FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Compute for

Consolidated Total Asset

Consolidated Total Liabilities

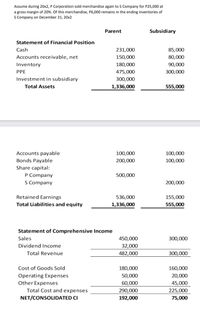

Transcribed Image Text:Assume during 20x2, P Corporation sold merchandise again to S Company for P25,000 at

a gross margin of 20%. Of this merchandise, P6,000 remains in the ending inventories of

S Company on December 31, 20x2

Parent

Subsidiary

Statement of Financial Position

Cash

231,000

85,000

Accounts receivable, net

150,000

80,000

Inventory

180,000

90,000

PPE

475,000

300,000

Investment in subsidiary

300,000

Total Assets

1,336,000

555,000

Accounts payable

100,000

100,000

Bonds Payable

200,000

100,000

Share capital:

P Company

S Company

500,000

200,000

Retained Earnings

536,000

155,000

Total Liabilities and equity

1,336,000

555,000

Statement of Comprehensive Income

Sales

450,000

300,000

Dividend Income

32,000

Total Revenue

482,000

300,000

Cost of Goods Sold

180,000

160,000

Operating Expenses

50,000

20,000

Other Expenses

60,000

45,000

Total Cost and expenses

290,000

225,000

NET/CONSOLIDATED CI

192,000

75,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please explain how the long-term and short-term classification of assets and liabilities is determined. In addition, please define “operating cycle.arrow_forwardDefine Long-lived assetsarrow_forwardPlease classify current assets fixed assets current liabilites and non current liabilities in this two picturearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education