Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

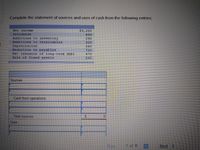

Transcribed Image Text:Problems

1

Sale of fixed assets

230

Sources

Cash from operations:

Total sources

Uses

Total uses

Transcribed Image Text:Complete the statement of sources and uses of cash from the following entries:

Net income

$3,200

600

Dividends

Additions to inventory

Additions to receivables

Depreciation

Reduction in payables

Net issuance of long-term debt

Sale of fixed assets

290

320

260

720

470

230

Sources

Cash from operations:

Total sources

Uses

Prey

1 of 8

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Apex Company prepared the statement of cash flows shown below: Apex Company Statement of Cash Flows—Indirect Method Operating activities: Net income $ 40,800 Adjustments to convert net income to cash basis: Depreciation $ 20,900 Increase in accounts receivable (61,300) Increase in inventory (25,300) Decrease in prepaid expenses 10,000 Increase in accounts payable 53,700 Decrease in accrued liabilities (11,200) Increase in income taxes payable 4,300 (8,900) Net cash provided by (used in) operating activities 31,900 Investing activities: Proceeds from the sale of equipment 14,900 Loan to Thomas Company (40,400) Additions to plant and equipment (120,000) Net cash provided by (used in) investing activities (145,500) Financing activities: Increase in bonds payable 89,400 Increase in common stock 40,000 Cash dividends (28,700) Net cash provided by (used in) financing activities 100,700 Net…arrow_forwardStatement of Cash Flows The comparative balance sheet of Hirayama Industries Inc. for December 31, 20Y2 and 20Y1, is as follows: Dec. 31, 20Y2 Dec. 31, 20Y1 Assets Cash $234 $18 Accounts receivable (net) 70 63 Inventories 150 127 Land 320 422 Equipment 262 224 Accumulated depreciation—equipment (87) (54) Total assets $949 $800 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $65 $47 Dividends payable 6 - Common stock, $1 par 160 102 Excess of paid-in capital over par 109 90 Retained earnings 609 561 Total liabilities and stockholders' equity $949 $800 The following additional information is taken from the records: Land was sold for $153. Equipment was acquired for cash. There were no disposals of equipment during the year. The common stock was issued for cash. There was a $79 credit to Retained Earnings for net income. There was a $31 debit to Retained…arrow_forwardYeoman Inc. reported the following data: Net income $170,000 Depreciation expense 29,000 Loss on disposal of equipment 11,850 Increase in accounts receivable 10,490 Increase in accounts payable 5,430 Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.arrow_forward

- 26arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Ravenna Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: Ending Balance Beginning Balance Cash and cash equivalents $ 102,000 $ 122,400 Accounts receivable 81,700 88,000 Inventory 109,700 100,000 Total current assets 293,400 310,400 Property, plant, and equipment 291,000 280,000 Less accumulated depreciation 97,000 70,000 Net property, plant, and equipment 194,000 210,000 Total assets $ 487,400 $ 520,400 Accounts payable $ 64,000 $ 113,700 Income taxes payable 49,700 65,700 Bonds payable 120,000 100,000 Common stock 140,000 120,000 Retained earnings 113,700 121,000 Total liabilities and stockholders’ equity $ 487,400 $ 520,400…arrow_forwardStatement of Cash Flows—Indirect Method The comparative balance sheet of Merrick Equipment Co. for December 31, 20Y9 and 20Y8, is as follows: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash $271,620 $255,000 Accounts receivable (net) 98,400 91,580 Inventories 277,770 271,170 Investments 0 105,050 Land 142,470 0 Equipment 306,470 239,730 Accumulated depreciation—equipment (71,750) (64,650) Total assets $1,024,980 $897,880 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $185,520 $176,880 Accrued expenses payable (operating expenses) 18,450 23,340 Dividends payable 10,250 8,080 Common stock, $10 par 55,350 44,000 Paid-in capital in excess of par—common stock 208,070 122,110 Retained earnings 547,340 523,470 Total liabilities and stockholders’ equity $1,024,980 $897,880 Additional data obtained from an examination of the accounts in the ledger for 20Y9…arrow_forward

- Demers Inc. reported the following data: Net income $409,500 Depreciation expense 46,460 Gain on disposal of equipment 37,860 Decrease in accounts receivable 25,340 Decrease in accounts payable 5,930 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. Use the minus sign to indicate cash outflows, cash payments, decreases in cash and for any adjustments, if required.arrow_forwardThe following information pertains to Peak Heights Company: Sales Expenses Cost of goods sold Salaries expense Net income Income Statement for Current Year $ 93,000 $ 51,875 Depreciation expense 6,000 12,000 69,875 $ 23,125 Partial Balance Sheet Current year Accounts receivable Inventory Salaries payable $ 10,500 13,000 2,250 Prior year $ 12,000 8,000 800 Required: Present the operating activities section of the statement of cash flows for Peak Heights Company using the indirect met Note: List cash outflows as negative amounts. PEAK HEIGHTS COMPANY Statement of Cash Flows (Partial)arrow_forwardA draft statement of cash flows contains the following: £ i Profit before tax 22 ii Depreciation 8 iii Increase in inventories -4 iv Decrease in receivables -3 v Increase in payables -2 Net cash inflow from operating activities 21 Which Two of the following corrections needs to be made to the calculation? a. ii and v b. iv and iii c. i and ii d. iv and varrow_forward

- Please help mearrow_forwardAsap The following information is available from the current period financial statements: Net income $126,307 Depreciation expense 23,648 Increase in accounts receivable 16,473 Decrease in accounts payable (19,595) The net cash flows from operating activities using the indirect method is a.$126,307 b.$113,887 c.$66,591 d.$186,023arrow_forwardBased on the following information, compute cash flows from financing activities under GAAP.Purchase of investments $ 250Dividends paid 1,200Interest paid 400Additional borrowing from bank 2,800arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education