Principles of Economics (MindTap Course List)

8th Edition

ISBN: 9781305585126

Author: N. Gregory Mankiw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Note:- Please don't simply copy and paste content from other

Do not provide the handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

Answer completely.

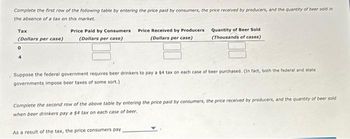

Transcribed Image Text:Complete the first row of the following table by entering the price paid by consumers, the price received by producers, and the quantity of beer sold in

the absence of a tax on this market.

Tax

(Dollars per case)

0

4

Price Paid by Consumers

(Dollars per case)

Price Received by Producers

(Dollars per case)

Quantity of Beer Sold

(Thousands of cases)

Suppose the federal government requires beer drinkers to pay a $4 tax on each case of beer purchased. (In fact, both the federal and state

governments impose beer taxes of some sort.)

As a result of the tax, the price consumers pay

Complete the second row of the above table by entering the price paid by consumers, the price received by producers, and the quantity of beer sold

when beer drinkers pay a $4 tax on each case of beer.

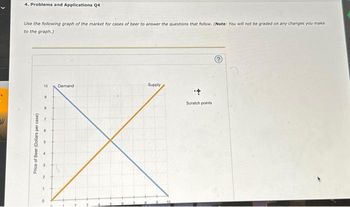

Transcribed Image Text:4. Problems and Applications Q4

Use the following graph of the market for cases of beer to answer the questions that follow. (Note: You will not be graded on any changes you make

to the graph.)

Price of Beer (Dollars per case)

10

9

Demand

Supply

Scratch points

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the price of a magazine is 4 each, what is the maximum number of magazines she could buy in a week?arrow_forwardWhat term would an economist use to describe what happens when a shopper gets in good deal on a product?arrow_forwardWhat does a downward-sloping demand curve mean about how buyers in a market will react to a higher price?arrow_forward

- Explain all the reasons why a decrease in a products price would lead to an increase in purchases.arrow_forwardThink back to a purchase that you made recently. How would you describe your thinking before you made that purchase?arrow_forwardConsider the demand for hamburgers. If the price of a substitute good (for example, hot dogs) increases and the price of a complement good (for example, hamburger buns) increases, can you tell for sure what will happen to the demand for hamburger? Why or why not? Illustrate your answer with a graph.arrow_forward

- Who determines how much utility an individual will receive from consuming a good?arrow_forwardIncome Effects depend on the income elasticity of demand for each good limit you buy. If one of the goods you buy has a negative income elasticity, that is, it is an inferior good, what must be true of the income elasticity of the other good you buy?arrow_forwardJeremy is deeply in love with Jasmine. Jasmine lives where cell phone coverage is poor, so he can either call her on the land-line phone for five cents per minute or he can drive to see her, at a round—trip cost of 2 in gasoline money. He has a total of 10 per week to spend on staying in touch. To make his preferred choice, Jeremy uses a handy utilimometer that measures his total utility from personal visits and from phone minutes. Using the values in Table 6.6, figure out the points 011 Jeremys consumption choice budget constraint (it may be helpful to do a sketch) and identify his utility-maximizing point.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...

Economics

ISBN:9781285165875

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning