Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

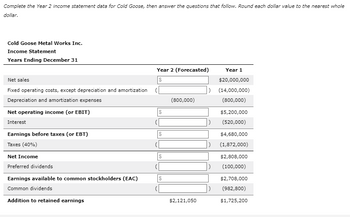

Cold Goose Metal Works Inc.’s income statement reports data for its first year of operation. The firm’s CEO would like sales to increase by 25% next year.

| 1. | Cold Goose is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). |

| 2. | The company’s operating costs (excluding |

| 3. | The company’s tax rate remains constant at 40% of its pre-tax income or earnings before taxes (EBT). |

| 4. | In Year 2, Cold Goose expects to pay $100,000 and $1,195,950 of preferred and common stock dividends, respectively. |

Transcribed Image Text:Complete the Year 2 income statement data for Cold Goose, then answer the questions that follow. Round each dollar value to the nearest whole

dollar.

Cold Goose Metal Works Inc.

Income Statement

Years Ending December 31

Net sales

Fixed operating costs, except depreciation and amortization

Depreciation and amortization expenses

Net operating income (or EBIT)

Interest

Earnings before taxes (or EBT)

Taxes (40%)

Net Income

Preferred dividends

Earnings available to common stockholders (EAC)

Common dividends

Addition to retained earnings

Year 2 (Forecasted)

$

$

$

$

$

(800,000)

$2,121,050

Year 1

$20,000,000

) (14,000,000)

(800,000)

$5,200,000

(520,000)

$4,680,000

(1,872,000)

$2,808,000

(100,000)

$2,708,000

(982,800)

$1,725,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $350,000 per year for the next 4 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 20% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $86 and variable costs at 70% of revenue. The company’s policy is to pay out one-half of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 2,160 Fixed costs 86 Variable costs (70% of revenue) 1,512 Depreciation 280 Interest (6% of beginning-of-year debt) 18 Taxable income 264 Taxes (at 35%) 92 Net income $ 172 Dividends $ 86 Addition to retained…arrow_forwardWater and Power Co. (W&P) currently has $575,000 in total assets and sales of $1,400,000. Half of W&P’s total assets come from net fixed assets, and the rest are current assets. The firm expects sales to grow by 22% in the next year. According to the AFN equation, the amount of additional assets required to support this level of sales is . (Note: Round your answer to the nearest whole number.) W&P was using its fixed assets at only 95% of capacity last year. How much sales could the firm have supported last year with its current level of fixed assets? (Note: Round your answer to the nearest whole number.) $1,547,368 $1,768,421 $1,473,684 $1,694,737 When you consider that W&P’s fixed assets were being underused, its target fixed assets to sales ratio should be %. (Note: Round your answer to two decimal places.) When you consider that W&P’s fixed assets were being underused, how much fixed assets must W&P raise to…arrow_forwardIncremental earnings: Company will spend 4.5 million on advertising for a new product. Ads will boost sales by 10.1 million first year and 8.1 million 2nd year plus increase other product sales by 2.2 million each year. The new product will have a gross profit margin of 33% and gross profit margin on existing products will increase by 20%. corporate tax rate is 25%. My Excel answer is below. Am I correct? For the TOTAL GROSS PROFIT, I added the gross profit from both the new product and existing product. Normally, I would subtract COGS from Sales It seems here it is given with the %. For TAXES, I multiplied EBIT to the 25%. For INCREMENTAL EARNINGS, I subtracted Taxes from EBIT. Incremental Earnings Forecast (in 000s) 1 2 Sales of new product 10.1 8.1 Sales of other products 2.2 2.2 Gross Profit for new product is 33% 3.33 2.67 Gross Profit for other products is 20% 0.44 0.44 Total Gross Profit 3.8 3.1 Selling, General and Administrative Expense (advertising) 4.5 0.0…arrow_forward

- The Frozen North Construction Company would like to forecast its minimum volume of work (turnover) in order to “break even” (i.e., cover its corporate overheads) for the coming year. The company’s previous year’s corporate overheads were $900,000. The company anticipates 22% inflation and 6% growth in the firm for the coming year. It also expects to achieve a gross margin of 13% on its projects, based on old experience. The company defines gross margin as a percentage of revenue (i.e., selling price). Determine the minimum volume of work, which will allow the Frozen North Company to break even at the end of the coming year.arrow_forwardSteber Packaging Inc. expects sales next year of $42 million. Of this total, 30 percent is expected to be for cash and the balance will be on credit, payable in 30 days. Operating expenses are expected to total $27 million. Accelerated depreciation is expected to total $8 million, although the company will only report $4 million of depreciation on its public financial reports. The marginal tax rate for Steber is 34 percent. Current assets now total $28 million and current liabilities total $15 million. Current assets are expected to increase to $33 million over the coming year. Current liabilities are expected to increase to $17 million. Compute the projected after-tax operating cash flow for Steber during the coming year. Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answer to two decimal places. $ millionarrow_forwardFor 2021, Gourmet Kitchen Products reported $24 million of sales and $18 million of operating costs (including depreciation). The company has $15 million of total invested federal-plus-state income tax rate was 25%. What was the firm's economic value added (EVA), that is, how much value did management add to stockholders' example, 25 million should be entered as 25,000,000. Round your answer to the nearest dollar, if necessary. $ capital. Its after-tax cost of capital is 9% and its wealth during 2021? Write out your answer completely. Forarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education