FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

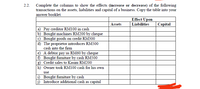

Transcribed Image Text:Complete the columns to show the effects (increase or decrease) of the following

transactions on the assets, liabilities and capital of a business. Copy the table into your

answer booklet.

2.2.

Effect Upon

Assets

Liabilities

Capital

a) Pay creditor RM100 in cash

b) Bought machines RM200 by cheque

c) Bought goods on credit RM300

d) The proprietor introduces RM500

cash into the firm

e) A debtor pay us RM60 by cheque

f) Bought funiture by cash RM500

g) Credit sales to Kasim RM200

h) Owner took RM100 cash for his own

use

i) Bought furniture by cash

j) Introduce additional cash as capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Explain and show through the balance sheet structure changes how the following transactions affect the money supply (M1): Transaction 1: The initial Loan from the FN Bank is taken by Mark who buys a car from a dealer. Use the balance sheet (T-accounts) to present the effects of this transaction on Mark and the car dealer, assuming that the dealer keeps money in the Second National Bank. How this transaction affects M1? Transaction 2: Assume that another guy, Jack, comes to the Second National Bank and takes the loan in the amount available. He wants to buy machinery for construction (Bulldozer) from the Caterpillar factory. Use the balance sheet (T-accounts) to present the effects of this transaction on Jack and the Caterpillar factory, assuming that the factory keeps money in the Third National Bank. How this transaction affects M1? Does this process stop eventually? Provide an intuition (and calculate) with respect how much money will be created out of the initial deposit ($400).arrow_forwardPlease answer asap thanksarrow_forwardBear Tree Services reports the following amounts on December 31, 2024. Cash Supplies Prepaid Insurance Building Assets Cash Inflows Customers Borrow from the bank (noite) Sale of Investments Required: 1. Prepare a balance sheet. 2. Prepare a statement of cash flows. In addition, the company reported the following cash flows. Balance Sheet $8.GOD 21700 4400 31.000 Statement of Cash Flows Liabilities and Stockholders. Equity Accounts payable Salaries payable Notes payable Comeon stock Retained earnings Cash Out FlowS $78,000 Employee salaries 29,000 Supplies 23,500 Dividends Purchase building Complete this question by entering your answers in the tabs below. $31.000 13,000 11,000 80,000 & Answer is complete but not entirely correct. $12,400 4,400 29,000 40,000 10,900 Prepare a statement of cash flows. (Cash outflows and decreases in cash should be indicated by a minus sign.)arrow_forward

- Only typed answer Refer to the accompanying table of information for the Moolah Bank. Assume that the listed amounts constitute this bank's complete set of accounts. Moolah's Multiple Choice assets are $1,100. liabilities are $1,100. net worth is $300. profit is $1,000.arrow_forwardEvaluate each of the following transactions in terms of their effect on assets, liabilities, and equity. 1. Receive payment of $12,000 owed by a customer2. Purchase equipment for $45,000 in cash3. Issue $85,000 in stock4. Borrow $67,000 from a bank What is the net change in Total Liabilities & Equity? Please don't provide answer in image format thank youarrow_forwardWhich one of the following transactions can immediately improve the Debt to Total Assets Ratio? A Receive $5,200 cash for services provided and recorded before. B Provide services and receive $5,000 cash. C Adjust for the consumption of supplies after the annual stocktake. D Purchase Vehicle for $6,000 on credit. E Pay $2,300 annual insurance premium.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education