FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

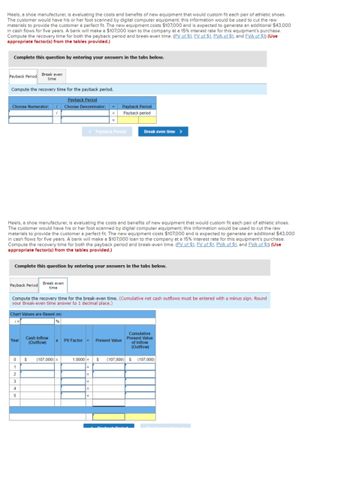

Transcribed Image Text:Heels, a shoe manufacturer, is evaluating the costs and benefits of new equipment that would custom fit each pair of athletic shoes.

The customer would have his or her foot scanned by digital computer equipment; this information would be used to cut the raw

materials to provide the customer a perfect fit. The new equipment costs $107,000 and is expected to generate an additional $43,000

in cash flows for five years. A bank will make a $107,000 loan to the company at a 15% interest rate for this equipment's purchase.

Compute the recovery time for both the payback period and break-even time. (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use

appropriate factor(s) from the tables provided.)

Complete this question by entering your answers in the tabs below.

Payback Period Break even

time

Compute the recovery time for the payback period.

Payback Period

Choose Numerator: Choose Denominator:

Payback Period Break even

time

Heels, a shoe manufacturer, is evaluating the costs and benefits of new equipment that would custom fit each pair of athletic shoes.

The customer would have his or her foot scanned by digital computer equipment; this information would be used to cut the raw

materials to provide the customer a perfect fit. The new equipment costs $107,000 and is expected to generate an additional $43,000

in cash flows for five years. A bank will make a $107,000 loan to the company at a 15% interest rate for this equipment's purchase.

Compute the recovery time for both the payback period and break-even time. (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use

appropriate factor(s) from the tables provided.)

Complete this question by entering your answers in the tabs below.

Chart Values are Based on:

i=

Year

Compute the recovery time for the break-even time. (Cumulative net cash outflows must be entered with a minus sign. Round

your Break-even time answer to 1 decimal place.)

0

1

2

3

4

5

Cash Inflow

(Outflow)

$

< Payback Period

x

(107,000) x

PV Factor - Present Value

Payback Period

Payback period

1.0000 =

=

Break even time >

=

=

Cumulative

Present Value

of Inflow

(Outflow)

S (107,000) $ (107,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose that you have been given a summer job as an intern at Issac Aircams, a company that manufactures sophisticated spy cameras for remote-controlled military reconnaissance aircraft. The company, which is privately owned, has approached a bank for a loan to help finance its growth. The bank requires financial statements before approving the loan. Required: Classify each cost listed below as either a product cost or a period cost for the purpose of preparing financial statements for the bank. × Answer is complete but not entirely correct. Costs Product Cost / Period Cost Period Cost Product Cost 1. Depreciation on salespersons' cars. 2. Rent on equipment used in the factory. 3. Lubricants used for machine maintenance. 4. Salaries of personnel who work in the finished goods warehouse. 5. Soap and paper towels used by factory workers at the end of a shift. 6. Factory supervisors' salaries. 7. Heat, water, and power consumed in the factory. 8. Materials used for boxing products for…arrow_forwardI know there is a Bartleby on this, but the commas are all out of place and I'm still confused. Could you give a more in-depth solution and explain on how to calcultae FCF, specifically with excel functions? We are entering the widget business. It costs $500,000, payable in year 1, to develop a prototype. This cost can be depreciated on a straight-line basis during years 1-5. Each widget sells for $40 and incurs a variable cost of $20. During year 1 the market size is 100,000, and the market size is growing at 10% per year. Profits are taxed at 40%, but there are no taxes on negative profits. a) Given our other assumptions, what market share (in %) is needed to ensure the total free cash flow (FCF) of $0 over the five year period? Note: FCF during a year equals after-tax profits plus depreciation minus fixed costs (if any).b) Describe how an increase in percent market growth rate changes total FCF over years 1-5.c) Describe how simultaneous changes in percent market share and changes…arrow_forwardAngie Silva has recently opened The Sandal Shop in Brisbane, Australia, a store that specializes in fashionable sandals. In time, she hopes to open a chain of sandal shops. As a first step, she has gathered the following data for her new store: Sales price per pair of sandals $ 30 Variable expenses per pair of sandals 15 Contribution margin per pair of sandals $ 15 Fixed expenses per year: Building rental $ 11,300 Equipment depreciation 11,300 Selling 9,000 Administrative 13,400 Total fixed expenses $ 45,000 1. What is the break-even point in unit sales and dollar sales? (Do not round intermediate calculations.)arrow_forward

- Adidas will put on sale what it bills as the world’s first computerized “smart shoe.” But consumerswill decide whether to accept the bionic running shoe’s $250 price tag—four times the average shoeprice at stores such as Foot Locker. Adidas uses a sensor, a microprocessor, and a motorized cablesystem to automatically adjust the shoe’s cushioning. The sensor under the heel measures compressionand decides whether the shoe is too soft or firm. That information is sent to the microprocessor, andwhile the shoe is in the air, the cable adjusts the heel cushion. The whole system weighs less than 40grams. Adidas’s computer-driven shoe—three years in the making—is the latest innovation in the $16.4billion U.S. sneaker industry. The top-end running shoe from New Balance lists for $199.99. Withrunners typically replacing shoes every 500 miles, the $250 Adidas could push costs to 50 cents per mile.Adidas is spending an estimated $20 million on the rollout.The investment required to develop a…arrow_forwardi need the answer quicklyarrow_forwardPlease help me. Thankyou.arrow_forward

- You are considering adding a new software title to those published by your highly successful software company. If you add the new product, it will use capacity on your disk duplicating machines that you had planned on using for your flagship product, “Battlin’ Bobby.” You had planned on using the unused capacity to start selling “BB” on the West coast in two years. You would eventually have had to purchase additional duplicating machines 10 years from today, but using the capacity for your new product will require moving this purchase up to 2 years from today. If the new machines will cost $113,000 and can be expensed under Section 179, your marginal tax rate is 21 percent, and your cost of capital is 14 percent, what is the opportunity cost associated with using the unused capacity for the new product? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardCNN reported that higher-income shoppers are the biggest bargain shoppers searching Amazon, clicking on their mobile devices and even querying Alexa looking for the best deals. If Rebecca Johnson purchased a state-of-the-art Biologique Recherche facial machine for her home business for $110,000, with a useful life of 5 years and a residual value of $36,000. What would be the book value of the machine after the first year using the straight-line depreciation method? Book valuearrow_forwardLamphere Lawn Care provides lawn and gardening services. The price of the service is fixed at a flat rate for each service, and most costs of providing the service are the same, given the similarity in the lawns and lots. The owner budgets income by estimating two factors that fluctuate with the economy: the contribution margin associated with each service call and the number of customers who will request lawn service. Looking at next year, the owner develops the following estimates of contribution margin (price less variable cost of the service, including labor) and the estimated number of service calls. Although the owner understands that it is not strictly true, the owner assumes that the cost of fuel and the number of customers are independent. Contribution Margin per Service Call Scenario Excellent Fair Poor (Price - $ 50 Variable cost) Service Calls 40 12 Number of 10,950 8,500 6,200 In addition to the variable costs of service, the owner estimates that other costs are $63,000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education