Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

N

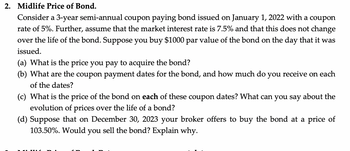

Transcribed Image Text:2. Midlife Price of Bond.

Consider a 3-year semi-annual coupon paying bond issued on January 1, 2022 with a coupon

rate of 5%. Further, assume that the market interest rate is 7.5% and that this does not change

over the life of the bond. Suppose you buy $1000 par value of the bond on the day that it was

issued.

(a) What is the price you pay to acquire the bond?

(b) What are the coupon payment dates for the bond, and how much do you receive on each

of the dates?

(c) What is the price of the bond on each of these coupon dates? What can you say about the

evolution of prices over the life of a bond?

(d) Suppose that on December 30, 2023 your broker offers to buy the bond at a price of

103.50%. Would you sell the bond? Explain why.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: (a) What is the price you pay to acquire the bond?

VIEW Step 2: (b) What are the coupon payment dates for the bond, and how much do you receive on each of the dates

VIEW Step 3: (c) What is the price of the bond on each of these coupon dates?

VIEW Step 4: (d) Suppose that on December 30, 2023, your broker offers to buy the bond at a price of 103.50%.

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A new homeowner, Ms. Dee Young, needs to decide whether to install R-11 or R-19 insulation in the attic of her new home. The insulated area is 1,650 square feet. The upgrade from R-11 to R-19 insulation costs $0.10 per square foot. The upgraded insulation is expected to save Ms. Dee Young approximately 350 kilowatt hours of energy usage per year. The planning horizon is 19 years and electricity costs $0.07/kWh. MARR is 12% per year. The future worth of R-19 insulation is $arrow_forwardis thsi correct?arrow_forwardboth a and barrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education