider a bond with a coupon of 5 percent, seven years to maturity, and a current price of $1,052.80. Suppose the yield on the bond suddenly increases by 2 percent. a. Use duration to estimate the new price of the bond. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Price b. Calculate the new bond price using the usual bond pricing formula. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Pricearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education