FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Comprehensive Question Ch4:

Par Corporation acquired a 70 percent interest in Sul Corporation's outstanding

voting common stockon January 1, 2011, for $490,000 cash. The stockholders'

equity (book value) of Sul on this date consisted of $500,000 capital stock and

$100,000 retained earnings.

The differences between the fair valueof Sul and the book value of Sul were

assigned $5,000 to Sul's undervalued inventory, $14,000 to undervalued buildings,

$21,000 to undervalued equipment, and $40,000 to previously unrecorded

patents. Any remaining excess is goodwill. The undervalued inventory items were

sold during 2011, and the undervalued buildings andequipment had remaining

useful lives of seven years and three years, respectively. The patents have a 40-

year life. Depreciation is straight line.At December 31, 2011, Sul's accounts

payable include $10,000 owed to Par. This $10,000account payable is due on

January 15, 2012. Separate financial statements for Par and Sul at 31 Dec-

2011 are summarized as follows (in thousands):

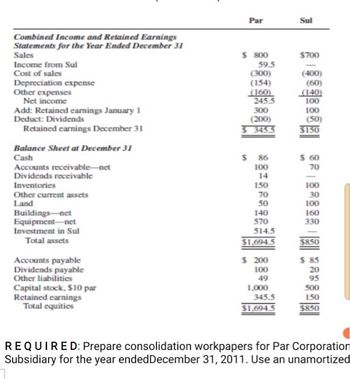

Transcribed Image Text:Combined Income and Retained Earnings

Statements for the Year Ended December 31

Sales

Income from Sul

Cost of sales

Depreciation expense

Other expenses

Net income

Add: Retained earnings January 1

Deduct: Dividends

Retained earnings December 31

Balance Sheet at December 31

Cash

Accounts receivable net

Dividends receivable

Inventories

Other current assets

Land

Buildings-net

Equipment-net

Investment in Sul

Total assets

Accounts payable

Dividends payable

Other liabilities

Capital stock, $10 par

Retained earnings

Total equities

Par

$ 800

59.5

(300)

(154)

(160)

245.5

300

(200)

$345.5

$ 86

100

14

150

70

50

140

570

514.5

$1,694.5

$ 200

100

49

1,000

345.5

$1,694.5

Sul

$700

(400)

(60)

(140)

100

100

(50)

$150

$ 60

70

100

30

100

160

330

$850

$ 85

20

95

500

150

$850

REQUIRED: Prepare consolidation workpapers for Par Corporation

Subsidiary for the year ended December 31, 2011. Use an unamortized

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- POPCORN Corporation acquired a 90% interest in the outstanding stock of SALT Corporation for $540,000 on 1/1/X1. At this time, the stockholders’ equity of SALT consisted of $400,000 of capital stock and $50,000 of retained earnings. The following table represents only those assets and liabilities of Salt which had book values different than their fair values at the date of acquisition: Book Value Fair Value Inventory $ 20,000 $ 15,000 Sold X1 Land 30,000 40,000 Still owned Buildings 10,000 50,000 Remaining life 8 years Notes Payable (50,000) (40,000) Matures on 12/31/X5 Comparative Balance Sheets for POPCORN and SALT AT 12/31/X3 are presented here: Popcorn Corporation & Subsidiary Consolidated Balance Sheet Workpaper For the Year Ended 12/31/X3 Assets: POPCORN SALT Debits Credits Consolidated Other Assets $355,000 $100,000 Inventory 100,000 50,000 Land…arrow_forwardX co, purchased 100% of Y Common stock at 1/1/2020 for $ 300,000 ,on the same date the y co stock was $ 100,000 and retained earning $120,000 , at acquisition date the net assets of y co. book value was equal to fair value except ( inventory FV more than BV of $26,000) and (land its FV more than BV10,000 ) (Building its FV more than BV by $ 14,000 ) but ( equipment its FV less than B V by $10,000) if Y CO. reported $160,000 net income for 31/12/2020 and paid $ 60,000 dividends . Other information 1- the Y inventory 50% sold during 2020 2- the building useful life was 7 years , but equipment 5 years 3- there is no impairment for goodwill during 2020 if inventory balance in 31/12/2020 in parent co 60,000 & in subsidiary co 50,000 what is amount of inventory in consolidated balance sheet in 31/12/2020 Select one: a. 110,000 b. 123,000 c. 136,000 d. 97,000arrow_forwardIn 1/1/2024 Smart co. with owner equity (ordinary shares 1,500,0000, premium 2,500,000 and retained earning 1,800,000) purchased 10% of Welly co.with owner equity (ordinary shares 800,0000, premium700,000 and retained earning 1,000,000) by isuing 50,000 of its 25par and 5 market price. In that date the inventory of welly book value was 100,000 and market value 140,000, equipment with book value 250,000 and fair market 320,000(7 years) In 31/12/2024 ART income was 280,000 before recorded any of DORPY and paid dividend 70,000, and income was 80,000 with 40,000 dividend, the market price share for Smart was 125 and 75 for welly in 31/12/2024 required: journalize all required entries for this investment in 01/01/2024 and 31/12/2024 with any elemination entries in 31/12/2024arrow_forward

