Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please prepare T accounts, General Journal General Ledger, Unadjusted

Transcribed Image Text:A

B

E F

G

H

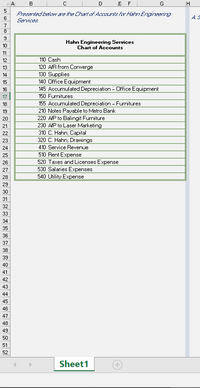

Fresented below are the Chart of Accounts for Hahn Engineering

6

Services

AS

7

8.

Hahn Engineering Services

Chart of Accounts

10

11

12

110 Cash

13

120 AR from Converge

130 Supplies

140 Office Equipment

14

15

16

145 Accumulated Depreciation - Office Equipment

17

150 Furnitures

18

155 Accumulated Depreciation - Furnitures

19

210 Notes Payable to Metro Bank

220 AP to Balingit Furniture

230 AP to Laser Marketing

310 C. Hahn, Capital

320 C. Hahn, Drawings

20

21

22

23

24

410 Service Revenue

510 Rent Expense

520 Taxes and Licenses Expense

530 Salaries Expenses

540 Utility Expense

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

Sheet1

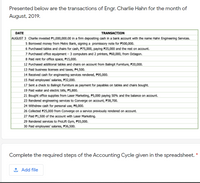

Transcribed Image Text:Presented below are the transactions of Engr. Charlie Hahn for the month of

August, 2019.

DATE

TRANSACTION

AUGUST 3 Charlie invested P1,000,000.00 in a firm depositing cash in a bank account with the name Hahn Engineering Services.

5 Borrowed money from Metro Bank, signing a promissory note for P500,000.

6 Purchased tables and chairs for cash, P75,000, paying P25,000 and the rest on account.

7 Purchased office equipment – 3 computers and 2 printers, P60,000, from Octagon.

8 Paid rent for office space, P15,000.

12 Purchased additional tables and chairs on account from Balingit Furniture, P20,000.

13 Paid business licenses and taxes, P4,500.

14 Received cash for engineering services rendered, P95,000.

15 Paid employees' salaries, P32,000.

17 Sent a check to Balingit Furniture as payment for payables on tables and chairs bought.

19 Paid water and electric bills, P5,800.

21 Bought office supplies from Laser Marketing, P5,000 paying 50% and the balance on account.

23 Rendered engineering services to Converge on account, P38,700.

24 Withdrew cash for personal use, P8,000.

26 Collected P25,000 from Converge on a service previously rendered on account.

27 Paid P1,500 of the account with Laser Marketing.

29 Rendered services to ProLift Gym, P55,000.

30 Paid employees' salaries, P36,500.

Complete the required steps of the Accounting Cycle given in the spreadsheet.

1 Add file

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Create journal entries for sage 50. ? 1.The owner Jasmine, had the bank transfer (by the bank memo) $20000 from the personal savings account to the business bank account to start the business. 2. Negotiated a 5-year bank loan of $40000 at an annual interest rate of 9.50% with Loyal Bank. The money was deposited in the bank account today. 3.Received invoice 402 for $1200 plus HST from Captain Insurance, for a one-year business Insurance Policy, commencing Aug 1, 2018. Issued cheque #1001 to pay this invoice.arrow_forwardKelly Jones and Tami Crawford borrowed $10,500 on a 7-month, 8% note from Gem State Bank to open their business, Oriole’s Coffee House. The money was borrowed on June 1, 2022, and the note matures January 1, 2023. Prepare the entry to record the receipt of the funds from the loan. Date Account Titles and Explanation Debit Credit June 1 enter an account title to record the receipt of the funds from the loan on June 1enter an account title to record the receipt of the funds from the loan on June 1 enter a debit amountenter a debit amount enter a credit amountenter a credit amount enter an account title to record the receipt of the funds from the loan on June 1enter an account title to record the receipt of the funds from the loan on June 1 enter a debit amountenter a debit amountarrow_forwardHharrow_forward

- Below are the transactions for Alex in Jan 2019: 1 Alex commenced business by depositing cash RM80,000 in the bank as capital 4 A machine was purchased and paid for with company cheque for RM42,000 8 Alex purchased goods for resale amounting to RM17,500 on credit 12 Alex made a cash sales of RM4,800; cost of good sold was RM2,600 16 Alex received a bank loan of RM30,000, the money was credited to the business bank account 20 Alex brought in his personal car for business use, the car was valued at RM65,000 23 Alex purchased goods for resale amounting to RM35,600, he paid the supplier by cheque 27 Alex paid supplier RM17,000 for the goods purchased on 8 Jan 2018, discount received RM500 30 Alex bought a computer for RM5,200 by cheque Required: Prepare the accounting equation for the month of January 2019.arrow_forwardKatie Wright’s banker has asked her to submit a personal balance sheet as of June 30, 2020, in support of an application for a $6,000 home improvement loan. She comes to you for help in preparing it. So far, she has made the following list of her assets and liabilities as of June 30, 2020:arrow_forwardJason and Matthew borrowed $38.400 on a 7-month, 5% note from Gem State Bank to open their business, Blossom's Coffee House The money was borrowed on June 1, 2025, and the note matures January 1, 2026. (a) ✓ Your answer is correct. Prepare the entry to record the receipt of the funds from the loan. (List all debit entries before credit entries, Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts) Date ne 1, 2025 Account Titles and Explanation (b) Question 5 of 12 Cash Date Notes Payable eTextbook and Medial Prepare the entry to accrue the interest on June 30, (List all debit entries before credit entries. Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts) Account Titles and Explanation Debit 38400 Credit Debit…arrow_forward

- 19 Dec. Borrowed $28,000 from the bank for personal use. The loan carried an interest rate of 6% a year and the first payment was due on 19 January. Williamson signed a note payable to the bank in the name of the business. How would this be journaled, put on an income statment, balance sheet, and cash flow statment for december 31st?arrow_forwardHow to enter that transaction into a cash receipts journal and also into a cash payments journalarrow_forwardKelly Jones and Tami Crawford borrowed $33,000 on a 7-month, 6% note from Gem State Bank to open their business, Crane’s Coffee House. The money was borrowed on June 1, 2022, and the note matures January 1, 2023. Prepare the entry to record the receipt of the funds from the loan. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit June 1 enter an account title to record the receipt of the funds from the loan on June 1 enter a debit amount enter a credit amount enter an account title to record the receipt of the funds from the loan on June 1 enter a debit amount enter a credit amount eTextbook and Media List of Accounts Prepare the entry to accrue the interest on June 30. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)…arrow_forward

- can you help me answer these questions please... The accounting records for Delta Driving School shows a cash balance of $14,134 on February 28, 2019. On the evening of February 28, company receipts of $1,250 were placed in the bank's night deposit drop box. The deposit was processed by the bank on March 1. The February 28 bank statement shows a balance of $18,877, including collection of a $6,000 note receivable plus $55 of interest earned, a service charge of $40, and a $1,550 debit memo for the payment of the company's utility bill. All of the checks that the company had written were listed on the bank statement except for check #1908 in the amount of $1,528. Prepare a bank reconciliation to calculate the company’s adjusted cash balance at February 28, 2019. Prepare the journal entries needed to adjust the cash records as a result of the bank reconciliation. Circle the number that will appear as Cash on Delta’s Balance Sheet at February 28, 2019.arrow_forwarda.arrow_forwardBlue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College