FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

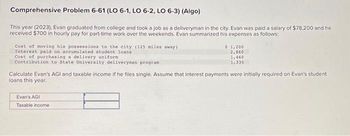

Comprehensive Problem 6-61 (LO 6-1, LO 6-2, LO 6-3) (Algo) This year (2023), Evan graduated from college and took a job as a deliveryman in the city. Evan was paid a salary of $78,200 and he received $700 in hourly pay for part-time work over the weekends. Evan summarized his expenses as follows: Cost of moving his possessions to the city (125 miles away) Interest paid on accumulated student loans Cost of purchasing a delivery uniform Contribution to State University deliveryman program $ 1,200 2,860 1,460 1,330 Calculate Evan's AGI and taxable income if he files single. Assume that interest payments were initially required on Evan's student loans this year. Evan's AGI Taxable income

Transcribed Image Text:Comprehensive Problem 6-61 (LO 6-1, LO 6-2, LO 6-3) (Algo)

This year (2023), Evan graduated from college and took a job as a deliveryman in the city. Evan was paid a salary of $78,200 and he

received $700 in hourly pay for part-time work over the weekends. Evan summarized his expenses as follows:

Cost of moving his possessions to the city (125 miles away)

Interest paid on accumulated student loans

Cost of purchasing a delivery uniformi

Contribution to State University deliveryman program

$ 1,200

2,860

1,460

1,330

Calculate Evan's AGI and taxable income if he files single. Assume that interest payments were initially required on Evan's student

loans this year.

Evan's AGI

Taxable income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Problem 6-50 (LO. 1, 3) Chee, single, age 40, had the following income and expenses during 2021: Income Salary $43,000 Rental of vacation home (rented 60 days, used personally 60 days, vacant 245 days) 4,000 Municipal bond interest 2,000 Dividend from General Electric 400 Expenses Interest on home mortgage 8,400 Interest on vacation home 4,758 Interest on loan used to buy municipal bonds 3,100 Property tax on home 2,200 Property tax on vacation home 1,098 State income tax 3,300 State sales tax 900 Charitable contributions 1,100 Tax return preparation fee 300 Utilities and maintenance on vacation home 2,600 Depreciation on rental portion of vacation home 3,500 Calculate Chee's net income from the vacation home, itemized deductions and taxable income for the year. If Chee has any options, choose the method that maximizes his deductions. In your computations, round any fractions to four decimal places. Then, round any amounts to the…arrow_forwardRequired information Problem 14-61 (LO 14-5) (Algo) [The following information applies to the questions displayed below.] Alexa owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: AGI Insurance Mortgage interest Property taxes Repairs & maintenance Utilities Depreciation $ 2,500 7,250 2,400 1,650 3,500 15,750 During the year, Alexa rented out the condo for 100 days. She did not use the condo at all for rsonal purposes during the year. Alexa's AGI from all sources other than the rental property is $200,000. Unless otherwise specified, Alexa has no sources of passive income. Problem 14-61 Part a (Algo) Assuming Alexa receives $22,000 in gross rental receipts, answer the following questions: Note: Leave no answer blank. Enter zero if applicable. a. What effect does the rental activity have on her AGI for the year?arrow_forwardplease solve Carrow_forward

- i need the answer quicklyarrow_forwardInterview Notes Barbara is age 57 and was widowed in 2021. She owns her own home and providedall the cost of keeping up her home for the entire year. Her only income for 2021 was$36,000 in W-2 wages. Jenny, age 24, and her daughter Marie, age 3, moved in with her mother, Barbara,after she separated from her spouse in April of 2021. Jenny’s only income for 2021was $15,000 in wages. Jenny provided over half of her own support. Marie did notprovide more than half of her own support. Jenny will not file a joint return with her spouse. She did not receive advance childtax credit payments for 2021. All individuals in the household are U.S. citizens with valid Social Security numbers.No one has a disability. They lived in the United States all year but not in a communityproperty state. 10. Which of the following statements is true? A. Jenny is eligible to claim Marie for the EIC even though her filing status is married filing separate…arrow_forwardLarry purchased an annuity from an insurance company that promises to pay him $6,500 per month for the rest of his life. Larry paid $626,340 for the annuity. Larry is in good health and is 72 years old. Larry received the first annuity payment of $6,500 this month. Use the expected number of payments in Exhibit 5-1 for this problem. Problem 5-59 Part-a (Algo) a. How much of the first payment should Larry include in gross income?arrow_forward

