FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req la

Req 1b

Req 2

Req 3

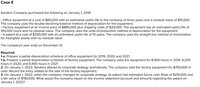

Prepare a partial depreciation schedule of factory equipment. The company used the equipment for 8,000 hours in 2019,

9,200 hours in 2020, and 8,900 hours in 2021. (Do not round intermediate calculations.)

Net Book

Depreciation

Expense

Accumulated

Year

Depreciation

Value

2019

2020

2021

< Req 1a

Req 2 >

Transcribed Image Text:Case E

Sanders Company purchased the following on January 1, 2019:

Office equipment at a cost of $60,000 with an estimated useful life to the company of three years and a residual value of $15,000.

The company uses the double-declining-balance method of depreciation for the equipment.

Factory equipment at an invoice price of $880,000 plus shipping costs of $20,000. The equipment has an estimated useful life of

100,000 hours and no residual value. The company uses the units-of-production method of depreciation for the equipment.

A patent at a cost of $330,000 with an estimated useful life of 15 years. The company uses the straight-line method of amortization

for intangible assets with no residual value.

The company's year ends on December 31.

Required:

1-a. Prepare a partial depreciation schedule of office equipment for 2019, 2020, and 2021.

1-b. Prepare a partial depreciation schedule of factory equipment. The company used the equipment for 8,000 hours in 2019, 9,200

hours in 2020, and 8,900 hours in 2021.

2. On January 1, 2022, Sanders altered its corporate strategy dramatically. The company sold the factory equipment for $700,000 in

cash. Record the entry related to the sale of the factory equipment.

3. On January 1, 2022, when the company changed its corporate strategy, its patent had estimated future cash flows of $210,000 and

a fair value of $190,000. What would the company report on the income statement (account and amount) regarding the patent on

January 1, 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data relate to the Machinery account of Wildhorse, Inc. at December 31, 2025. Original cost Year purchased Useful life Salvage value Depreciation method Accum. depr. through 2025* a. Cash A Machinery (Machine A) $54,280 2020 15,340 10 years $3,658 Sum-of-the-years'-digits $36,816 B 15,340 $60,180 2021 Machinery 15,000 hours $3,540 Activity $41,536 C $94,400 2022 15 years $5,900 Straight-line $17,700 D $94,400 *In the year an asset is purchased, Wildhorse, Inc. does not record any depreciation expense on the asset. In the year an asset is retired or traded in, Wildhorse, Inc. takes a full year's depreciation on the asset. The following transactions occurred during 2026. 2024 10 years $5,900 On May 5, Machine A was sold for $15,340 cash. The company's bookkeeper recorded this retirement in the following manner in the cash receipts journal. Double-declining balance $18,880arrow_forwardPharoah Limited purchased a machine on account on April 1, 2024, at an invoice price of $356,620. On April 2, it paid $2,130 for delivery of the machine. A one-year, $3,970 insurance policy on the machine was purchased on April 5. On April 19, Pharoah paid $7,590 for installation and testing of the machine. The machine was ready for use on April 30. Pharoah estimates the machine's useful life will be five years or 6,212 units with a residual value of $73,690. Assume the machine produces the following numbers of units each year: 896 units in 2024; 1,400 units in 2025; 1,405 units in 2026; 1,396 units in 2027; and 1,115 units in 2028. Pharoah has a December 31 year end. - Show Transcribed Text Your answer is partially correct. Ű Ć Assume that the company, after recording depreciation using the straight-line method, for the first four months of 2026, determined on May 1, 2026 that the machine could be operated for one more year than originally estimated. Because of this, the residual…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Please complete all required partsarrow_forwardPete's Propellers Company showed the following information in its Property, Plant, and Equipment Subledger regarding Machine #5027. Machine 5027 Date of Depreciation purchane Jan. 12/10 Jan. 12/18 Rat. Cost $ 62,000 40,000 16,200 Component Single metal housing Methode Reaidual Ent.tife SL. $8,000 15 yra Motor DDB 6,000 10 yrs Blade Jan. 12/18 SL 1,400 s yrs $118,200 *SL = Straight-line; DDB = Double-declining-balance On January 7, 2020, the machine blade cracked and it was replaced with a new one costing $13,200 purchased for cash (the old blade was scrapped). The new blade had an estimated residual value of $2,000 and an estimated life of filve years and would continue to be depreciated using the straight-line method. During 2020, it was determined that the useful life on the metal housing should be Increased to a total of 18 years instead of 15 years and that the residual value should be increased to $10,000. Required: 1. Prepare the entry to record the purchase of the replacement…arrow_forwardA machine was purchased on 1 January 2021 and the other details of the machine are:- Cost of machine N$324 000 Depreciation rate 5 % Determine the amount of deprecation as at 31 December 2021arrow_forward

- Required information [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2020. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2020: Date Placed in Asset Cost Service $ 360,000 1,602,000 82,000 Office furniture Machinery Used delivery truck* *Not considered a luxury automobile. 02/03/2020 07/22/2020 08/17/2020 During 2020, Karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2021 to increase its production capacity. These are the assets acquired during 2021: Date Placed in Asset Cost Service Computers and information system Luxury autot Assembly equipment Storage building $ 442,000 90,500 1,410,000 03/31/2021 05/26/2021 08/15/2021 11/13/2021 700,000 tUsed 100% for business purposes. Karane generated taxable income in 2021 of $1,785,000 for purposes…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardHistorical cost $ 270,000 Estimated useful life 6 years Salvage value $ 24,000 Estimated useful hours 12,000 hours 3,100 2019 1,100 2020 1,200 2021 Estimated hours per year: 2,800 2022 2,600 2023 1,200 2024 Required 1 Complete the depreciation schedule using the Units of Production Method. Page Adventure Park, Corp. ciation Schedule - Units of Production Depreciation Accumulated Depreciable Year Expense Depreciation Cost 12.31.19 12.31.20 12.31.21 12.31.22 12.31.23 12.32.24 2 Record depreciation expense for 2020. General Journal DR CR 3 What is the net book value of the equipment on 12.31.20? Historical cost (Accumulated depreciation) Net book value at 12.31.20 |24arrow_forward

- 2. A company purchased a truck for $35,000 on January 1, 2019. The truck is estimated to have a useful life of four years and a salvage value of $1,000. Assuming that the company uses straight-line depreciation, what is depreciation expense for the year ended December 31, 2020? a. $8,750 b. $17,500 c. $8,500 d. $17,000 e. $25,500arrow_forwardPrepare the journal entry; to record depreciation expense for 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Datearrow_forwardDon't give solution in image format..arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education