Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

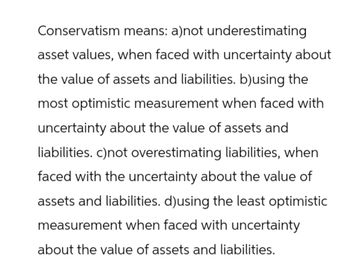

Transcribed Image Text:Conservatism means: a)not underestimating

asset values, when faced with uncertainty about

the value of assets and liabilities. b)using the

most optimistic measurement when faced with

uncertainty about the value of assets and

liabilities. c)not overestimating liabilities, when

faced with the uncertainty about the value of

assets and liabilities. d)using the least optimistic

measurement when faced with uncertainty

about the value of assets and liabilities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Financial analysis does not include assessing future performance and risk because financial statements are based on past performance. True or False True Falsearrow_forwardWhich of the following statements describing the elements of intrinsic valuation is most accurate? A.) When the present value of the cashflows is discounted with the appropriate rate and this present value is positive, then the asset providing these cashflows has a value to the investor. B.) The risk-free rate is the lowest rate that an investor can earn from short-term investments. C.) Cashflows may include depreciation expenses and amortization costs. D.) A simple calculation of present values of expected cashflows of different investments using the risk free rate would be enough to determine which asset is best.arrow_forwardSeve &Exit According to the principle of conservatism, when faced with uncertainty about the value of an item, a company should use the Help measure that avoids Multiple Choice overstating assets and understating liabilities. overstating essets and liabilities. O understating assets and liabilities. understating essets and overstating liabilities.arrow_forward

- Critically evaluate the pros and cons of the following statement: Financial statements are useless because they present assets at their historical costs rather than at their fair market values.arrow_forwardWhen adding a risky asset to a portfolio of may risky assets, which property of the asset has a greater influence on risk: its standard deviation or its covariance with other assets? Explainarrow_forwardWhich of the following statements describing the elements of intrinsic valuation is most accurate? a. A simple calculation of present values of expected cashflows of different investments using the risk free rate would be enough to determine which asset is best. b. The risk-free rate is the lowest rate that an investor can earn from short-term investments.c. When the present value of the cashflows is discounted with the appropriate rate end this present value is positive, then the asset providing these cashflows have a value to the investor. d.Cashflows may include depreciatipon expenses and amortization costs.arrow_forward

- When identifying undervalued and overvalued assets, which of the following statements is least likely accurate?a. An asset is properly valued if its estimated rate of return is below the required rate of return.b. An asset is considered overvalued if its required rate of return is below its estimated rate of return.c. An asset is considered overvalued if its estimated rate of return is below its required rate of return.d. An asset is considered overvalued if its estimated rate of return is above its required rate of return.e. None of the abovearrow_forward1.How can exit value accounting be used to assess the financial risk of a balance sheet. 2.Evaluate the argument that a mixed or piecemeal approach to standard setting is required in order to ‘better’ measure profit and financial position. 3.Explain how both exit price and current entry price accounting systems can be used to make decisions about retaining or selling assets.arrow_forwardWhat does it mean to adopt a maturity matching approach to financing assets, includingcurrent assets? How would a more aggressive or a more conservative approach differ fromthe maturity matching approach, and how would each affect expected profits and risk? Ingeneral, is one approach better than the others?arrow_forward

- When calculating a client’s net worth always use the sentiment value of each asset and the full, or outstanding, balance due for each liability. A. True B. Falsearrow_forwardNeed helparrow_forwardThe desired rate of return on an investment should reflect the degree of risk involved. A. True B. Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning