FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

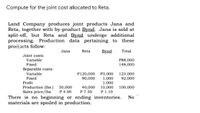

Transcribed Image Text:Compute for the joint cost allocated to Reta.

Land Company produces joint products Jana and

Reta, together with by-product Bynd. Jana is sold at

split-off, but Reta and Bynd undergo additional

processing. Production data pertaining to these

proiticts follow:

Jana

Reta

Bynd

Total

Joint costs:

Variable

P88,000

148,000

Fixed

Separable costs:

P120,000

90,000

Variable

123,000

Fixed

Profit

Production (lbs.)

Sales price/lbs.

P3,000

1,000

1,000

10,000

P 1.10

92,000

50,000

P 4.00

40,000

P 7.50

100,000

There is no beginning or ending inventories.

materials are spoiled in production.

No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Double Company produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Double's production, sales, and costs follows. DBB-1 DBB-2 DBB-3 Total Units Sold 16,200 24,300 36,300 76,800 Price (after additional processing) $ 65 $ 50 $ 75 Separable Processing cost $ 112,000 $ 46,000 $ 68,000 $ 226,000 Units Produced 16,200 24,300 36,300 76,800 Total Joint Cost $ 3,610,000 Sales Price at Split-off $ 25 $ 35 $ 55 The amount of joint costs allocated to product DBB-1 using the physical measure method is: Multiple Choice $752,083. $761,484. $1,706,289. $1,203,333. $1,142,227.arrow_forwardAllocating Joint Costs Using the Net Realizable Value Method Please answer in same format as question.arrow_forwardNonearrow_forward

- PT Agile Box produces products 1,2 and 3 from one combined product process. Information relating to the allocation of combined production costs is as follows Production Product Points / Market / unit Volume Units price 1.200 unit 3 200.000 600 unit 250.000 3 500 unit 4 350.000 Total 2.300 unit Based on this data, you allocate a joint production cost of IDR 345,000,000 to each product and calculate the cost / unit of each product if PT DZAKI uses the following alternatives: a. Average unit method b. Weighted average method (based on points /units) 2. 1, 2.arrow_forwardDenver Fabricators manufactures products DF1 and DF2 from a joint process, which also yields a by-product, BP. The company accounts for the revenues from its by-product sales as other income. Additional information follows: DF1 DF2 BP Total Units produced 27,000 18,000 15,000 60,000 Allocated joint costs ? ? ? $ 560,000 Sales value at split-off $ 561,000 $ 187,000 $ 102,000 $ 850,000 Required: Assuming that joint product costs are allocated using the net realizable value at split-off approach, what joint costs are allocated to each of the joint products DF1 and DF2 and to the by-product, BP?arrow_forwardMarin Products produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Marin's production, sales, and costs follows. DBB-1 DBB-2 DBB-3 Total Units Sold 16,000 25,000 36,000 77,000 Price (after addt’l processing) $ 30 $ 15 $ 40 Separable Processing cost $ 179,000 $ 72,000 $ 107,000 $ 358,000 Units Produced 16,000 25,000 36,000 77,000 Total Joint Cost $ 3,600,000 Sales Price at Split-off $ 20 $ 30 $ 50 The amount of joint costs allocated to product DBB-2 using the sales value at split-off method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the…arrow_forward

- Division X of Bella Corporation sells Part A to other companies for $87.20 per unit. According to the company's accounting system, the costs to Division X to make a unit of Part A are: O $87.20 per unit O $62.60 per unit O $58.10 per unit O $79.95 per unit O None of the above Direct materials Direct labor $5.80 Variable Division Y of Bella Corporation uses a part much like Part A in one of its products. Division Y can buy this part from an outside supplier for $79.95 per unit. However, Division Y could use Part A instead of the part it purchases from the outside supplier. What is the most Division Y would be willing to pay the Division X for Part A? Question 21 $42.70 manufacturing $9.60 overhead Fixed manufacturing $4.50 overheadarrow_forwardExercise 11-47 (Algo) Net Realizable Value Method with By-Products (LO 11-7, 10) Butterfly Corp. manufactures products M1 and M2 from a joint process, which also yields a by-product, B1. Butterfly accounts for the revenues from its by-product sales as other income. Additional information follows: M1 24,400 ? M2 13,800 ? Joint cost of product M1 B1 9,600 ? Units produced Allocated joint costs Sales value at split-off $378,000 $252,000 $96,000 Total 47,800 $352,000 $726,000 Required: Assuming that joint product costs are allocated using the net realizable value at split-off approach, what was the joint cost allocated to product M1? (Do not round intermediate calculations.)arrow_forwardMarin Products produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Marin's production, sales, and costs follows. DBB-1 DBB-2 DBB-3 Total Units Sold 11,000 17,000 24,000 52,000 Price (after addt’l processing) $ 10 $ 25 $ 30 Separable Processing cost $ 282,000 $ 114,000 $ 169,000 $ 565,000 Units Produced 17,600 31,000 39,400 88,000 Total Joint Cost $ 4,800,000 Sales Price at Split-off $ 20 $ 30 $ 50 The amount of joint costs allocated to product DBB-3 using the physical measure method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education