Concept explainers

Congratulations on finding your dream home! The 4-bedroom, 3-bath home is perfect for you and your family. You have negotiated a great price with the seller of 159,000.Youhave10,000 saved to put down on this investment (down payment). You have decided that your monthly budget for a mortgage will be no more than $775. You have been talking with two different lenders to help you mortgage your dream home.

- Lender #1 will lend you up to $150,000 at 5% for 25 years.

- Lender #2 will lend you $159,000 at 4.5% for 30 years.

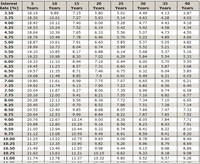

a) Which lender would you use? Why? Calculate the monthly payment under each lender option. Use Table 14-1 to find the appropriate table factors. Label and show all of your work.

b) Remembering your budget of $775 per month, how would your lender choice change if you did not have any money to use as a down payment? Recalculate the monthly payment under each lender option. Label and show all of your work.

Step by stepSolved in 3 steps

- Excited to buy her dream car, Molly rushes into her local Jeep dealership. Molly picks out a car, sits down at the financing desk, and hears the following, “Well we ran your credit history. You’ve got a really thin file just a years worth of student loan payments. The deal you saw was for ‘well- qualified buyers.’ The best deal we can offer you is 6.6% for 60 months. A little more bad news, the cash allowance is also based on credit history, so you don’t qualify for $500. That said, you’re excited about a keep and I want to see you driving one, so I can do $400 for you. How much total interest will Molly pay using this plan? How much will Molly’s monthly payment be using the Bankrate calculator in the screen shot below?arrow_forwardPlease help me stepwise and correct both by formula as welll as excelarrow_forwardAlexa needs $8,600 worth of new equipment for his shop. He can borrow this money at a discount rate of 6% for a year. Find the amount of the loan Alexa should ask for so that the proceeds are $8,600.Maturity = $arrow_forward

- You love to go fishing. You are happiest when you are on the water, the sea breeze blowing in your face, as you race to get to your favorite fishing spot before the sun peeks over the horizon. You are interested in purchasing a new fishing boat that costs $35,000. You have found a nearby marina that is offering a special financing rate of 6% APR (0.5% per month) on new boat loans with a tern of 48 months with required monthly payments. Assuming that you do not make a down payment on the boat (meaning you will need to borrow the full purchase price) and you take the marina's special financing deal, then your monthly boat payments would be closest to which of the following? You may assume that your first loan payment will be due one month from the time of purchase. O A. $773. O B. $729. O C. $842. O D. $822. O E. $921. O F. $647. -12 O Time Remaining: 00:27:47 Next etv 11 DD F10 F9 888 F8 F7 F6 F5 F4 F3 esc & # 2$ % 8. @ 7 3 4arrow_forward1. You purchased two condos for $100,000 cash down, with loan and insurance payments of $1,500 3 month for the next 10 years. Your association fees are $150 amonth. You plan to rent out one of the condos to cover 80% of your housing expenses. What rent amount do you need to charge your tenant?arrow_forwardYuli plans to purchase a vehicle, and she is working with two bank offers. . Bank One Loan Offer: $73,800, 6% annual interest, 60 months. . Bank Two Loan Offer: $73,800, 3% annual interest, 84 months. Yuli's ultimate financial goal is to select the loan with the lowest monthly payment regardless of duration. Based on her financial goal, which loan will Yuli choose? O A. Bank One: Loan Offer O B. Bank Two: Loan Offer OC. Both monthly payments are the same. O D. Not enough information given to answer the question.arrow_forward

- Please help solve this and please show all the steps to solve this step by step in Excel. Two years ago, Martin purchased a house for $100,000. Martin borrowed a mortgage with 80% of LTV (loan to value ratio). The interest rate on the mortgage is 6%. Payment terms are being made monthly to amortize the loan over 30 years. Martin has found another lender who will refinance the current outstanding loan balance plus all the costs associated with the new loan at 4.5% with monthly payments for 30 years. Suppose that the new lender will charge three discount points on the new loan and other refinancing costs will equal $3,000. What is the new loan amount if you choose to refinance? What is Martin's monthly payment for the new loan? What is the effective cost of Martin's new loan and do you refinance if he holds the loan for 30 years?arrow_forwardPlease make an excel spreadsheet and show the formulas in the cells for the problem below and please explain You buy a house of $450,000 today. You put a down payment of 20% and borrow a fixed-rate mortgage of $360,000 with interest rate of 4% and 15 years. After 3 years, your house is appreciated to the value of $550,000 and market interest rate goes up to 6.5%. How much money will you make in book after 3 years?arrow_forwardUse Worksheet 5.3. Rachel and Alexander Harrison need to calculate the amount they can afford to spend on their first home. They have a comt annual income of $67,500 and have $37,000 available for a down payment and closing costs. The Harrisons estimate that homeowner's insurance property taxes will be $250 per month. They expect the mortgage lender to use a 30 percent (of monthly gross income) mortgage payment afford ratio, to lend at an interest rate of 6 percent on a 30-year mortgage, and to require a 10 percent down payment. Based on this information, use th home affordability analysis form in Worksheet 5.3 to determine the highest-priced home the Harrisons can afford. Assume that closing costs are o of the down payment. Round the answer to the nearest dollar.arrow_forward

- 5. In the spring of 2022, you and your family were looking for the house of your dreams. Given your household income and your expenses, you determined that you could afford to pay $1,250 for a monthly house payment. As of February 2022, it looked like you could get a 30-year mortgage rate of 3.20%. a) Given the above information, what is the maximum amount you could finance for your dream home?arrow_forwardPlease show how to solve this using excel and please show all formulas in the spreadsheet please!! Steven decides to buy a house with price of $500,000, Steven puts 20% down payment and considers a 15-year fixed rate mortgage to pay the remaining balance. The lender offers him three choices of the mortgage with monthly payments shown in the table as a., b., and c. Assume that the origination cost is $8,000. A. If the loan will be outstanding for 15 years, what is the effective cost for each choice? Which choice is most ideal? explain? B. Which mortgage choices are not properly priced? explain?arrow_forwardUSE EXCEL TO SOLVE THE PROBLEM AND SHOW THE EXCEL FORMULA AS WELL! You are hoping to buy a house in the future and recently received an inheritance of $20,000. You intend to use your inheritance as a down payment on your house. a. If you put your inheritance in an account that earns a 7 percent interest rate compounded annually, how many years will it be before your inheritance grows to $30,000? b. If you let your money grow for 10.25 years at 7 percent, how much will you have? c. How long will it take your money to grow to $30,000 if you move it into an account that pays 3 percent compounded annually? How long will it take your money to grow to $30,000 if you move it into an account that pays 11 percent? d. What does all of this tell you about the relationship among interest rates, time, and future sums?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education