Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

✔️✔️✅✅✔️✔️✔️✅✅

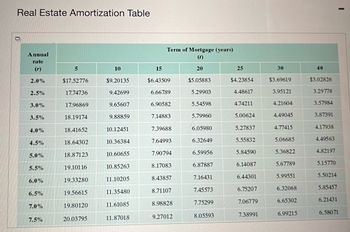

Transcribed Image Text:Real Estate Amortization Table

Annual

rate

2.0%

2.5%

3.0%

3.5%

4.0%

4.5%

5.0%

5.5%

6.0%

6.5%

7.0%

7.5%

5

$17.52776

17.74736

17.96869

18.19174

18.41652

18.64302

18.87123

19.10116

19.33280

19.56615

19.80120

20.03795

10

$9.20135

9.42699

9.65607

9.88859

10.12451

10.36384

10.60655

10.85263

11.10205

11.35480

11.61085

11.87018

15

Term of Mortgage (years)

$6.43509

6.66789

6.90582

7.14883

7.39688

7.64993

7.90794

8.17083

8.43857

8.71107

8.98828

9.27012

20

$5.05883

5.29903

5.54598

5.79960

6.05980

6.32649

6.59956

6.87887

7.16431

7.45573

7.75299

8.05593

25

$4.23854

4.48617

4.74211

5.00624

5.27837

5.55832

5.84590

6.14087

6.44301

6.75207

7.06779

7.38991

30

$3.69619

3.95121

4.21604

4.49045

4.77415

5.06685

5.36822

5.67789

5.99551

6.32068

6.65302

6.99215

40

$3.02826

3.29778

3.57984

3.87391

4.17938

4.49563

4.82197

5.15770

5.50214

5.85457

6.21431

6.58071

I

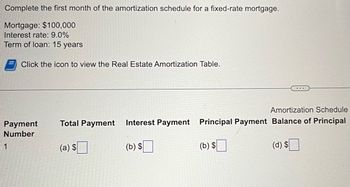

Transcribed Image Text:Complete the first month of the amortization schedule for a fixed-rate mortgage.

Mortgage: $100,000

Interest rate: 9.0%

Term of loan: 15 years

Click the icon to view the Real Estate Amortization Table.

Payment

Number

1

Amortization Schedule

Total Payment Interest Payment Principal Payment Balance of Principal

(a) $

(b) $

(b) $

(d) $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education