- Problem 9-28 (LO. 2) On July 1, 2017, Brent purchases a new automobile for $40,000. He uses the car 80% for business and drives the car as follows: 8,000 miles in 2017, 19,000 miles in 2018, 20,000 miles in 2019, and 15,000 miles in 2020. Determine Brent's basis in the business portion of the auto as of January 1, 2021, under the following assumptions: If required, round answers to the nearest dollar. a. Brent uses the automatic mileage method. Compute his basis adjustments for depreciation for each year. Click here to access the basis adjustment table. 2017: $ 2018: $ 2019: $ 2020: $ Brent's adjusted basis in the auto on January 1, 2021, is $ Feedback b. Brent uses the actual cost method. [Assume that no § 179 expensing is claimed and that 200% declining-balance cost recovery with the half-year convention is used. The recovery limitation for an auto placed in service in 2017 is as follows: $3,160 (first year), $5,100 (second year), $3,050 (third year), and $1,875 (fourth year).]…arrow_forwardProblem 13-88 (LO. 8) Lloyd owns a beach house (four years) and a cabin in the mountains (six years). His adjusted basis is $300,000 in the beach house and $315,000 in the mountain cabin. Lloyd also rents a townhouse in the city where he is employed. During the year, he occupies each of the three residences as follows: Townhouse 135 days Beach house 155 days Mountain cabin 75 days The beach house is close enough to the city so that he can commute to work during the spring and summer. Although this level of occupancy may vary slightly from year to year, it is representative during the time period that Lloyd has owned the two residences. Because Lloyd plans to retire in several years, he sells both the beach house and the mountain cabin. The mountain cabin is sold on March 3, 2020, for $540,000 (related selling expenses of $35,000). The beach house is sold on December 10, 2020, for $700,000 (related selling expenses of $42,000). a. Calculate Lloyd's least…arrow_forwardExercise 9-12 (Algorithmic) (LO. 2) Lara uses the standard mileage method for determining auto expenses. During 2023, she used her car as follows: 23,200 miles for business, 4,640 miles for personal use, 6,960 miles for a move to a new job, 2,320 miles for charitable purposes, and 1,160 miles for medical visits. Presuming that all the mileage expenses are allowable (i.e., not subject to percentage limitations), what is Lara's deduction for: If required, round your answers to the nearest dollar. a. Business? $15,198 b. Charitable? 325 c. Medical? 255arrow_forward

- Problem 9-33 (LO. 5) Melanie is employed full-time as an accountant for a national hardware chain. She recently started a private consulting practice, which provides tax advice and financial planning to the general public. For this purpose, she maintains an office in her home. Expenses relating to her home for 2020 are as follows: Real property taxes $3,600 Interest on home mortgage 3,800 Operating expenses of home 900 Melanie's residence cost $350,000 (excluding land) and has living space of 2,000 square feet, of which 20% (400 square feet) is devoted to business. The office was placed in service in February 2019, and under the Regular Method, Melanie had an unused office in the home deduction of $800 for 2019. Assume there is sufficient net income from her consulting practice. depreciation table below. Round deprecation to the nearest dollar. 8-7cCost Recovery Tables Summary of Tables Exhibit 8.3 Regular MACRS table for personalty. Depreciation…arrow_forwardexplain how you would position the applicable and needed insurance solutions to fit both the clients budget and needs for the following instances: Winston and Neisha have been married for almost 40 years. Neisha is 60 and Winston is 63. Neisha works in HR with her present company and has $300,000 in retirement savings. Winston works for the state government which provides him a pension of $1,500 per month (100% transferrable to Neisha) and $200,000 in a 457b plan. They have no debt and full health care benefits through Winston. They will have $2,500 per month combined Social Security income, no debt, and monthly expenses of $5,000. They plan to retire when Winston is 65 years old. Austin and Jenifer are both 35 years old with two (2) children ages 7 & 9. Austin works as an IT Manager with a medium-size firm and his salary is $120,000 annually. Jenifer stays at home with their children and works part-time earning approximately $10,000 to $15,000 a year. They had no other debt…arrow_forwardProblem 12-31 (LO. 4) Paul and Karen Kent are married, and both are employed (Paul earned $44,000 and Karen earned $9,000 in 2020). Paul and Karen have two dependent children, Samuel and Joy, both under the age of 13. Paul and Karen pay $3,800 ($1,900 for each child) to Sunnyside Day Care Center (422 Sycamore Road, Ft. Worth, TX 76028; Employer Identification Number 11- 2345678), to care for their children while they are working. Click to view Applicable Rate of Credit based on Adjusted Gross Income. a. Assuming that Paul and Karen file a joint return, what, if any, is their tax credit for child and dependent care expenses? b. Complete Form 2441 for Paul and Karen; their AGI is $53,750, and their tax liability before any available child care credit is $2,825. Neither Paul nor Karen received any child care benefits from their employers. Enter amounts as positive numbers. Form 2441 OMB No. Child and Dependent Care Expenses 1545-0074 Department of> Attach to Form 1040, 1040-SR, or the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education