- Nonearrow_forwardC4arrow_forwardes On January 1, 2023, QuickPort Company acquired 90 percent of the outstanding voting stock of NetSpeed, Incorporated, for $1,107,000 in cash and stock options. At the acquisition date, NetSpeed had common stock of $1,150,000 and Retained Earnings of $57,500. The acquisition-date fair value of the 10 percent noncontrolling interest was $123,000. QuickPort attributed the $22,500 excess of NetSpeed's fair value over book value to a database with a five-year remaining life. During the next two years, NetSpeed reported the following: Items 2023 2024 Net Income $ 31,500 45,000 Dividends Declared $ 4,500 4,500 On July 1, 2023, QuickPort sold communication equipment to NetSpeed for $28,500. The equipment originally cost $32,500 and had accumulated depreciation of $5,500 and an estimated remaining life of three years at the date of the Intra-entity transfer. Required: a. Compute the equity method balance in QuickPort's Investment in NetSpeed, Incorporated, account as of December 31, 2024. b.…arrow_forward

- Nonearrow_forwardPar Corporation acquired a 70 percent interest in Sul Corporation’s outstanding voting common stockon January 1, 2011, for $490,000 cash. The stockholders’ equity (book value) of Sul on this date consistedof $500,000 capital stock and $100,000 retained earnings. The differences between the fair valueof Sul and the book value of Sul were assigned $5,000 to Sul’s undervalued inventory, $14,000 to undervalued buildings, $21,000 to undervalued equipment, and $40,000 to previously unrecorded patents. Any remaining excess is goodwill. The undervalued inventory items were sold during 2011, and the undervalued buildings andequipment had remaining useful lives of seven years and three years, respectively. The patents have a 40-year life. Depreciation is straight line.At December 31, 2011, Sul’s accounts payable include $10,000 owed to Par. This $10,000account payable is due on January 15, 2012. Separate financial statements for Par and Sul at 31 Dec- 2011are summarized as follows (in…arrow_forwardX co, purchased 80% of Y Common stock at 1/1/2020 for $ 300,000 ,on the same date the y co stock was $ 100,000 and retained earning $120,000 , at acquisition date the net assets of y co. book value was equal to fair value except ( inventory FV more than BV of $26,000) and (land its FV more than BV10,000 ) (Building its FV more than BV by $ 14,000 ) but ( equipment its FV less than B V by $10,000) if Y CO. reported $160,000 net income for 31/12/2020 and paid $ 60,000 dividends . Other information 1- the y inventory completely sold during 2020 2- the building useful life was 7 years , but equipment 5 years 3- there is no impairment for goodwill during 2020 what is the amount of income from subsidiary reported in parents co income statement on 31/12/2020 Select one: a. 122,800 b. 102,000 c. 107,200 d. 128,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education