Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Complete the following for the present value of an ordinary annuity. (Use Table 13.2.) (Do not round intermediate calculations. Round

your answer to the nearest cent.)

Present value (amount

needed now to invest to

receive annuity)

Amount of

Payment

Time

Interest rate

annuity expected

%24

860

Annually

5 years

7 %

acer

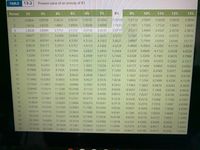

Transcribed Image Text:TABLE

13-2

Present value of an annuity of $1

Perlod

2%

3%

4%

5%

6%

7%

8%

10%

11%

12%

13%

1.

0.9804

09709

0.9615

09524

0.9434

09346

0.9259

0,9174

0.9091

0.9009

0.8929

0.8850

1.8594

17591 1.7355

0808

1.7833

2.5771

2.

1.9416

1.9135

1.8861

1.8334

17125

1,6901

1.6681

3.

2.8839

2.8286

2.7751

2.7232

2.6730

2.6243

2.5313

2.4869

2.4437 2.4018 2.3612

3.8077

3.7171

3.6299

3.5459

3.4651

3.3872

3.3121 32397 3.1699 3.1024 3.0373

2.9745

4.5797

4.4518

4.3295

3.8897 37908

3.6959 3.6048

4.2305 4.1114

4.8684 4.7122 4.5638

4.7134

4.2124

4.1002 3.9927

3.5172

9.

5.6014

5.4172

5.2421

5.0757

4.9173

4.7665

4.485943553

3.9975

7.

6.4720

6.2303

6.0021

5.7864

5.5824

5.3893

5.2064

5.0330

4.4226

8.

7.3255

7.0197

6.7327

6.4632

6.2098

5.97 13 5.7466

55348 5.3349 5.1461

4.9676

4.7988

6.

8.1622

7.7861

7.4353

7.1078

6.8017

6.5152 6.2469

5.9952 5.7590 5.5370

6.4177 6.1446 5.8892 5. 6502 54262

6.8052 6.4951 6.2065 5.9377

7.1607 6.8137 6.4924

7.4869 7.1034 6.7499

5.3282

5.1317

10

8.9826

8.5302

8.1109

77217

7.3601

7.0236

6.7101

11

9.7868

9.2526

8.7605

8.3064

7.8869

7.4987

7.1390

5.6869

12

10.5753

9.9540

9.3851

8.8632

8.3838

7.9427

7.5361

6.1944

5.9176

13

11.3483

10.6350

9.9856

9.3936

8.8527

8.3576

7.9038

6.4235

6.1218

14

12.1062

11.2961

10.5631

9.8986

9.2950

8.7455 8.2442

77862 7.3667 6.9819 66282

6.3025

15

12.8492

11.9379

11.1184 10.3796

9.7122 9.1079

8.5595

8.0607 7.6061 7.1909 6.8109

8.3126 7.8237

64624

16

13.5777

12.5611

11.6523

10.8378

10.1059

9.4466

8.8514

7.3792 6.9740

6.6039

17

14.2918

13.1661

12.1657 112741

10.4773

9.7632 9.1216

8.5436 8.0216 7.5488 7.1196

10.0591 9.37 19 8.7556 8.2014 7.7016 7.2497

6.7291

18

14.9920

13.7535

12.6593 11.6896

13.1339 12.0853 11.1581

10.8276

6.8399

19

15.6784

14.3238

10.3356

9.6036

8.9501 8.3649 7.8393 7.3658

6.9380

20

16.3514

14.8775

13.5903

12.4622 11.4699

10.5940

9.1285 8.5136

7.9633 7.4694

7.0248

10.6748 9.8226 9.0770 8.4217 7.8431 7.3300

25

19.5234

17.4131

15.6221

14.0939

12.7834 11.6536

30

22.3964

19.6004

17.2920

15.3724 137648

12.4090

11.2578

10.2737 94269

8.6938

8.0552

7.4957

40

27.3554

23.1148

19.7928

17.1591 15.0463

13.3317

11.9246

10.7574 9.7790

8.9511

8.2438 7.6344

50

31.4236

25.7298

21.4822

18.2559 15.7619

13.8007 12.2335

10.9617 9.9148

90417

8.3045

7.6752

4.

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- use table 12-1 to calculate the future value of the ordinary annuity.arrow_forwardFor each of the following annuities, calculate the annuity payment. Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Annuity Payment $ $ $ Future Value 24,150 960,000 772,000 131,000 Years 8 36 22 13 Interest Rate 5% 7 8 4arrow_forwardFind the amount accumulated FV in the given annuity account. (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $200 is deposited monthly for 10 years at 6% per year in an account containing $9,000 at the start FV = $ 49150 Need Help? Read It Watch It Submit Answerarrow_forward

- Find the future value of an annuity due with an annual payment of $14,000 for three years at 3% annual interest using the simple interest formula. How much was invested? How much interest was earned? What is the future value of the annuity? $ 44,570.78 (Round to the nearest cent as needed.) How much was invested? $ 42000 How much interest was earned? $2.570.78 (Round to the nearest cent as needed.)arrow_forwardSubject :- Accountingarrow_forwardUse Table 12-2 to calculate the present value (in $) of the annuity due. (Enter a number. Round your answer to the nearest cent.) Annuity Payment Payment Frequency Time Nominal Interest Period (years) Rate (%) Compounded Present Value of the Annuity $300 every month (2 1/4) 6 monthly $ Need Help? Read Itarrow_forward

- Future value of an ordinary annuity. Fill in the missing future values in the following table for an ordinary annuity: Number of Payments or Years 5 16 Annual Interest Rate 8% 18% Data table 5 16 25 340 Present Value (Click on the following icon Number of Payments or Years Annual Interest Rate 8% 18% 4% 0.9% 0 0 Annuity $282.81 $1,331.99 in order to copy its contents into a spreadsheet.) 0 0 0 0 Present Value Annuity $282.81 $1,331.99 $726.91 $460.85 Future Value $1,659.13 (Round to the nearest cent.) (Round to the nearest cent.) Future Value ? ? ? ? Xarrow_forwardImage attached of questionarrow_forwardUrgent..hand written plzarrow_forward

- Suppose the interest rate is 6.9 APR with monthly compounding. What is the present value of an annuity that pays $110 every three months for five years? (Note: Be careful not to round any intermediate steps less than six decimal places.) Question content area bottom Part 1 The present value of the annuity is $ enter your response here. (Round to the nearest cent.)arrow_forwardFind the amount accumulated FV in the given annuity account. HINT [See Quick Example 1 and Example 1.] (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $2,300 is deposited quarterly for 10 years at 7% per year FV = $arrow_forwardSolve by using formulas. (Round your answer to the nearest cent.) Ordinary Annuity AnnuityPayment PaymentFrequency TimePeriod (years) NominalRate (%) InterestCompounded Future Valueof the Annuity (in $) $5,000 every 6 months 9 9.0 semiannually $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education